Question: Problem 2 (30) The CAPM is valid. Three assets, Stock A, Stock B, and a well-diversified portfolio P can be characterized as follows: Assets Market

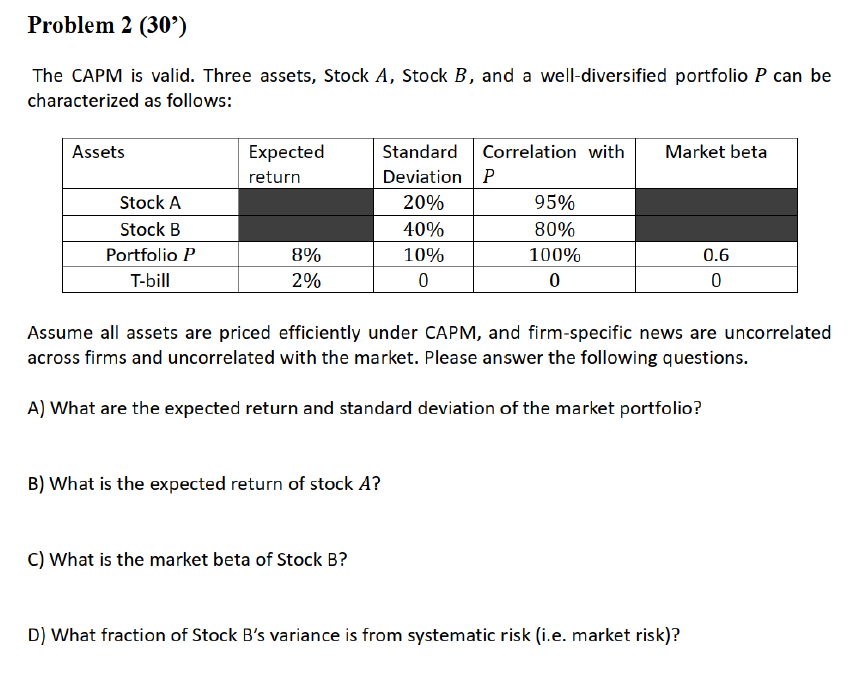

Problem 2 (30) The CAPM is valid. Three assets, Stock A, Stock B, and a well-diversified portfolio P can be characterized as follows: Assets Market beta Expected return Stock A Stock B Portfolio P T-bill Standard Correlation with Deviation P 20% 95% 40% 80% 10% 100% 0 0 8% 2% 0.6 0 Assume all assets are priced efficiently under CAPM, and firm-specific news are uncorrelated across firms and uncorrelated with the market. Please answer the following questions. A) What are the expected return and standard deviation of the market portfolio? B) What is the expected return of stock A? C) What is the market beta of Stock B? D) What fraction of Stock B's variance is from systematic risk (i.e. market risk)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts