Question: L and M are partners in Elem Co. each contributing $50,000 towards their capital. On March 31,2018 the business reported the following: a. Sales turnover

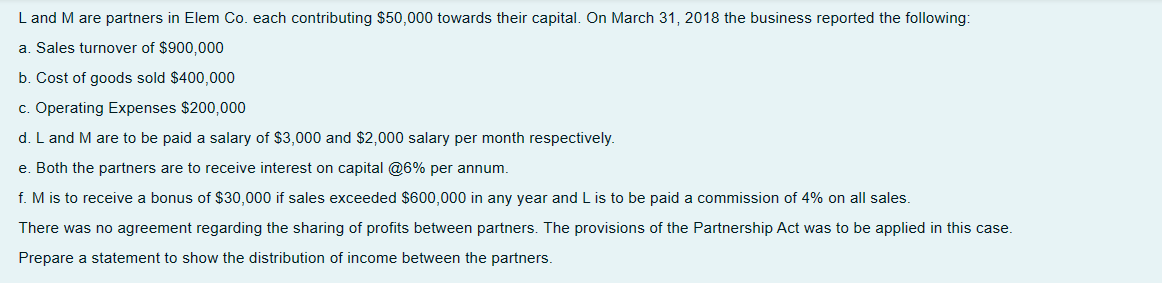

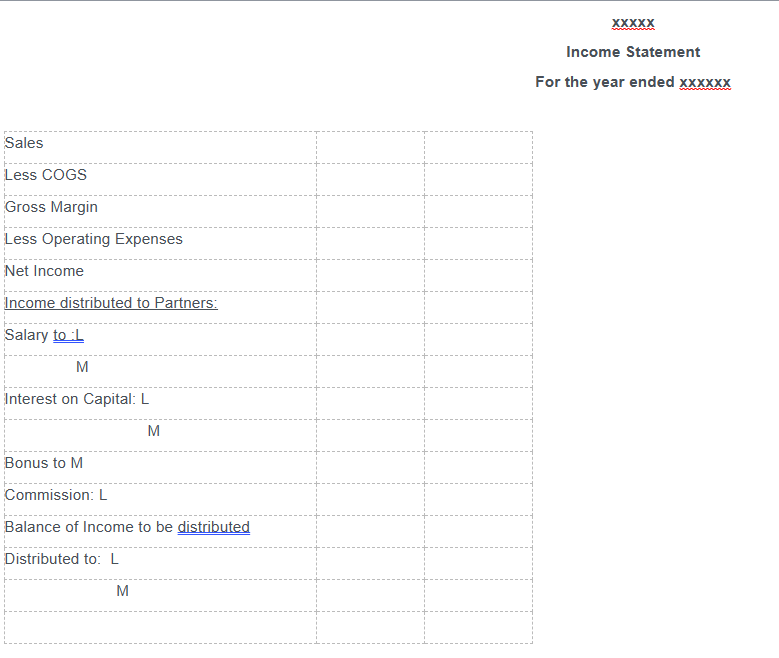

L and M are partners in Elem Co. each contributing $50,000 towards their capital. On March 31,2018 the business reported the following: a. Sales turnover of $900,000 b. Cost of goods sold $400,000 c. Operating Expenses $200,000 d. L and M are to be paid a salary of $3,000 and $2,000 salary per month respectively. e. Both the partners are to receive interest on capital @6\% per annum. f. M is to receive a bonus of $30,000 if sales exceeded $600,000 in any year and L is to be paid a commission of 4% on all sales. There was no agreement regarding the sharing of profits between partners. The provisions of the Partnership Act was to be applied in this case. Prepare a statement to show the distribution of income between the partners. XXXXX Income Statement For the year ended xxxxxx Sales Less COGS Gross Margin Less Operating Expenses Net Income Income distributed to Partners: Salary to:L M Interest on Capital: L Bonus to M Commission: L Balance of Income to be distributed Distributed to: L M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts