Question: Problem 2 (16 points)_ Consider a project that involves the purchase of a $100,000 machine. The machine will last for three years. It is expected

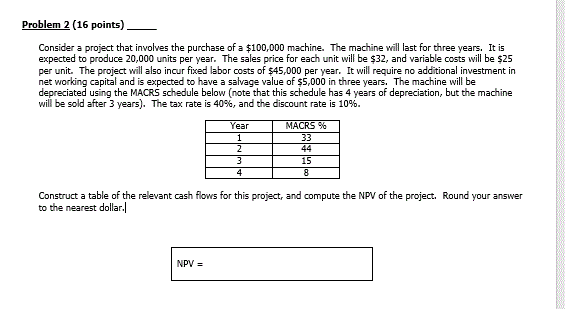

Problem 2 (16 points)_ Consider a project that involves the purchase of a $100,000 machine. The machine will last for three years. It is expected to produce 20,000 units per year. The sales price for each unit will be $32, and variable costs will be $25 per unit. The project will also incur fixed labor costs of $45,000 per year. It will require no additional investment in net working capital and is expected to have a salvage value of $5,000 in three years. The machine will be depreciated using the MACRS schedule below (note that this schedule has 4 years of depreciation, but the machine will be sold after 3 years). The tax rate is 40%, and the discount rate is 10%. MACRS % 15 Construct a table of the relevant cash flows for this project, and compute the NPV of the project. to the nearest dollar. Round your answer NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts