Question: Problem 2 (22 marks) You are a fixed income manager in a large superannuation fund. Your institution is holding the following Australian Government bonds on

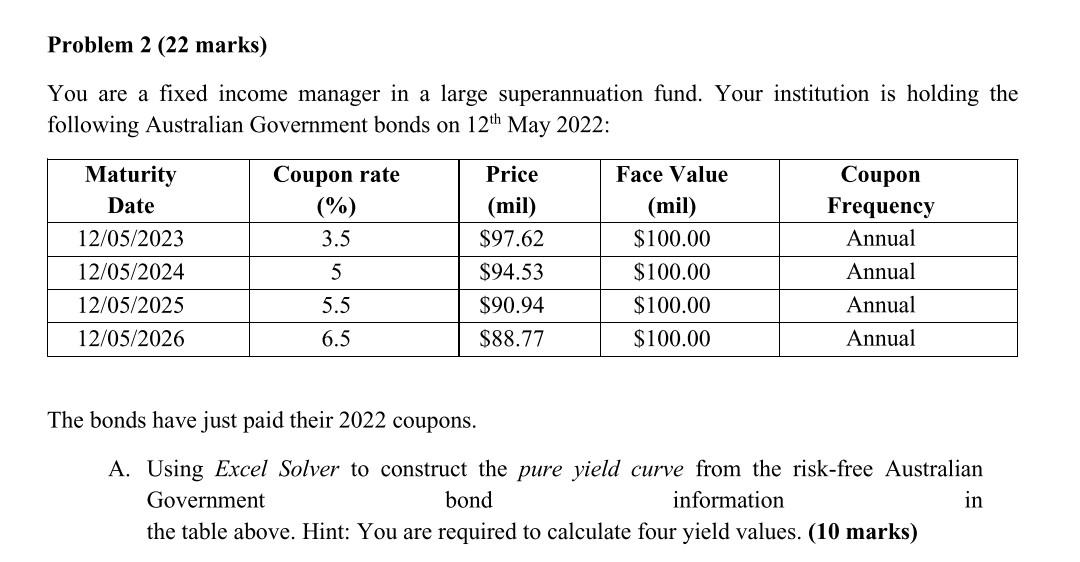

Problem 2 (22 marks) You are a fixed income manager in a large superannuation fund. Your institution is holding the following Australian Government bonds on 12th May 2022: Coupon rate Price Face Value Maturity Date Coupon Frequency (%) (mil) (mil) 12/05/2023 3.5 $97.62 $100.00 Annual 12/05/2024 5 $94.53 $100.00 Annual 12/05/2025 5.5 $90.94 $100.00 Annual 12/05/2026 6.5 $88.77 $100.00 Annual The bonds have just paid their 2022 coupons. A. Using Excel Solver to construct the pure yield curve from the risk-free Australian Government bond information in the table above. Hint: You are required to calculate four yield values. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock