Question: Problem 2 An Electronics shop provides specialty-manufacturing service. The initial outlay is $30 million and, management estimates that the firm might generate cash flows for

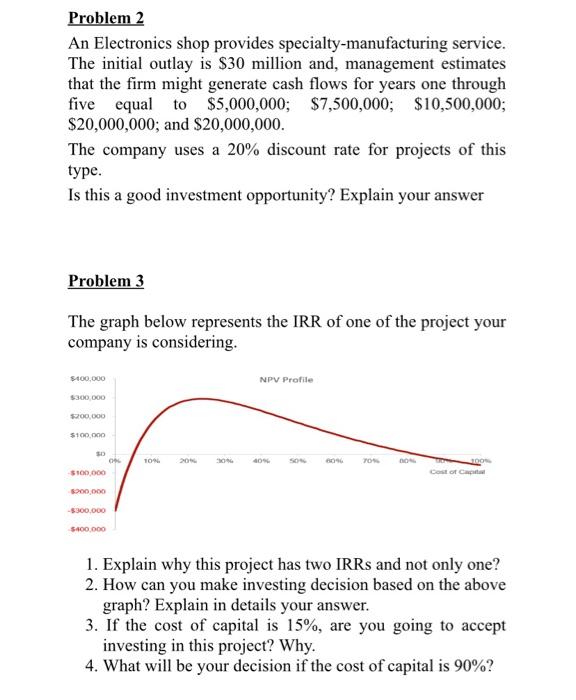

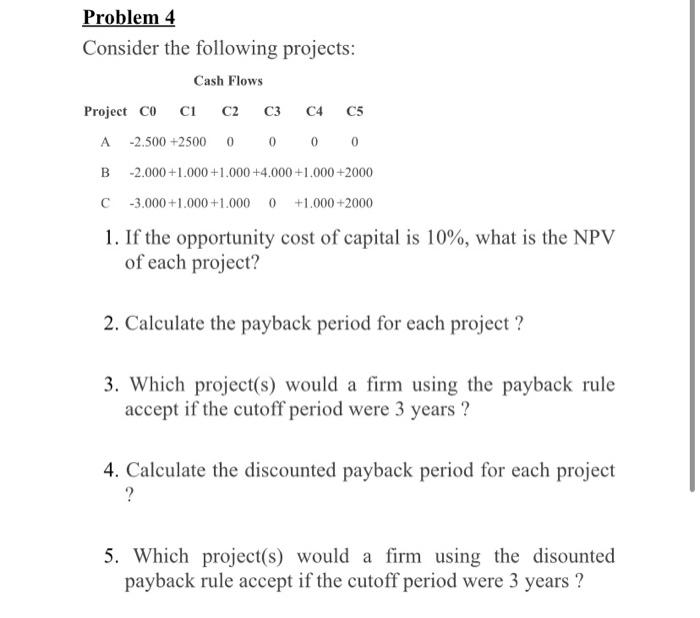

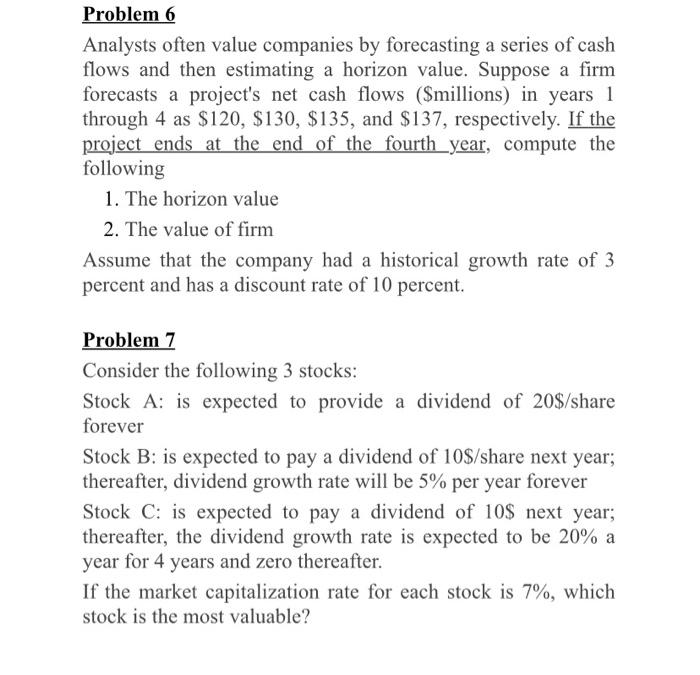

Problem 2 An Electronics shop provides specialty-manufacturing service. The initial outlay is $30 million and, management estimates that the firm might generate cash flows for years one through five equal to $5,000,000;$7,500,000;$10,500,000; $20,000,000; and $20,000,000. The company uses a 20% discount rate for projects of this type. Is this a good investment opportunity? Explain your answer Problem 3 The graph below represents the IRR of one of the project your company is considering. 1. Explain why this project has two IRRs and not only one? 2. How can you make investing decision based on the above graph? Explain in details your answer. 3. If the cost of capital is 15%, are you going to accept investing in this project? Why. 4. What will be your decision if the cost of capital is 90% ? Problem 4 Consider the following projects: 1. If the opportunity cost of capital is 10%, what is the NPV of each project? 2. Calculate the payback period for each project ? 3. Which project(s) would a firm using the payback rule accept if the cutoff period were 3 years ? 4. Calculate the discounted payback period for each project ? 5. Which project(s) would a firm using the disounted payback rule accept if the cutoff period were 3 years ? Problem 6 Analysts often value companies by forecasting a series of cash flows and then estimating a horizon value. Suppose a firm forecasts a project's net cash flows (\$millions) in years 1 through 4 as $120,$130,$135, and $137, respectively. If the project ends at the end of the fourth year, compute the following 1. The horizon value 2. The value of firm Assume that the company had a historical growth rate of 3 percent and has a discount rate of 10 percent. Problem 7 Consider the following 3 stocks: Stock A: is expected to provide a dividend of 20$/ share forever Stock B: is expected to pay a dividend of 10$/ share next year; thereafter, dividend growth rate will be 5% per year forever Stock C : is expected to pay a dividend of 10$ next year; thereafter, the dividend growth rate is expected to be 20% a year for 4 years and zero thereafter. If the market capitalization rate for each stock is 7%, which stock is the most valuable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts