Question: Problem 2. In class, it is said that a new forward contract should always have zero value because the initial delivery price is set to

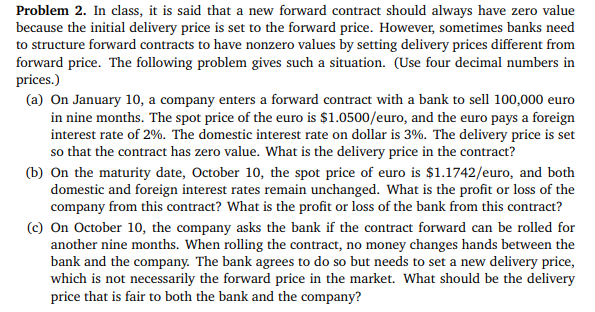

Problem 2. In class, it is said that a new forward contract should always have zero value because the initial delivery price is set to the forward price. However, sometimes banks need to structure forward contracts to have nonzero values by setting delivery prices different from forward price. The following problem gives such a situation. (Use four decimal numbers in prices.) (a) On January 10, a company enters a forward contract with a bank to sell 100,000 euro in nine months. The spot price of the euro is $1.0500/euro, and the euro pays a foreign interest rate of 2%. The domestic interest rate on dollar is 3%. The delivery price is set so that the contract has zero value. What is the delivery price in the contract? (b) On the maturity date, October 10, the spot price of euro is $1.1742/euro, and both domestic and foreign interest rates remain unchanged. What is the profit or loss of the company from this contract? What is the profit or loss of the bank from this contract? (c) On October 10, the company asks the bank if the contract forward can be rolled for another nine months. When rolling the contract, no money changes hands between the bank and the company. The bank agrees to do so but needs to set a new delivery price, which is not necessarily the forward price in the market. What should be the delivery price that is fair to both the bank and the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts