Question: 1) Consider a world in which there are only two periods: period 0 and period 1 and three possible states of the world in period

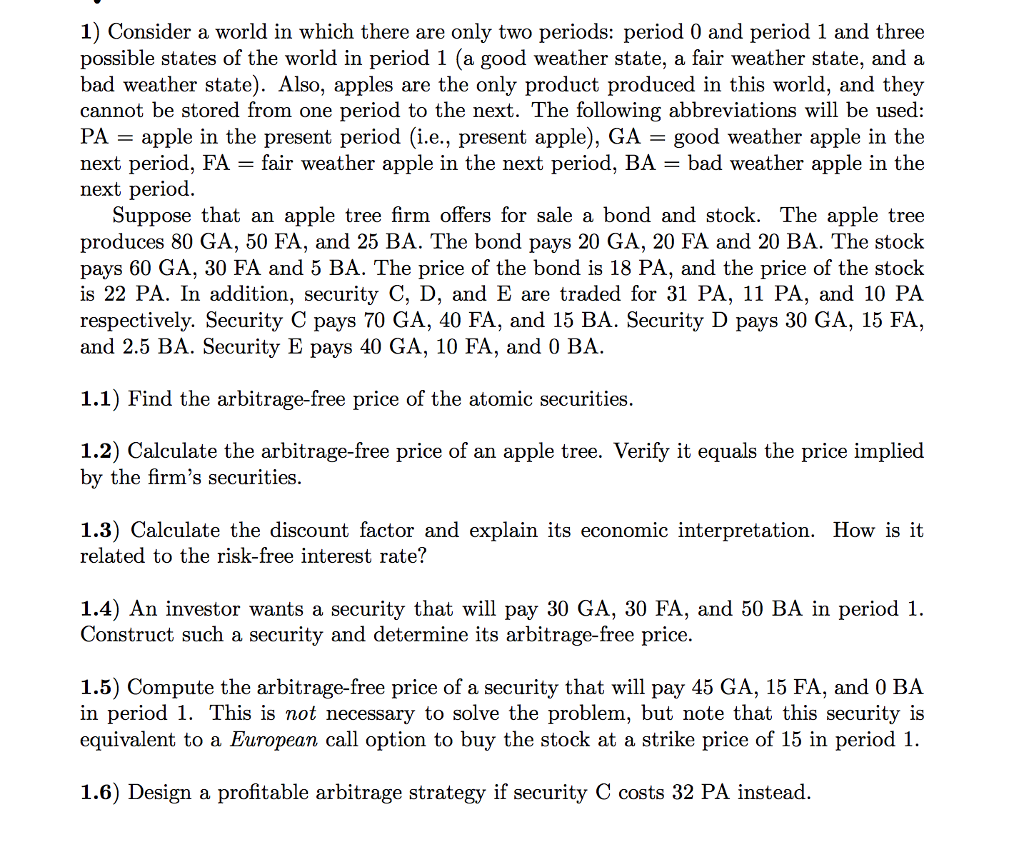

1) Consider a world in which there are only two periods: period 0 and period 1 and three possible states of the world in period 1 (a good weather state, a fair weather state, and a bad weather state). Also, apples are the only product produced in this world, and they cannot be stored from one period to the next. The following abbreviations will be used PA - apple in the present period (i.e., present apple), GA- good weather apple in the next period. FA fair weather apple in the next period. BA-bad weather apple in the next period Suppose that an apple tree firm offers for sale a bond and stock. The apple tree produces 80 GA, 50 FA, and 25 BA. The bond pays 20 GA, 20 FA and 20 BA. The stock pays 60 GA, 30 FA and 5 BA. The price of the bond is 18 PA, and the price of the stock is 22 PA. In addition, security C, D, and E are traded for 31 PA, 11 PA, and 10 PA respectively. Security C pays 70 GA, 40 FA, and 15 BA. Security D pays 30 GA, 15 FA and 2.5 BA. Security E pays 40 GA, 10 FA, and 0 BA 1.1) Find the arbitrage-free price of the atomic securities 1.2) Calculate the arbitrage-free price of an apple tree. Verify it equals the price implied by the firm's securities 1.3) Calculate the discount factor and explain its economic interpretation. How is it related to the risk-free interest rate? 1.4) An investor wants a security that will pay 30 GA, 30 FA, and 50 BA in period 1. Construct such a security and determine its arbitrage-free price. 1.5) Compute the arbitrage-free price of a security that will pay 45 GA, 15 FA, and 0 BA in period 1. This is not necessary to solve the problem, but note that this security is equivalent to a European call option to buy the stock at a strike price of 15 in period 1. 1.6) Design a profitable arbitrage strategy if security C costs 32 PA instead 1) Consider a world in which there are only two periods: period 0 and period 1 and three possible states of the world in period 1 (a good weather state, a fair weather state, and a bad weather state). Also, apples are the only product produced in this world, and they cannot be stored from one period to the next. The following abbreviations will be used PA - apple in the present period (i.e., present apple), GA- good weather apple in the next period. FA fair weather apple in the next period. BA-bad weather apple in the next period Suppose that an apple tree firm offers for sale a bond and stock. The apple tree produces 80 GA, 50 FA, and 25 BA. The bond pays 20 GA, 20 FA and 20 BA. The stock pays 60 GA, 30 FA and 5 BA. The price of the bond is 18 PA, and the price of the stock is 22 PA. In addition, security C, D, and E are traded for 31 PA, 11 PA, and 10 PA respectively. Security C pays 70 GA, 40 FA, and 15 BA. Security D pays 30 GA, 15 FA and 2.5 BA. Security E pays 40 GA, 10 FA, and 0 BA 1.1) Find the arbitrage-free price of the atomic securities 1.2) Calculate the arbitrage-free price of an apple tree. Verify it equals the price implied by the firm's securities 1.3) Calculate the discount factor and explain its economic interpretation. How is it related to the risk-free interest rate? 1.4) An investor wants a security that will pay 30 GA, 30 FA, and 50 BA in period 1. Construct such a security and determine its arbitrage-free price. 1.5) Compute the arbitrage-free price of a security that will pay 45 GA, 15 FA, and 0 BA in period 1. This is not necessary to solve the problem, but note that this security is equivalent to a European call option to buy the stock at a strike price of 15 in period 1. 1.6) Design a profitable arbitrage strategy if security C costs 32 PA instead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts