Question: Problem 2: A retail bank has a total exposure to 4,000 customers of 133,271 million ISK (see excel sheet Homework 2 SPM 2019 The total

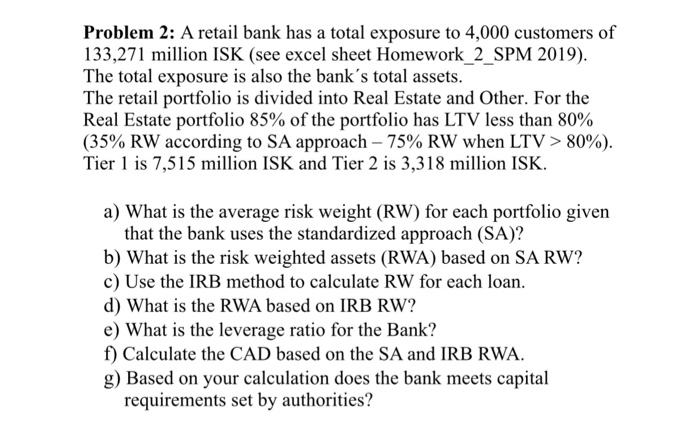

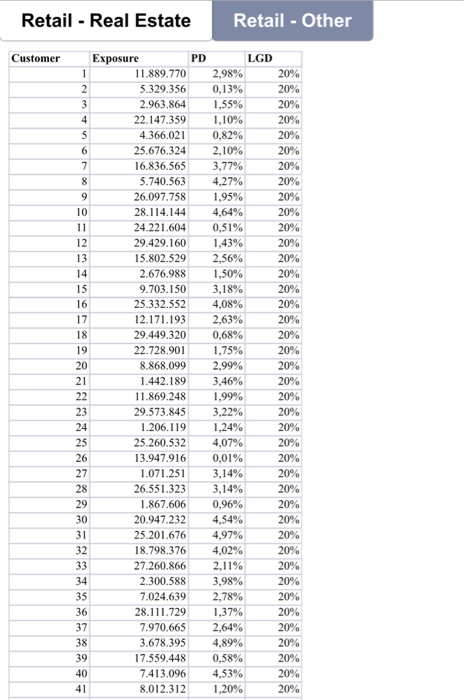

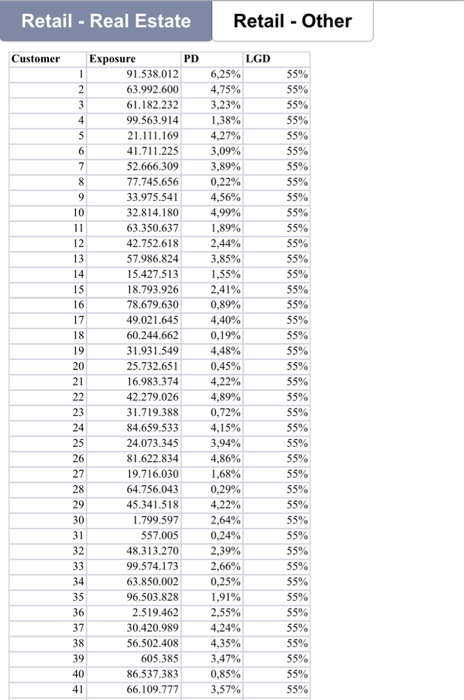

Problem 2: A retail bank has a total exposure to 4,000 customers of 133,271 million ISK (see excel sheet Homework 2 SPM 2019 The total exposure is also the bank's total assets The retail portfolio is divided into Real Estate and Other. For the Real Estate portfolio 85% of the portfolio has LTV less than 80% (35% Rw according to SA approach-75% RW when LTV > 80%) Tier 1 is 7,515 million ISK and Tier 2 is 3,318 million ISK. a) What is the average risk weight (RW) for each portfolio given that the bank uses the standardized approach (SA)? b) What is the risk weighted assets (RWA) based on SA RW? c) Use the IRB method to calculate RW for each loan d) What is the RWA based on IRB RW? e) What is the leverage ratio for the Bank? f) Calculate the CAD based on the SA and IRB RWA g) Based on your calculation does the bank meets capital requirements set by authorities? 2001 201-0. 2 3 4 1 4 0 1 2 1 3 4 2 0 1 2 3 1 3 1 4 0 3 3 0 4 4 4 2 3 2 1 2 4 041 5452453544 613 86 5 3 2 6 9 4 93 e 11 5 2 2 4 5 6 5 26 2 2 2 5 2 9 2 2 2 2 8 1 1 2 1 2 3 1 26-20 2 8 7 2 7 273778 12 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 2 3 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 4 4 64 2 3 66 2 9 545 4 2 0 2 2 0 1 2 4 4 3 4 3 3 0 4 4 1 2 3 1 2 0 4 0 4 0 4 4 0 4 3 4 1 78436 4 11 1 6 5 5 4 5 2 8 2 9 7 2 4- re 9 6 6 9 2 4 5 7 3 2 3 4 5 5 8 7 9 6 3 5 6 4 3 4 4 8 9 64 45 2345678911 12 3 4 5 6 7 8 9 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 40 41 1 Problem 2: A retail bank has a total exposure to 4,000 customers of 133,271 million ISK (see excel sheet Homework 2 SPM 2019 The total exposure is also the bank's total assets The retail portfolio is divided into Real Estate and Other. For the Real Estate portfolio 85% of the portfolio has LTV less than 80% (35% Rw according to SA approach-75% RW when LTV > 80%) Tier 1 is 7,515 million ISK and Tier 2 is 3,318 million ISK. a) What is the average risk weight (RW) for each portfolio given that the bank uses the standardized approach (SA)? b) What is the risk weighted assets (RWA) based on SA RW? c) Use the IRB method to calculate RW for each loan d) What is the RWA based on IRB RW? e) What is the leverage ratio for the Bank? f) Calculate the CAD based on the SA and IRB RWA g) Based on your calculation does the bank meets capital requirements set by authorities? 2001 201-0. 2 3 4 1 4 0 1 2 1 3 4 2 0 1 2 3 1 3 1 4 0 3 3 0 4 4 4 2 3 2 1 2 4 041 5452453544 613 86 5 3 2 6 9 4 93 e 11 5 2 2 4 5 6 5 26 2 2 2 5 2 9 2 2 2 2 8 1 1 2 1 2 3 1 26-20 2 8 7 2 7 273778 12 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 2 3 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 4 4 64 2 3 66 2 9 545 4 2 0 2 2 0 1 2 4 4 3 4 3 3 0 4 4 1 2 3 1 2 0 4 0 4 0 4 4 0 4 3 4 1 78436 4 11 1 6 5 5 4 5 2 8 2 9 7 2 4- re 9 6 6 9 2 4 5 7 3 2 3 4 5 5 8 7 9 6 3 5 6 4 3 4 4 8 9 64 45 2345678911 12 3 4 5 6 7 8 9 2 2 2 2 2 2 2 2 2 2 3 3 3 3 3 3 3 3 3 3 40 41 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts