Question: Problem 2 (25 points total) Show all your work. Answers without calculation/work will not earn points. A firm is considering an expansion project that will

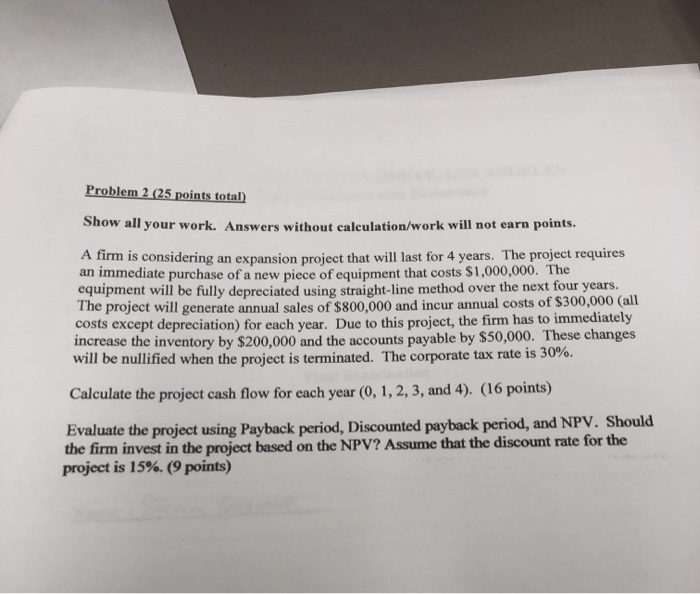

Problem 2 (25 points total) Show all your work. Answers without calculation/work will not earn points. A firm is considering an expansion project that will last for 4 years. The project requires an immediate purchase of a new piece of equipment that costs $1,000,000. The equipment will be fully depreciated using straight-line method over the next four years. 800,000 and incur annual costs of $300,000 Call costs except depreciation) for each year. Due to this project, the firm has to immediately increase the inventory by $200,000 and the accounts payable by $50,000. These changes will be nullified when the project is terminated. The corporate tax rte is 30%. Calculate the project cash flow for each year (0, 1, 2, 3, and 4). (16 points) Evaluate the project using Payback period, Discounted payback period, and NPV. Should firm invest in the project based on the NPV? Assume that the discount rate for the the project is 15%. (9 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts