Question: Problem 2 - 4 4 ( LO 2 - 6 ) Vinitpaul has the following information: Required: ( square ) a .

Problem LO

Vinitpaul has the following information:

Required: square

a How much must Vinitpaul pay in estimated taxes to avoid a penalty?

Note: Round the final answer to nearest whole dollar amount.

Minimum estimated tax payment

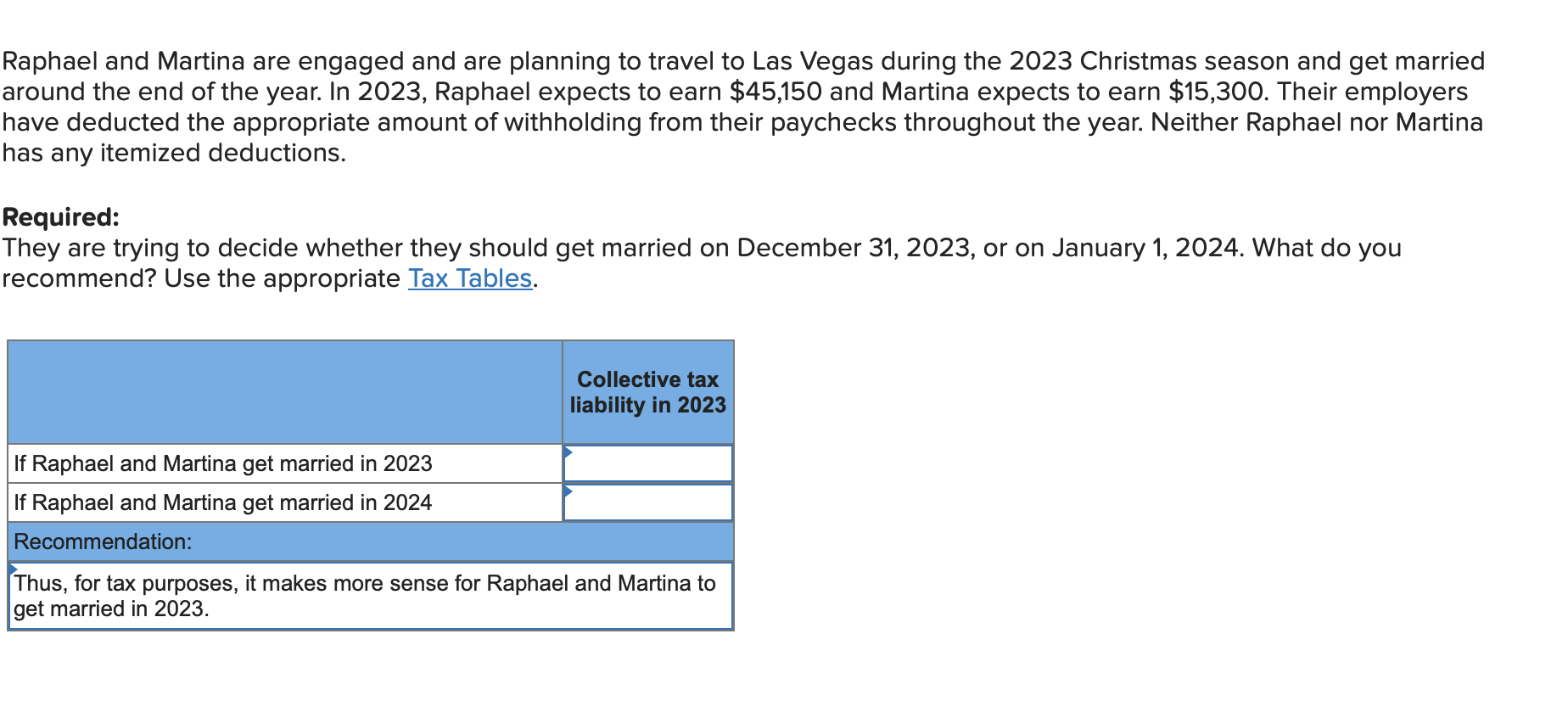

b If Vinitpaul had paid $ per quarter, would he have avoided the estimated tax penalty? Raphael and Martina are engaged and are planning to travel to Las Vegas during the Christmas season and get married around the end of the year. In Raphael expects to earn $ and Martina expects to earn $ Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year. Neither Raphael nor Martina has any itemized deductions.

Required:

They are trying to decide whether they should get married on December or on January What do you recommend? Use the appropriate Tax Tables. Raphael and Martina are engaged and are planning to travel to Las Vegas during the Christmas season and get married around the end of the year. In Raphael expects to earn $ and Martina expects to earn $ Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year. Neither Raphael nor Martina has any itemized deductions.

Required:

They are trying to decide whether they should get married on December or on January What do you recommend? Use the appropriate Tax Tables.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock