Question: Problem 2 ( 30 points): Evaluating portfolio performance Assume Lord Darth Vader has two investment opportunities. Death Star Inc (DS) has expected return E(RDS)=6% and

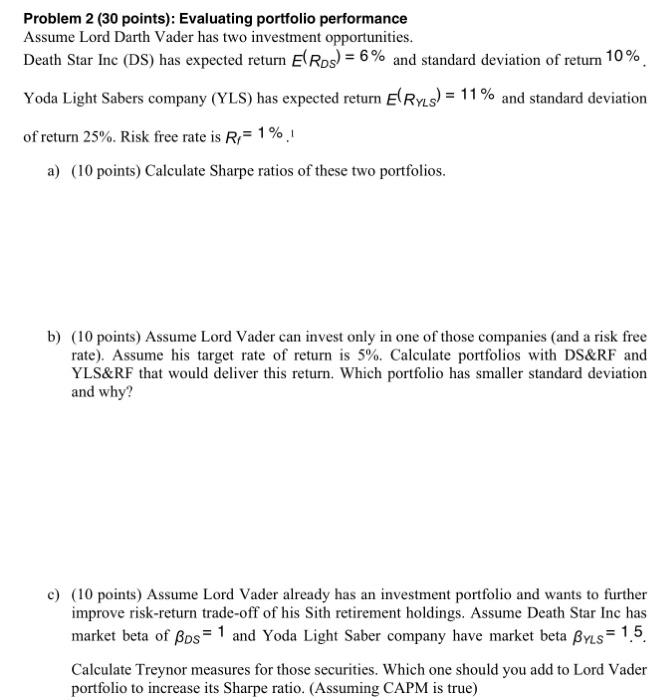

Problem 2 ( 30 points): Evaluating portfolio performance Assume Lord Darth Vader has two investment opportunities. Death Star Inc (DS) has expected return E(RDS)=6% and standard deviation of return 10%. Yoda Light Sabers company (YLS) has expected return E(RYLS)=11% and standard deviation of return 25%. Risk free rate is Rf=1%, 1 a) (10 points) Calculate Sharpe ratios of these two portfolios. b) (10 points) Assume Lord Vader can invest only in one of those companies (and a risk free rate). Assume his target rate of return is 5%. Calculate portfolios with DS\&RF and YLS\&RF that would deliver this return. Which portfolio has smaller standard deviation and why? c) (10 points) Assume Lord Vader already has an investment portfolio and wants to further improve risk-return trade-off of his Sith retirement holdings. Assume Death Star Inc has market beta of DS=1 and Yoda Light Saber company have market beta YLS=1.5. Calculate Treynor measures for those securities. Which one should you add to Lord Vader portfolio to increase its Sharpe ratio. (Assuming CAPM is true)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts