Question: Problem 2 (25 points). Attached is information for the Blue Company for 20X2. The following additional information is also available for the company. BLUE COMPANY

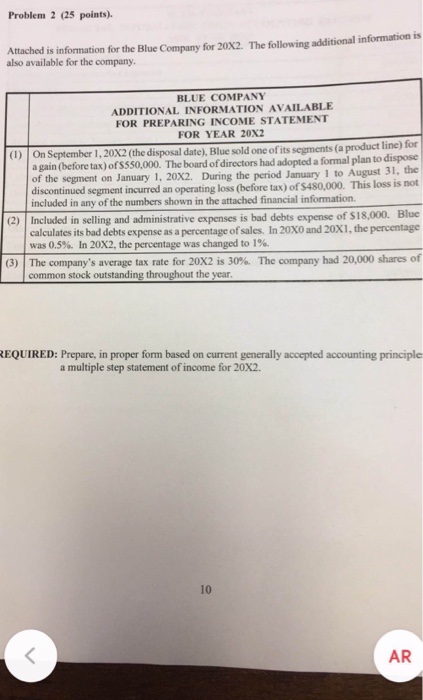

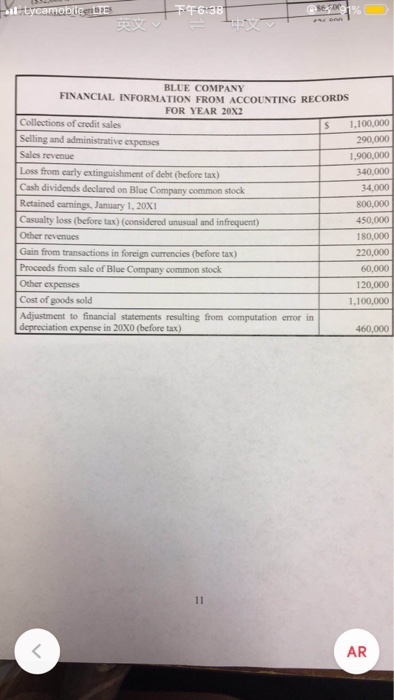

Problem 2 (25 points). Attached is information for the Blue Company for 20X2. The following additional information is also available for the company. BLUE COMPANY ADDITIONAL INFORMATION AVAILABLE FOR PREPARING INCOME STATEMENT FOR YEAR 20x2 (1) On September 1, 20X2(the disposal date). Blue sold one of its segments (a product line) fon the a gain (before tax)of $550,000. The board of directors had adopted a formal plan to dispose of the segment on January 1, 20X2. During the period January 1 to August3 discontinued segment incurred an operating loss (before tax) of $480,000. This loss is not included in any of the numbers shown in the attached financial information. (2) Included in selling and administrative expenses is bad debts expense of $18,000. Blue calculates its bad debts expense as a percentage of sales. In 20X0 and 20X1, the percentage was 0.5%. In 20X2, the percentage was changed to l %. (3) | The company's average tax rate for 20X2 is 30%. The company had 20,000 shares of common stock outstanding throughout the year EQUIRED: Prepare, in proper form based on current generally accepted accounting principle a multiple step statement of income for 20x2. 10 AR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts