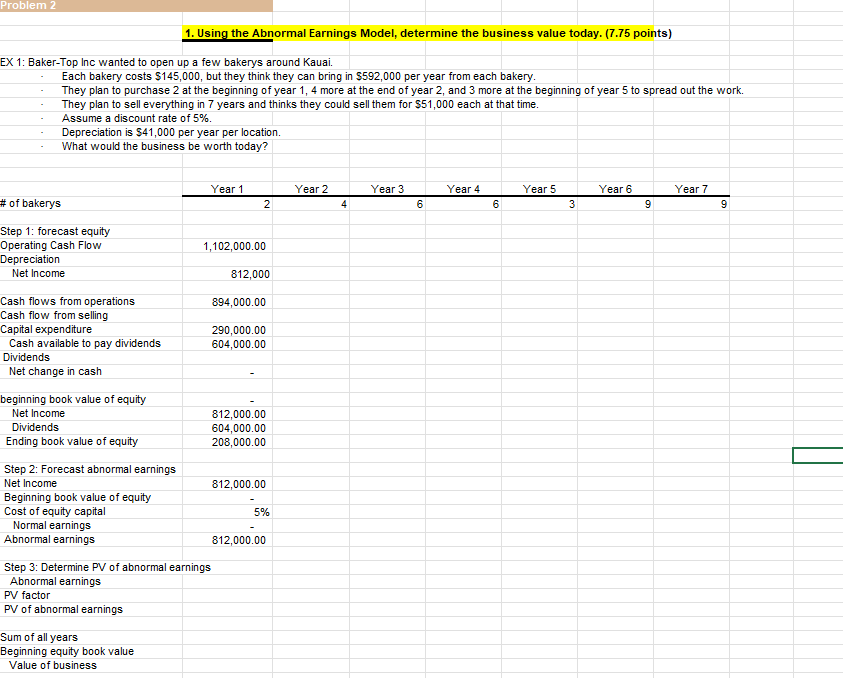

Question: Problem 2 1. Using the Abnormal Earnings Model, determine the business value today. (7.75 points) EX 1: Baker-Top Inc wanted to open up a

Problem 2 1. Using the Abnormal Earnings Model, determine the business value today. (7.75 points) EX 1: Baker-Top Inc wanted to open up a few bakerys around Kauai. Each bakery costs $145,000, but they think they can bring in $592,000 per year from each bakery. They plan to purchase 2 at the beginning of year 1, 4 more at the end of year 2, and 3 more at the beginning of year 5 to spread out the work. They plan to sell everything in 7 years and thinks they could sell them for $51,000 each at that time. Assume a discount rate of 5%. Depreciation is $41,000 per year per location. What would the business be worth today? Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 2 4 6 6 3 9 9 # of bakerys Step 1: forecast equity Operating Cash Flow Depreciation Net Income 1,102,000.00 812,000 Cash flows from operations 894,000.00 Cash flow from selling Capital expenditure 290,000.00 Cash available to pay dividends 604,000.00 Dividends Net change in cash beginning book value of equity Net Income 812,000.00 Dividends 604,000.00 Ending book value of equity 208,000.00 Step 2: Forecast abnormal earnings Net Income 812,000.00 Beginning book value of equity 5% 812,000.00 Cost of equity capital Normal earnings Abnormal earnings Step 3: Determine PV of abnormal earnings Abnormal earnings PV factor PV of abnormal earnings Sum of all years Beginning equity book value Value of business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts