Question: Problem 2 (40 points): Briefly answer in Excel the questions that follow (each question is worth 5 points). An answer of 1-3 sentences for each

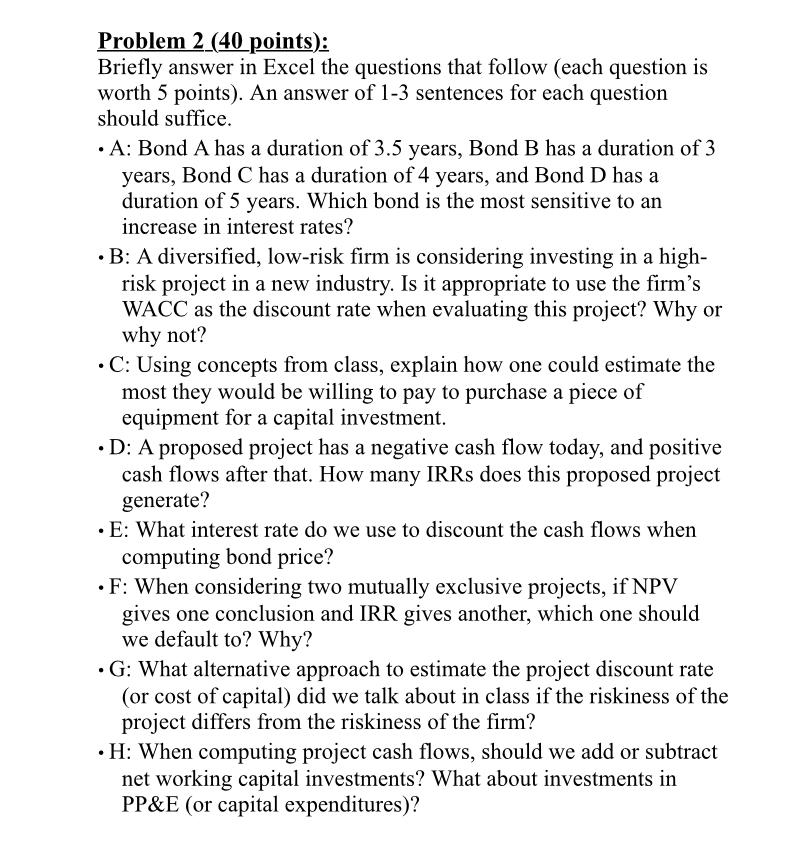

Problem 2 (40 points): Briefly answer in Excel the questions that follow (each question is worth 5 points). An answer of 1-3 sentences for each question should suffice. A: Bond A has a duration of 3.5 years, Bond B has a duration of 3 years, Bond C has a duration of 4 years, and Bond D has a duration of 5 years. Which bond is the most sensitive to an increase in interest rates? B: A diversified, low-risk firm is considering investing in a high- risk project in a new industry. Is it appropriate to use the firm's WACC as the discount rate when evaluating this project? Why or why not? C: Using concepts from class, explain how one could estimate the most they would be willing to pay to purchase a piece of equipment for a capital investment. D: A proposed project has a negative cash flow today, and positive cash flows after that. How many IRRs does this proposed project generate? E: What interest rate do we use to discount the cash flows when computing bond price? F: When considering two mutually exclusive projects, if NPV gives one conclusion and IRR gives another, which one should we default to? Why? G: What alternative approach to estimate the project discount rate (or cost of capital) did we talk about in class if the riskiness of the project differs from the riskiness of the firm? H: When computing project cash flows, should we add or subtract net working capital investments? What about investments in PP&E (or capital expenditures)? Problem 2 (40 points): Briefly answer in Excel the questions that follow (each question is worth 5 points). An answer of 1-3 sentences for each question should suffice. A: Bond A has a duration of 3.5 years, Bond B has a duration of 3 years, Bond C has a duration of 4 years, and Bond D has a duration of 5 years. Which bond is the most sensitive to an increase in interest rates? B: A diversified, low-risk firm is considering investing in a high- risk project in a new industry. Is it appropriate to use the firm's WACC as the discount rate when evaluating this project? Why or why not? C: Using concepts from class, explain how one could estimate the most they would be willing to pay to purchase a piece of equipment for a capital investment. D: A proposed project has a negative cash flow today, and positive cash flows after that. How many IRRs does this proposed project generate? E: What interest rate do we use to discount the cash flows when computing bond price? F: When considering two mutually exclusive projects, if NPV gives one conclusion and IRR gives another, which one should we default to? Why? G: What alternative approach to estimate the project discount rate (or cost of capital) did we talk about in class if the riskiness of the project differs from the riskiness of the firm? H: When computing project cash flows, should we add or subtract net working capital investments? What about investments in PP&E (or capital expenditures)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts