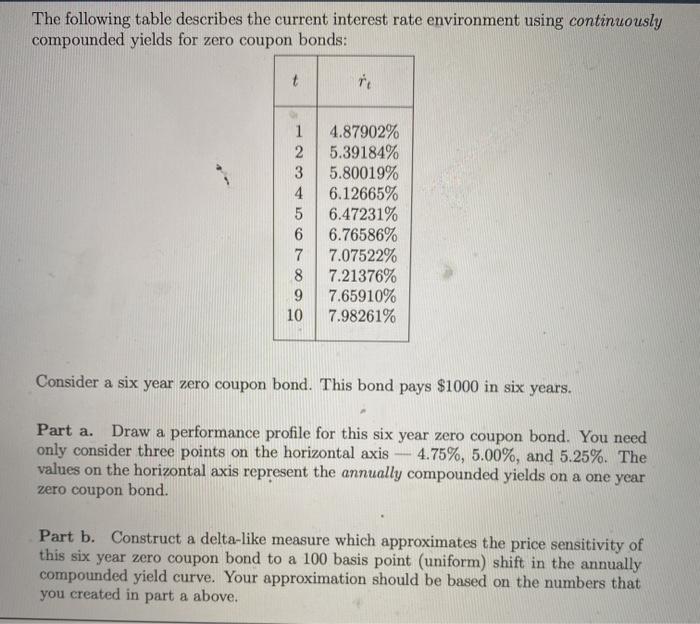

Question: The following table describes the current interest rate environment using continuously compounded yields for zero coupon bonds: t 1 2 3 4 5 6 7

The following table describes the current interest rate environment using continuously compounded yields for zero coupon bonds: t 1 2 3 4 5 6 7 8 9 10 4.87902% 5.39184% 5.80019% 6.12665% 6.47231% 6.76586% 7.07522% 7.21376% 7.65910% 7.98261% Consider a six year zero coupon bond. This bond pays $1000 in six years. Part a. Draw a performance profile for this six year zero coupon bond. You need only consider three points on the horizontal axis 4.75%, 5.00%, and 5.25%. The values on the horizontal axis represent the annually compounded yields on a one year zero coupon bond. Part b. Construct a delta-like measure which approximates the price sensitivity of this six year zero coupon bond to a 100 basis point (uniform) shift in the annually compounded yield curve. Your approximation should be based on the numbers that you created in part a above. Part c. Compare our usual dollar delta value for this security with the calculation in part b. Which is larger? Why is this appropriate? Part d. For the case of uniform shifts in the annually compounded yield curve, The following table describes the current interest rate environment using continuously compounded yields for zero coupon bonds: t 1 2 3 4 5 6 7 8 9 10 4.87902% 5.39184% 5.80019% 6.12665% 6.47231% 6.76586% 7.07522% 7.21376% 7.65910% 7.98261% Consider a six year zero coupon bond. This bond pays $1000 in six years. Part a. Draw a performance profile for this six year zero coupon bond. You need only consider three points on the horizontal axis 4.75%, 5.00%, and 5.25%. The values on the horizontal axis represent the annually compounded yields on a one year zero coupon bond. Part b. Construct a delta-like measure which approximates the price sensitivity of this six year zero coupon bond to a 100 basis point (uniform) shift in the annually compounded yield curve. Your approximation should be based on the numbers that you created in part a above. Part c. Compare our usual dollar delta value for this security with the calculation in part b. Which is larger? Why is this appropriate? Part d. For the case of uniform shifts in the annually compounded yield curve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts