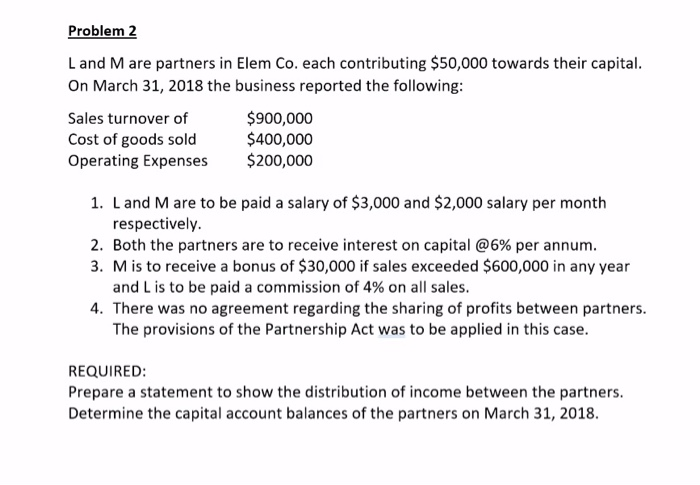

Question: Problem 2 Land M are partners in Elem Co. each contributing $50,000 towards their capital. On March 31, 2018 the business reported the following: Sales

Problem 2 Land M are partners in Elem Co. each contributing $50,000 towards their capital. On March 31, 2018 the business reported the following: Sales turnover of $900,000 Cost of goods sold $400,000 Operating Expenses $200,000 1. Land M are to be paid a salary of $3,000 and $2,000 salary per month respectively. 2. Both the partners are to receive interest on capital @6% per annum. 3. Mis to receive a bonus of $30,000 if sales exceeded $600,000 in any year and L is to be paid a commission of 4% on all sales. 4. There was no agreement regarding the sharing of profits between partners. The provisions of the Partnership Act was to be applied in this case. REQUIRED: Prepare a statement to show the distribution of income between the partners. Determine the capital account balances of the partners on March 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts