Question: Problem 2 Blastoise Builders Inc. entered into a contract to construct an office building and plaza at a contract price of P100,000,000. Income is to

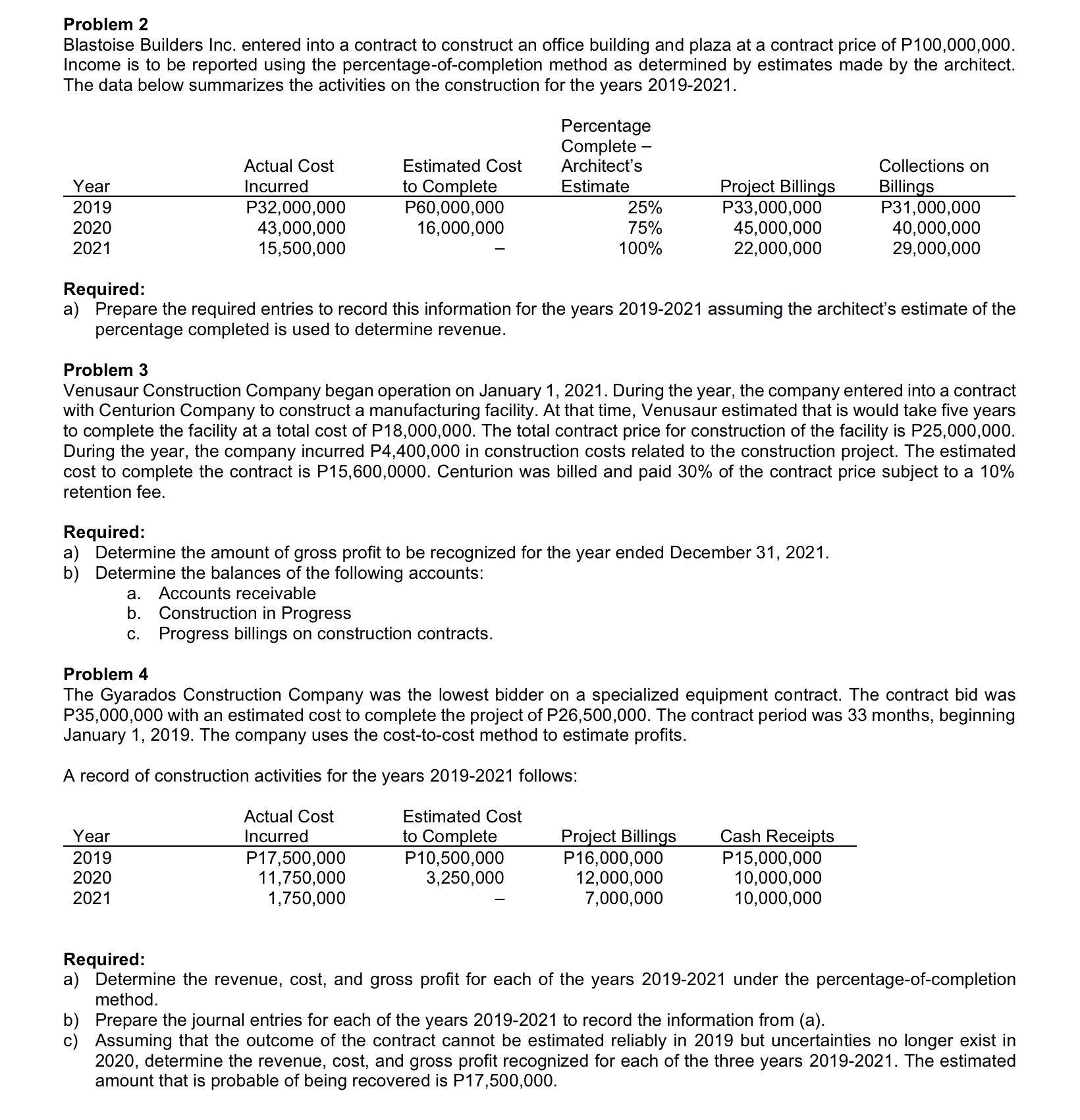

Problem 2 Blastoise Builders Inc. entered into a contract to construct an office building and plaza at a contract price of P100,000,000. Income is to be reported using the percentageofcompletion method as determined by estimates made by the architect. The data below summarizes the activities on the construction for the years 2019~2021. Percentage Complete Actual Cost Estimated Cost Architect's Collections on Year Incurred to Complete Estimate Project Billings Billings 2019 P32,000,000 P60,000,000 25% P33,000,000 P31 ,000,000 2020 43,000,000 16,000,000 75% 45,000,000 40,000,000 2021 15,500,000 100% 22,000,000 29,000,000 Required: a) Prepare the required entries to record this information for the years 2019-2021 assuming the architect's estimate of the percentage completed is used to determine revenue. Problem 3 Venusaur Construction Company began operation on January 1, 2021. During the year, the company entered into a contract with Centurion Company to construct a manufacturing facility. At that time, Venusaur estimated that is would take ve years to complete the facility at a total cost of P18,000,000. The total contract price for construction of the facility is P25,000,000. During the year, the company incurred P4,400,000 in construction costs related to the construction project. The estimated cost to complete the contract is P15,600,0000. Centurion was billed and paid 30% of the contract price subject to a 10% retention fee. Required: a) Determine the amount of gross profit to be recognized for the year ended December 31, 2021. b) Determine the balances of the following accounts: a. Accounts receivable b. Construction in Progress c. Progress billings on construction contracts. Problem 4 The Gyarados Construction Company was the lowest bidder on a specialized equipment contract. The contract bid was P35,000,000 with an estimated cost to complete the project of P26,500,000. The contract period was 33 months, beginning January 1, 2019. The company uses the cost-tocost method to estimate prots. A record of construction activities for the years 20192021 follows: Actual Cost Estimated Cost Year Incurred to Complete Project Billings Cash Receipts 2019 P17,500,000 P10,500,000 P16,000,000 P15,000,000 2020 11,750,000 3,250,000 12,000,000 10,000,000 2021 1,750,000 7,000,000 10,000,000 Required: a) Determine the revenue, cost, and gross prot for each of the years 2019-2021 under the percentage-ofcompletion method. b) Prepare the journal entries for each of the years 20192021 to record the information from (a). c) Assuming that the outcome of the contract cannot be estimated reliably in 2019 but uncertainties no longer exist in 2020, determine the revenue, cost, and gross prot recognized for each of the three years 20192021. The estimated amount that is probable of being recovered is P17,500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts