Question: Problem 2. (Holding Period Yield. Total points: 23.) There are three parts to this problem, each with 3 questions (to fill out the appropriate calculator

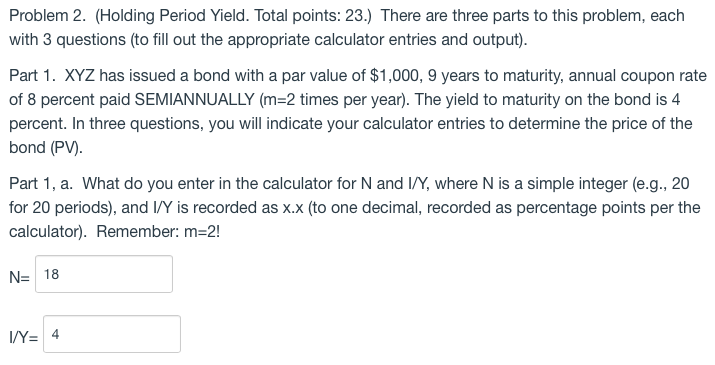

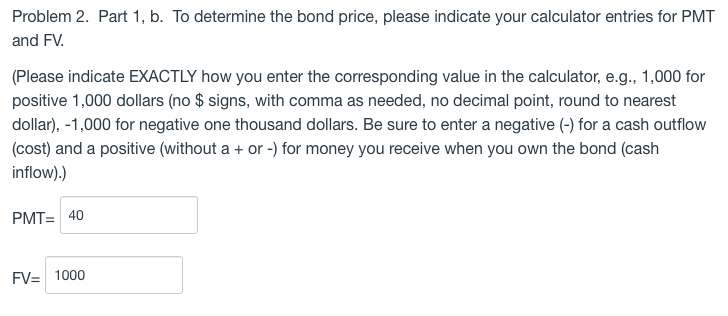

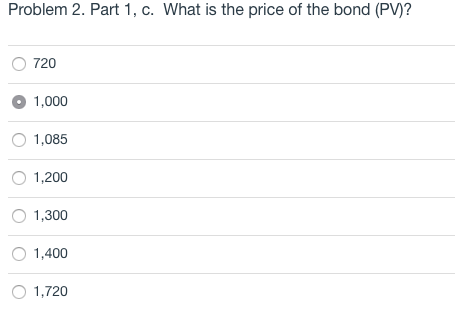

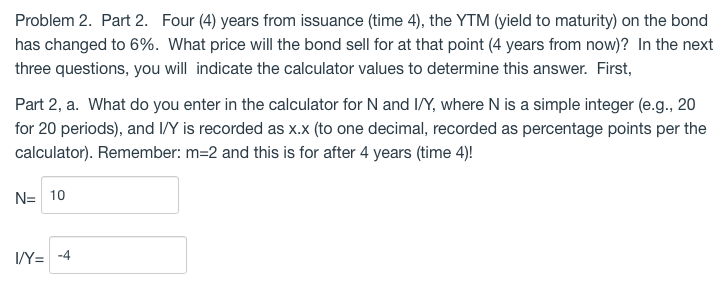

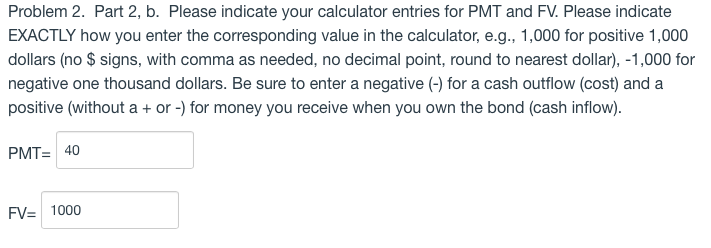

Problem 2. (Holding Period Yield. Total points: 23.) There are three parts to this problem, each with 3 questions (to fill out the appropriate calculator entries and output). Part 1. XYZ has issued a bond with a par value of $1,000, 9 years to maturity, annual coupon rate of 8 percent paid SEMIANNUALLY (m=2 times per year). The yield to maturity on the bond is 4 percent. In three questions, you will indicate your calculator entries to determine the price of the bond (PV). Part 1, a. What do you enter in the calculator for N and I/Y, where N is a simple integer (e.g., 20 for 20 periods), and I/Y is recorded as x.x (to one decimal, recorded as percentage points per the calculator). Remember: m=2! N= 18 I/Y= 4 Problem 2. Part 1, b. To determine the bond price, please indicate your calculator entries for PMT and FV. (Please indicate EXACTLY how you enter the corresponding value in the calculator, e.g., 1,000 for positive 1,000 dollars (no $ signs, with comma as needed, no decimal point, round to nearest dollar), -1,000 for negative one thousand dollars. Be sure to enter a negative (-) for a cash outflow (cost) and a positive (without a + or -) for money you receive when you own the bond (cash inflow).) PMT= 40 FV= 1000 Problem 2. Part 1, c. What is the price of the bond (PV)? 720 1,000 1,085 1,200 O 1,300 1,400 1,720 Problem 2. Part 2. Four (4) years from issuance (time 4), the YTM (yield to maturity) on the bond has changed to 6%. What price will the bond sell for at that point (4 years from now)? In the next three questions, you will indicate the calculator values to determine this answer. First, Part 2, a. What do you enter in the calculator for N and I/9, where N is a simple integer (e.g., 20 for 20 periods), and I/Y is recorded as x.x (to one decimal, recorded as percentage points per the calculator). Remember: m=2 and this is for after 4 years (time 4)! N= 10 I/Y= -4 Problem 2. Part 2, b. Please indicate your calculator entries for PMT and FV. Please indicate EXACTLY how you enter the corresponding value in the calculator, e.g., 1,000 for positive 1,000 dollars (no $ signs, with comma as needed, no decimal point, round to nearest dollar), -1,000 for negative one thousand dollars. Be sure to enter a negative (-) for a cash outflow (cost) and a positive (without a + or -) for money you receive when you own the bond (cash inflow). PMT= 40 FV= 1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts