Question: Problem 2. Consider a world in which there are only two periods and three possible states of the world in the second period (a good

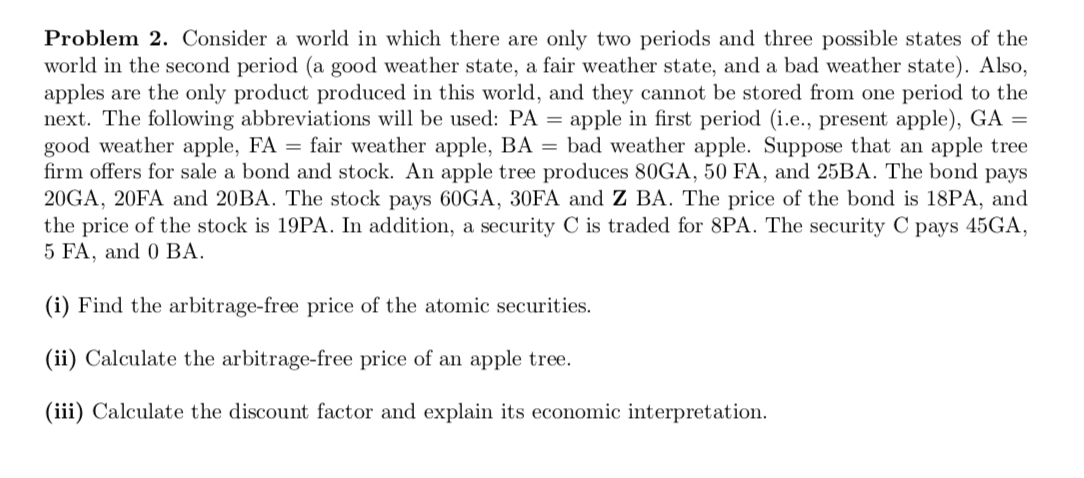

Problem 2. Consider a world in which there are only two periods and three possible states of the world in the second period (a good weather state, a fair weather state, and a bad weather state). Also, apples are the only product produced in this world, and they cannot be stored from one period to the next. The following abbreviations will be used: PA = apple in first period (i.e., present apple), GA = good weather apple, FA = fair weather apple, BA = bad weather apple. Suppose that an apple tree firm offers for sale a bond and stock. An apple tree produces 80GA, 50 FA, and 25BA. The bond pays 20GA, 20FA and 20BA. The stock pays 60GA, 30FA and Z BA. The price of the bond is 18PA, and the price of the stock is 19PA. In addition, a security C is traded for 8PA. The security C pays 45GA, 5 FA, and 0 BA. (i) Find the arbitrage-free price of the atomic securities. (ii) Calculate the arbitrage-free price of an apple tree. (iii) Calculate the discount factor and explain its economic interpretation. Problem 2. Consider a world in which there are only two periods and three possible states of the world in the second period (a good weather state, a fair weather state, and a bad weather state). Also, apples are the only product produced in this world, and they cannot be stored from one period to the next. The following abbreviations will be used: PA = apple in first period (i.e., present apple), GA = good weather apple, FA = fair weather apple, BA = bad weather apple. Suppose that an apple tree firm offers for sale a bond and stock. An apple tree produces 80GA, 50 FA, and 25BA. The bond pays 20GA, 20FA and 20BA. The stock pays 60GA, 30FA and Z BA. The price of the bond is 18PA, and the price of the stock is 19PA. In addition, a security C is traded for 8PA. The security C pays 45GA, 5 FA, and 0 BA. (i) Find the arbitrage-free price of the atomic securities. (ii) Calculate the arbitrage-free price of an apple tree. (iii) Calculate the discount factor and explain its economic interpretation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts