Question: Problem 2 - Chapter 5 Journal Entries. Record the following transactions in general journal form related to the capital activities of the Foster City described

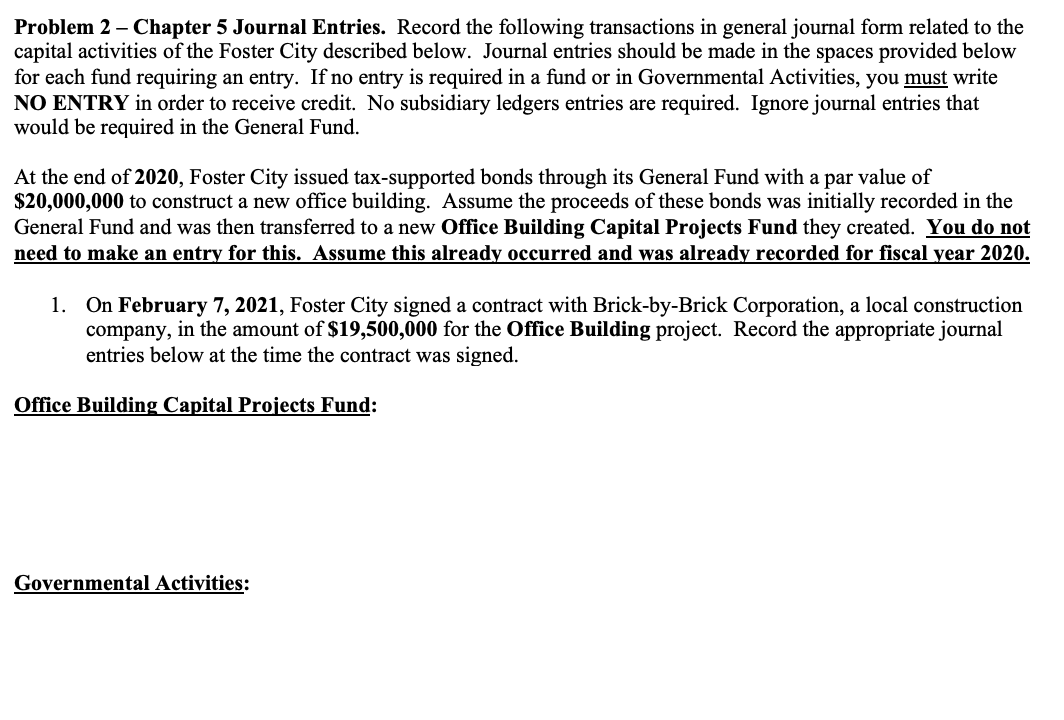

Problem 2 - Chapter 5 Journal Entries. Record the following transactions in general journal form related to the capital activities of the Foster City described below. Journal entries should be made in the spaces provided below for each fund requiring an entry. If no entry is required in a fund or in Governmental Activities, you must write NO ENTRY in order to receive credit. No subsidiary ledgers entries are required. Ignore journal entries that would be required in the General Fund. At the end of 2020, Foster City issued tax-supported bonds through its General Fund with a par value of $20,000,000 to construct a new office building. Assume the proceeds of these bonds was initially recorded in the General Fund and was then transferred to a new Office Building Capital Projects Fund they created. You do not need to make an entry for this. Assume this already occurred and was already recorded for fiscal year 2020. 1. On February 7, 2021, Foster City signed a contract with Brick-by-Brick Corporation, a local construction company, in the amount of $19,500,000 for the Office Building project. Record the appropriate journal entries below at the time the contract was signed. Office Building Capital Projects Fund: Governmental Activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts