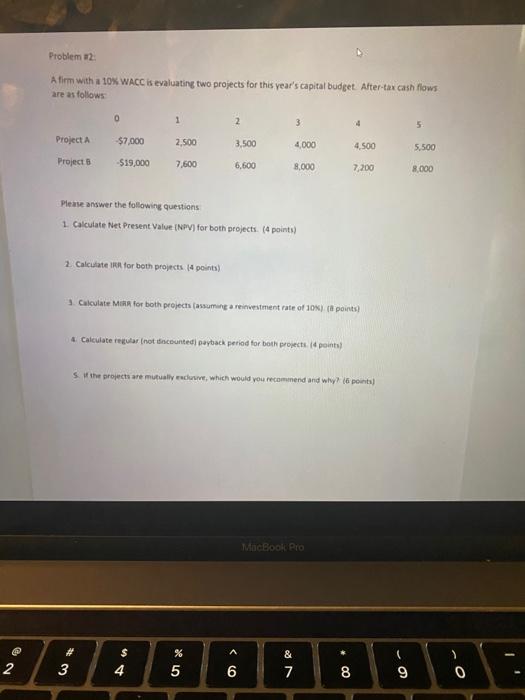

Question: Problem 2 A firm with a 10% WACC is evaluating two projects for this year's capital budget. After-tax cash flows are as follows 0 1

Problem 2 A firm with a 10% WACC is evaluating two projects for this year's capital budget. After-tax cash flows are as follows 0 1 2 3 5 Project $7,000 2.500 3,500 4.000 4.500 5.500 Project $19,000 7,600 6,600 8,000 7,200 8.000 Please answer the following questions 1. Calculate Net Present Value (NPV) for both projects. (4 points) 2. Calculate in for both projects. la points) Calculate Men for both projects fassuming a reinvestment rate of 10 ( points) Calculate tegular (not discounted payback period for both project is points s. the projects are mutually eduwee, which would you recommend and why? le points) MacBook Pro 4 2 3 $ 4 % 5 & 7 6 8 9 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts