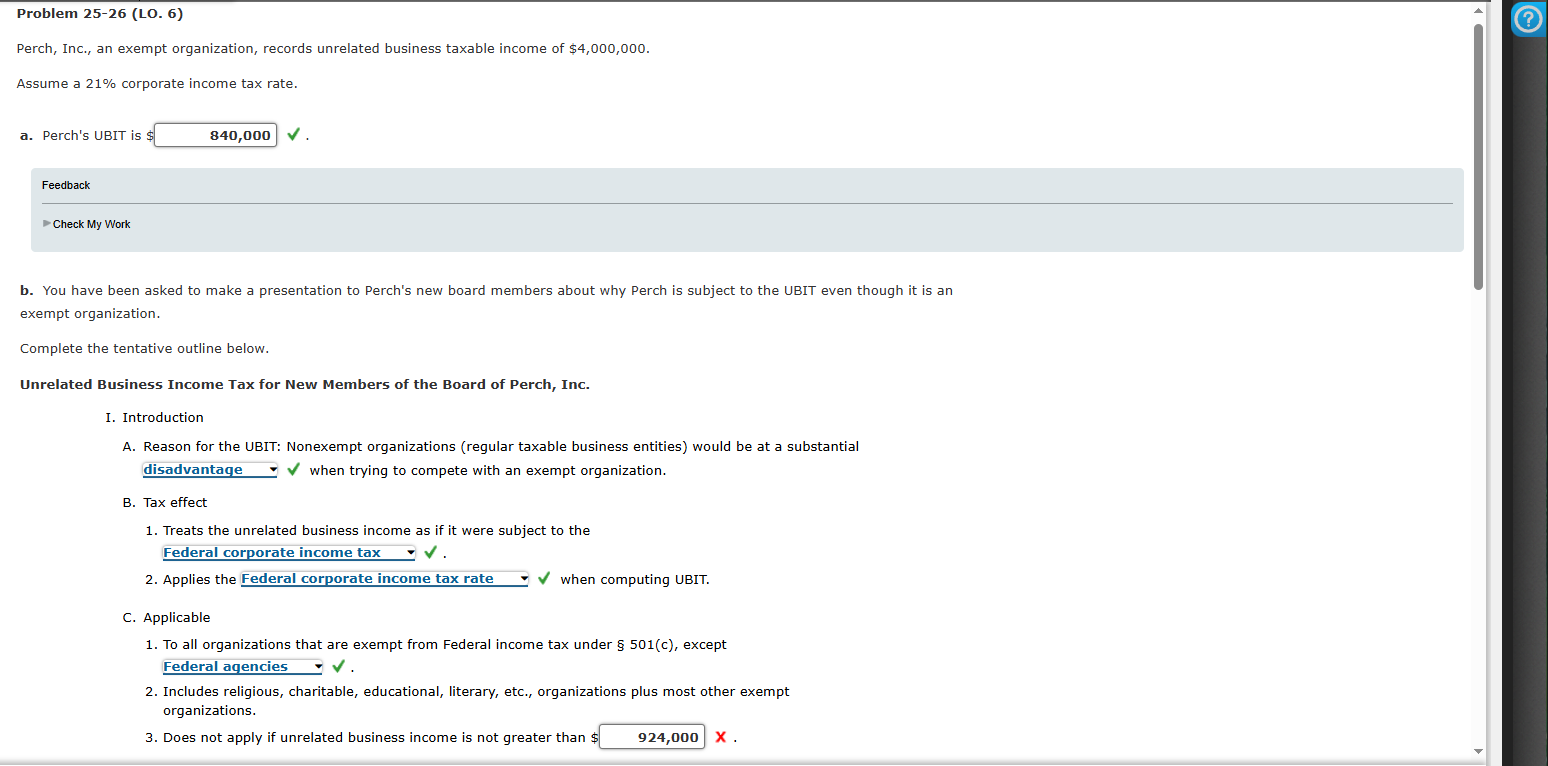

Question: Problem 2 5 - 2 6 ( LO . 6 ) Perch, Inc., an exempt organization, records unrelated business taxable income of $ 4

Problem LO Perch, Inc., an exempt organization, records unrelated business taxable income of $ Assume a corporate income tax rate. a Perch's UBIT is : checkmark Feedback Check My Work b You have been asked to make a presentation to Perch's new board members about why Perch is subject to the UBIT even though it is an exempt organization. Complete the tentative outline below. Unrelated Business Income Tax for New Members of the Board of Perch, Inc. I. Introduction A Reason for the UBIT: Nonexempt organizations regular taxable business entities would be at a substantial checkmark when trying to compete with an exempt organization. B Tax effect Treats the unrelated business income as if it were subject to the Federal corporate income tax Applies the Federal corporate income tax rate checkmark when computing UBIT. C Applicable To all organizations that are exempt from Federal income tax under c except Federal agencies checkmark Includes religious, charitable, educational, literary, etc., organizations plus most other exempt organizations. Does not apply if unrelated business income is not greater than $ X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock