Question: Problem 2 (40 points): Briefly answer in Excel the questions that follow (each question is worth 5 points). An answer of 1-3 sentences for each

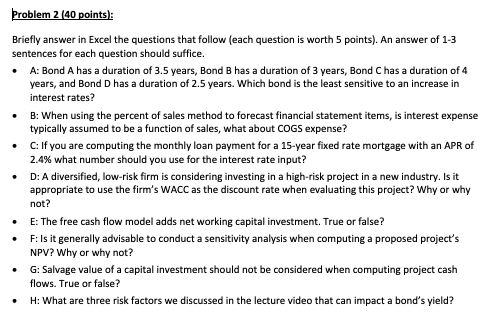

Problem 2 (40 points):

Briefly answer in Excel the questions that follow (each question is worth 5 points). An answer of 1-3 sentences for each question should suffice.

- A: Bond A has a duration of 3.5 years, Bond B has a duration of 3 years, Bond C has a duration of 4 years, and Bond D has a duration of 2.5 years. Which bond is the least sensitive to an increase in interest rates?

- B: When using the percent of sales method to forecast financial statement items, is interest expense typically assumed to be a function of sales, what about COGS expense?

- C: If you are computing the monthly loan payment for a 15-year fixed rate mortgage with an APR of 2.4% what number should you use for the interest rate input?

- D: A diversified, low-risk firm is considering investing in a high-risk project in a new industry. Is it appropriate to use the firms WACC as the discount rate when evaluating this project? Why or why not?

- E: The free cash flow model adds net working capital investment. True or false?

- F: Is it generally advisable to conduct a sensitivity analysis when computing a proposed projects NPV? Why or why not?

- G: Salvage value of a capital investment should not be considered when computing project cash flows. True or false?

- H: What are three risk factors we discussed in the lecture video that can impact a bonds yield?

Problem 2 (40 points): Briefly answer in Excel the questions that follow (each question is worth 5 points). An answer of 1-3 sentences for each question should suffice. A: Bond A has a duration of 3.5 years, Bond B has a duration of 3 years, Bond C has a duration of 4 years, and Bond D has a duration of 2.5 years. Which bond is the least sensitive to an increase in interest rates? B: When using the percent of sales method to forecast financial statement items, is interest expense typically assumed to be a function of sales, what about COGS expense? C: If you are computing the monthly loan payment for a 15-year fixed rate mortgage with an APR of 2.4% what number should you use for the interest rate input? D: A diversified, low-risk firm is considering investing in a high-risk project in a new industry. Is it appropriate to use the firm's WACC as the discount rate when evaluating this project? Why or why not? E: The free cash flow model adds net working capital investment. True or false? F: Is it generally advisable to conduct a sensitivity analysis when computing a proposed project's NPV? Why or why not? G: Salvage value of a capital investment should not be considered when computing project cash flows. True or false? H: What are three risk factors we discussed in the lecture video that can impact a bond's yield? Problem 2 (40 points): Briefly answer in Excel the questions that follow (each question is worth 5 points). An answer of 1-3 sentences for each question should suffice. A: Bond A has a duration of 3.5 years, Bond B has a duration of 3 years, Bond C has a duration of 4 years, and Bond D has a duration of 2.5 years. Which bond is the least sensitive to an increase in interest rates? B: When using the percent of sales method to forecast financial statement items, is interest expense typically assumed to be a function of sales, what about COGS expense? C: If you are computing the monthly loan payment for a 15-year fixed rate mortgage with an APR of 2.4% what number should you use for the interest rate input? D: A diversified, low-risk firm is considering investing in a high-risk project in a new industry. Is it appropriate to use the firm's WACC as the discount rate when evaluating this project? Why or why not? E: The free cash flow model adds net working capital investment. True or false? F: Is it generally advisable to conduct a sensitivity analysis when computing a proposed project's NPV? Why or why not? G: Salvage value of a capital investment should not be considered when computing project cash flows. True or false? H: What are three risk factors we discussed in the lecture video that can impact a bond's yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts