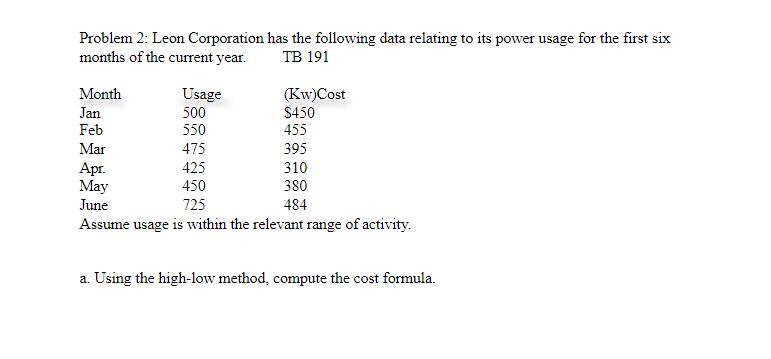

Question: Problem 2: Leon Corporation has the following data relating to its power usage for the first six months of the current year. TB 191

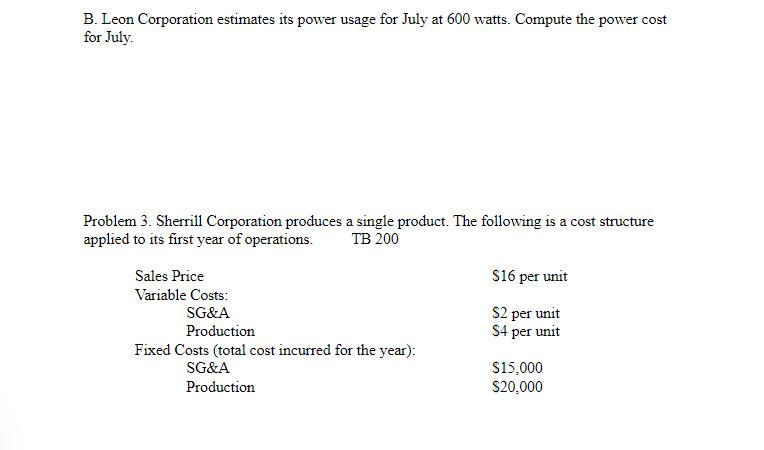

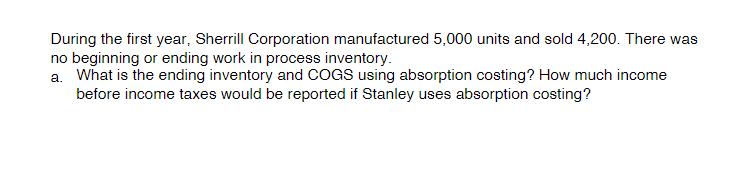

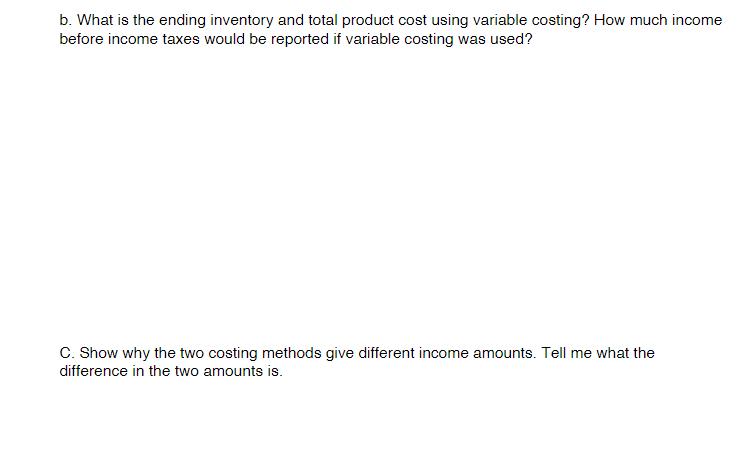

Problem 2: Leon Corporation has the following data relating to its power usage for the first six months of the current year. TB 191 Month Usage (Kw)Cost Jan 500 $450 Feb 550 455 Mar 475 395 Apr. 425 310 May 450 380 June 725 484 Assume usage is within the relevant range of activity. a. Using the high-low method, compute the cost formula. B. Leon Corporation estimates its power usage for July at 600 watts. Compute the power cost for July. Problem 3. Sherrill Corporation produces a single product. The following is a cost structure applied to its first year of operations. TB 200 Sales Price $16 per unit Variable Costs: SG&A $2 per unit $4 per unit Production Fixed Costs (total cost incurred for the year): SG&A $15,000 Production $20,000 During the first year, Sherrill Corporation manufactured 5,000 units and sold 4,200. There was no beginning or ending work in process inventory. a. What is the ending inventory and COGS using absorption costing? How much income before income taxes would be reported if Stanley uses absorption costing? b. What is the ending inventory and total product cost using variable costing? How much income before income taxes would be reported if variable costing was used? C. Show why the two costing methods give different income amounts. Tell me what the difference in the two amounts is.

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Problem 2 a Using the highlow method compute the cost formula ANSWER Usage Cost High 725 484 Low 425 ... View full answer

Get step-by-step solutions from verified subject matter experts