Question: .. Problem 2 (20 points): Consider a 1-factor model with factor y. For today's value of y=5%, your portfolio's value is V(0.05)=$1,000,000. However, a small

..

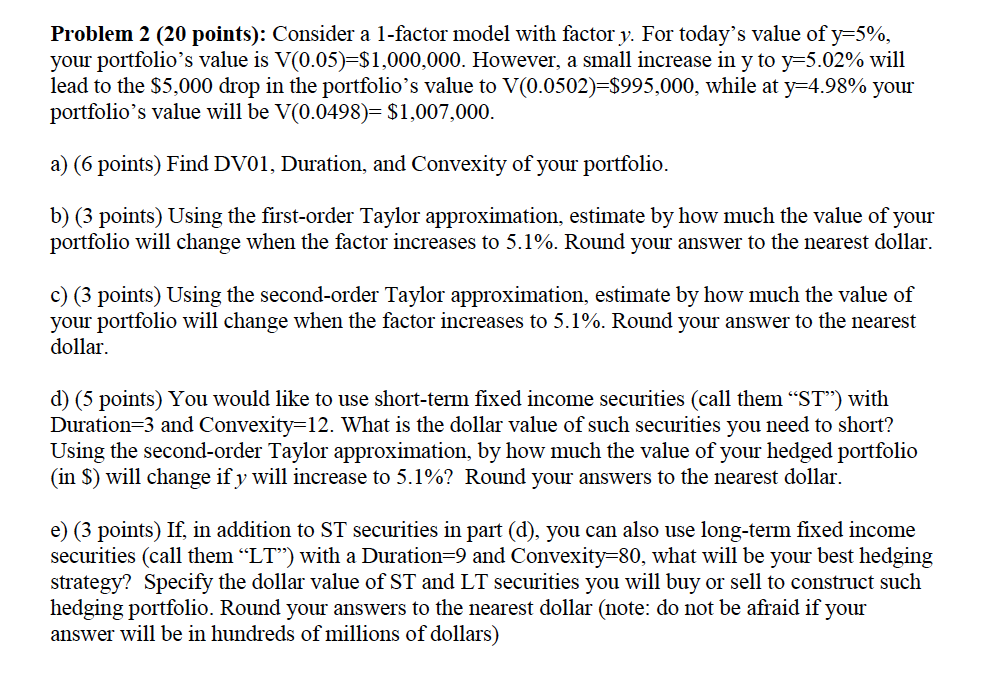

Problem 2 (20 points): Consider a 1-factor model with factor y. For today's value of y=5%, your portfolio's value is V(0.05)=$1,000,000. However, a small increase in y to y=5.02% will lead to the $5,000 drop in the portfolio's value to V(0.0502)=$995,000, while at y=4.98% your portfolio's value will be V(0.0498)= $1,007,000. a) (6 points) Find DV01, Duration, and Convexity of your portfolio. b) (3 points) Using the first-order Taylor approximation, estimate by how much the value of your portfolio will change when the factor increases to 5.1%. Round your answer to the nearest dollar. c) (3 points) Using the second-order Taylor approximation, estimate by how much the value of your portfolio will change when the factor increases to 5.1%. Round your answer to the nearest dollar. d) (5 points) You would like to use short-term fixed income securities (call them ST) with Duration=3 and Convexity=12. What is the dollar value of such securities you need to short? Using the second-order Taylor approximation, by how much the value of your hedged portfolio (in $) will change if y will increase to 5.1%? Round your answers to the nearest dollar. e) (3 points) If, in addition to ST securities in part (d), you can also use long-term fixed income securities (call them LT) with a Duration=9 and Convexity=80, what will be your best hedging strategy? Specify the dollar value of ST and LT securities you will buy or sell to construct such hedging portfolio. Round your answers to the nearest dollar (note: do not be afraid if your answer will be in hundreds of millions of dollars) Problem 2 (20 points): Consider a 1-factor model with factor y. For today's value of y=5%, your portfolio's value is V(0.05)=$1,000,000. However, a small increase in y to y=5.02% will lead to the $5,000 drop in the portfolio's value to V(0.0502)=$995,000, while at y=4.98% your portfolio's value will be V(0.0498)= $1,007,000. a) (6 points) Find DV01, Duration, and Convexity of your portfolio. b) (3 points) Using the first-order Taylor approximation, estimate by how much the value of your portfolio will change when the factor increases to 5.1%. Round your answer to the nearest dollar. c) (3 points) Using the second-order Taylor approximation, estimate by how much the value of your portfolio will change when the factor increases to 5.1%. Round your answer to the nearest dollar. d) (5 points) You would like to use short-term fixed income securities (call them ST) with Duration=3 and Convexity=12. What is the dollar value of such securities you need to short? Using the second-order Taylor approximation, by how much the value of your hedged portfolio (in $) will change if y will increase to 5.1%? Round your answers to the nearest dollar. e) (3 points) If, in addition to ST securities in part (d), you can also use long-term fixed income securities (call them LT) with a Duration=9 and Convexity=80, what will be your best hedging strategy? Specify the dollar value of ST and LT securities you will buy or sell to construct such hedging portfolio. Round your answers to the nearest dollar (note: do not be afraid if your answer will be in hundreds of millions of dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts