Question: Problem 2: Estimating the DCF Growth Rate Suppose Stark, Ltd., just issued a dividend of $2.08 per share on its common stock. The company paid

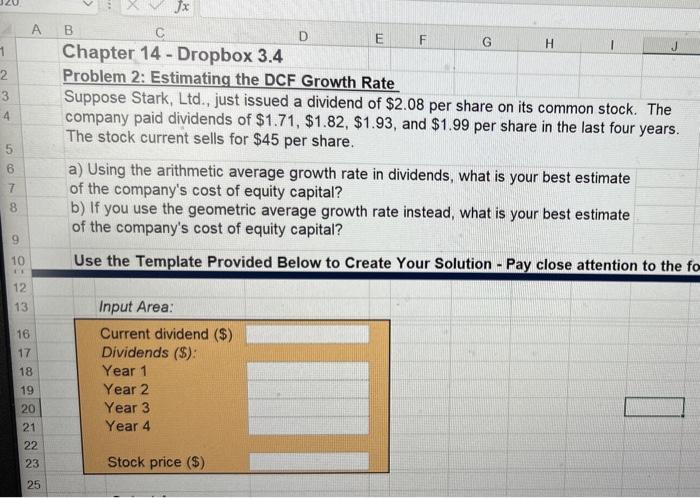

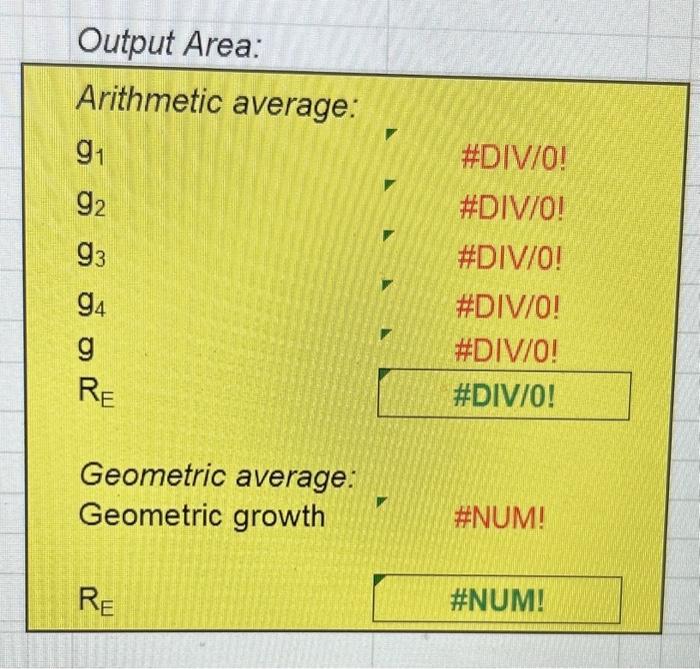

Problem 2: Estimating the DCF Growth Rate Suppose Stark, Ltd., just issued a dividend of $2.08 per share on its common stock. The company paid dividends of $1.71,$1.82,$1.93, and $1.99 per share in the last four years. The stock current sells for $45 per share. a) Using the arithmetic average growth rate in dividends, what is your best estimate of the company's cost of equity capital? b) If you use the geometric average growth rate instead, what is your best estimate of the company's cost of equity capital? Output Area: Arithmetic average: \begin{tabular}{ll} g1 & \\ g2 & \#DIV/O! \\ g3 & \#DIV/0! \\ g4 & \#DIV/O! \\ g & \#DIV/O! \\ RE & \#DIV/0! \\ \hline \end{tabular} Geometric average: Geometric growth \#NUM! RE \#NUM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts