Question: Problem 2: Corprate Financing with Collateral. Consider entrepreneur i en- dowed with a business where investment I generates stochastic revenue equal R with prob- ability

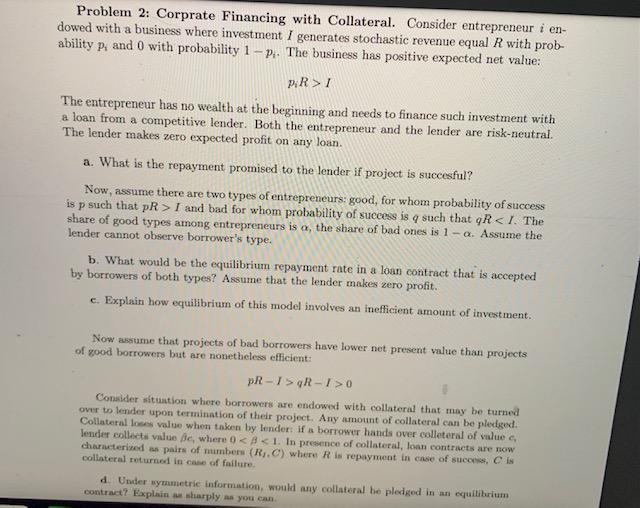

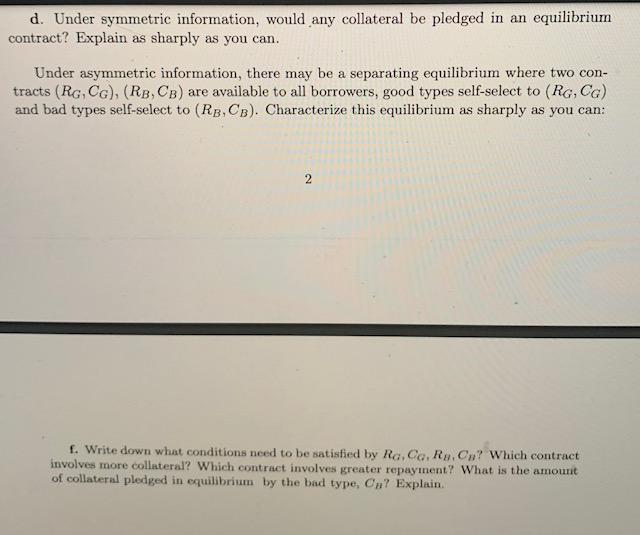

Problem 2: Corprate Financing with Collateral. Consider entrepreneur i en- dowed with a business where investment I generates stochastic revenue equal R with prob- ability P, and 0 with probability 1 - P. The business has positive expected net value: PiR>I The entrepreneur has no wealth at the beginning and needs to finance such investment with a loan from a competitive lender. Both the entrepreneur and the lender are risk-neutral. The lender makes zero expected profit on any loan. a. What is the repayment promised to the lender if project is succesful? Now, assume there are two types of entrepreneurs: good, for whom probability of success is p such that pR>I and bad for whom probability of success is q such that ORCI. The share of good types among entrepreneurs is a, the share of bad ones is 1-a. Assume the lender cannot observe borrower's type. b. What would be the equilibrium repayment rate in a loan contract that is accepted by borrowers of both types? Assume that the lender makes zero profit. c. Explain how equilibrium of this model involves an inefficient amount of investment. Now assume that projects of bad borrowers have lower net present value than projects of good borrowers but are nonetheless efficient: PR-T>R-I>0 Consider situation where borrowers are endowed with collateral that may be turned over to lender upon termination of their project. Any amount of collateral can be pledged. Collateral loses valve when taken by lender: if a borrower hands over colleteral of value c, lender collecta value fe, where 0 I The entrepreneur has no wealth at the beginning and needs to finance such investment with a loan from a competitive lender. Both the entrepreneur and the lender are risk-neutral. The lender makes zero expected profit on any loan. a. What is the repayment promised to the lender if project is succesful? Now, assume there are two types of entrepreneurs: good, for whom probability of success is p such that pR>I and bad for whom probability of success is q such that ORCI. The share of good types among entrepreneurs is a, the share of bad ones is 1-a. Assume the lender cannot observe borrower's type. b. What would be the equilibrium repayment rate in a loan contract that is accepted by borrowers of both types? Assume that the lender makes zero profit. c. Explain how equilibrium of this model involves an inefficient amount of investment. Now assume that projects of bad borrowers have lower net present value than projects of good borrowers but are nonetheless efficient: PR-T>R-I>0 Consider situation where borrowers are endowed with collateral that may be turned over to lender upon termination of their project. Any amount of collateral can be pledged. Collateral loses valve when taken by lender: if a borrower hands over colleteral of value c, lender collecta value fe, where 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts