Question: Problem 2: Kent Poff is getting old and is thinking about his estate. His children are his beneficiaries. Therefore he: Makes gifts of $500,000 to

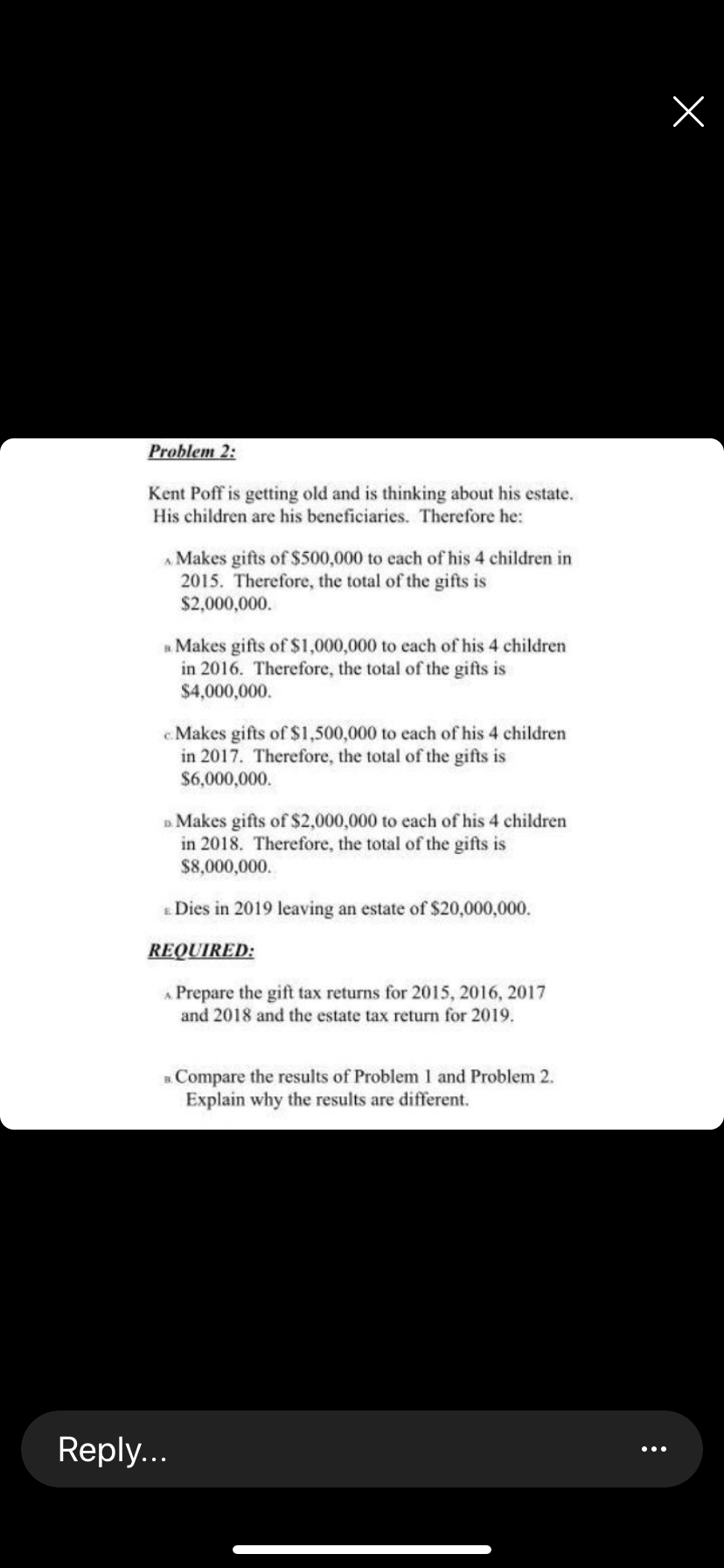

Problem 2: Kent Poff is getting old and is thinking about his estate. His children are his beneficiaries. Therefore he: Makes gifts of $500,000 to each of his 4 children in 2015. Therefore, the total of the gifts is $2,000,000 Makes gifts of $1,000,000 to each of his 4 children in 2016. Therefore, the total of the gifts is $4,000,000 c Makes gifts of $1,500,000 to each of his 4 children in 2017. Therefore, the total of the gifts is $6,000,000 Makes gifts of $2,000,000 to each of his 4 children in 2018. Therefore, the total of the gifts is $8,000,000 Dies in 2019 leaving an estate of $20,000,000. REQUIRED: Prepare the gift tax returns for 2015, 2016, 2017 and 2018 and the estate tax return for 2019. Compare the results of Problem 1 and Problem 2. Explain why the results are different. Reply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts