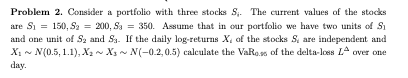

Question: Problem 2. Consider a portfolio with three stocks S. The current values of the stacks are Si = 150, S2 = 200, S3 = 350.

Problem 2. Consider a portfolio with three stocks S. The current values of the stacks are Si = 150, S2 = 200, S3 = 350. Assume that in our portfolio we have two units of S and one unit of S, and S. If the daily log-returns X of the stocks S. are independent and Xi (0.5, 1.1), X2 XsN(-0.2, 0.5) calculate the VaRoss of the delta-lces over one day. Problem 2. Consider a portfolio with three stocks S. The current values of the stacks are Si = 150, S2 = 200, S3 = 350. Assume that in our portfolio we have two units of S and one unit of S, and S. If the daily log-returns X of the stocks S. are independent and Xi (0.5, 1.1), X2 XsN(-0.2, 0.5) calculate the VaRoss of the delta-lces over one day

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts