Question: Problem 2. (2 points) Consider the duration model of parallel yield curve shifts. Assume that all continuously compounded yields are currently at 5%. Suppose you

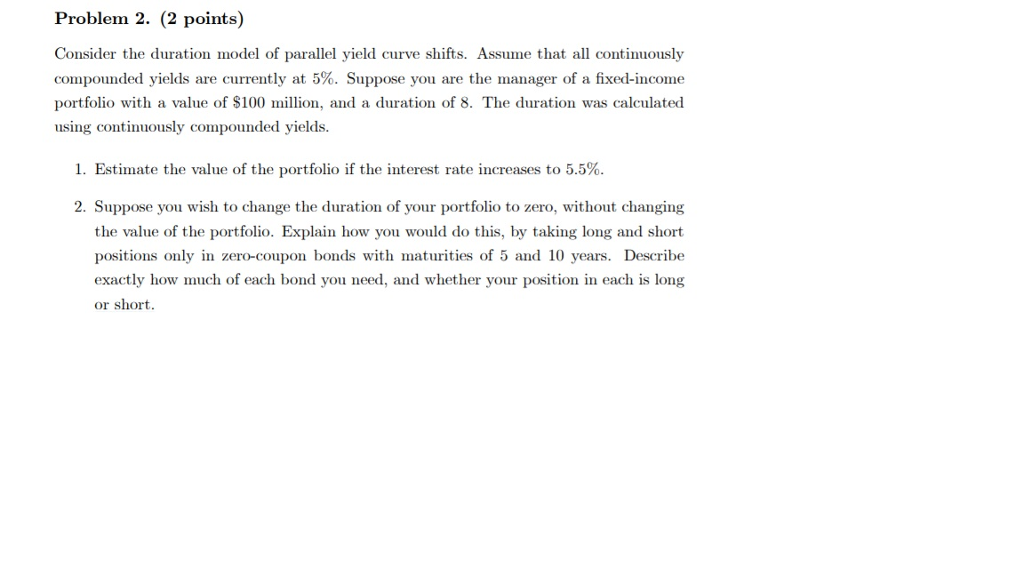

Problem 2. (2 points) Consider the duration model of parallel yield curve shifts. Assume that all continuously compounded yields are currently at 5%. Suppose you are the manager of a xed-income portfolio with a value of $100 million, and a duration of 8. The duration was calculated using continuously compounded yields. 1. Estimate the value of the portfolio if the interest rate increases to 5.5%. 2. Suppose you wish to change the duration of your portfolio to zero, without changing the value of the portfolio. Explain how you would do this, by taking long and short positions only in zero-coupon bonds with maturities of 5 and 10 years. Describe exactly how much of each bond you need, and whether your position in each is long or short.

Problem 2. (2 points) Consider the duration model of parallel yield curve shifts. Assume that all continuously compounded yields are currently at 5%. Suppose you are the manager of a fixed-income portfolio with a value of S100 million, and a duration of 8. The duration was calculated using continuously compounded yields I. Estimate the value of the portfolio if the interest rate increases to 5.5%. 2. Suppose you wish to change the duration of your portfolio to zero, without changing the value of the portfolio. Explain how you would do this, by taking long and short positions only in zero-coupon bonds with maturities of 5 and 10 years. Describe exactly how much of each bond you need, and whether your position in each is long or short

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts