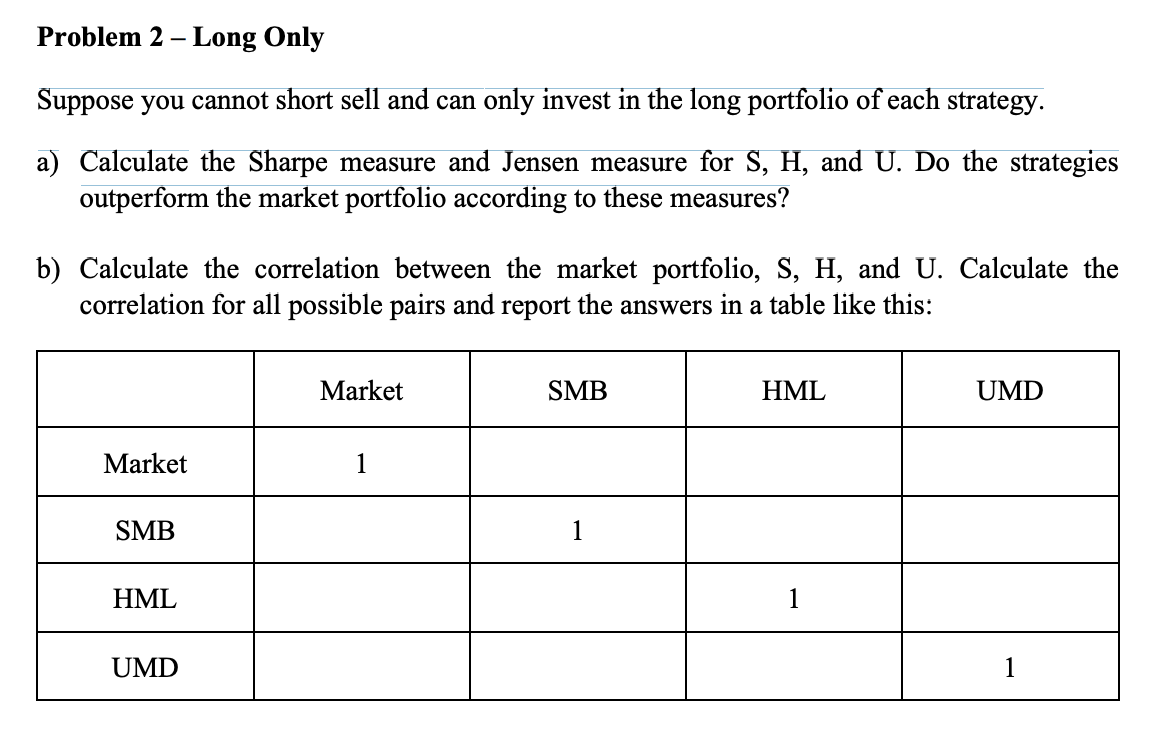

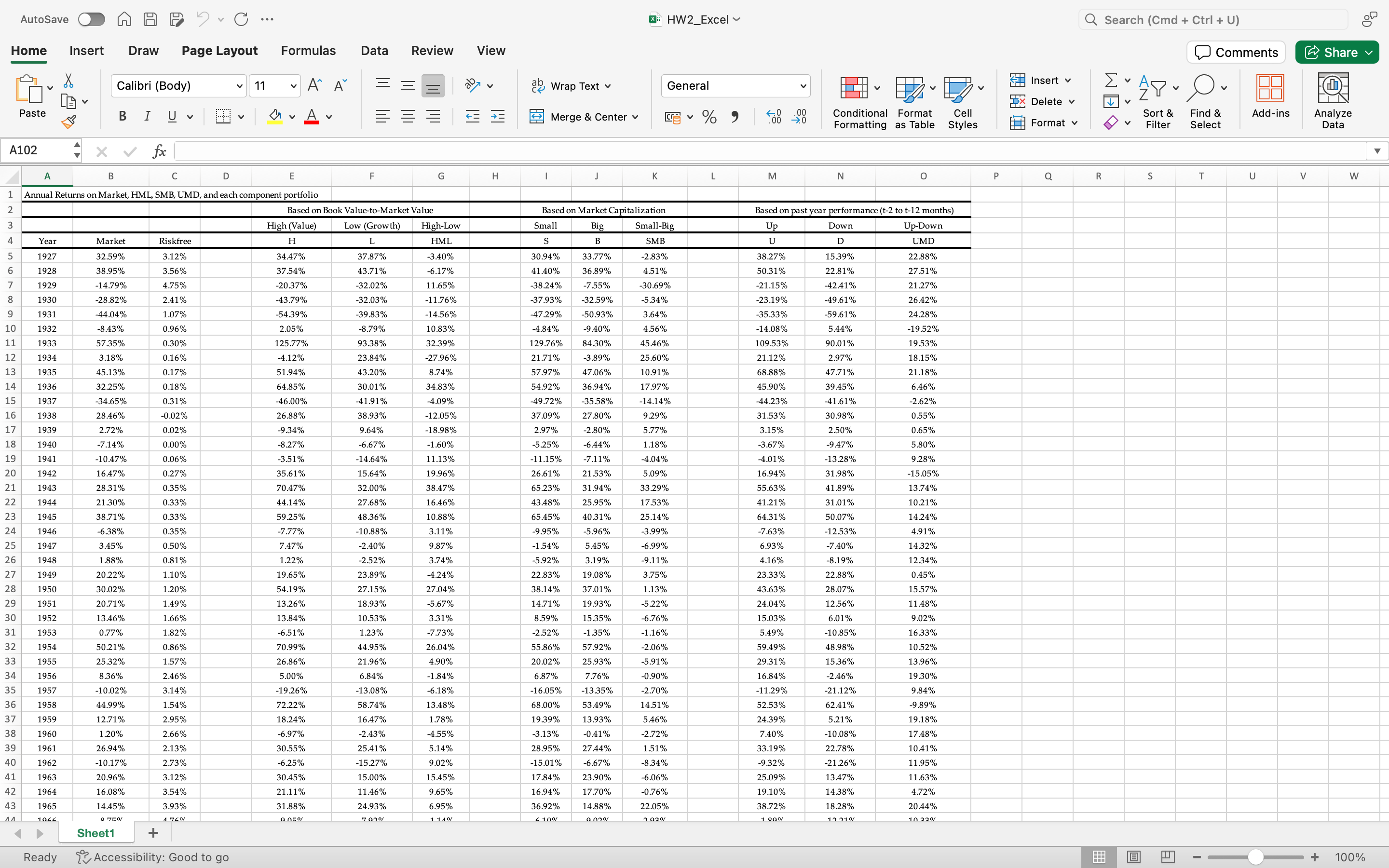

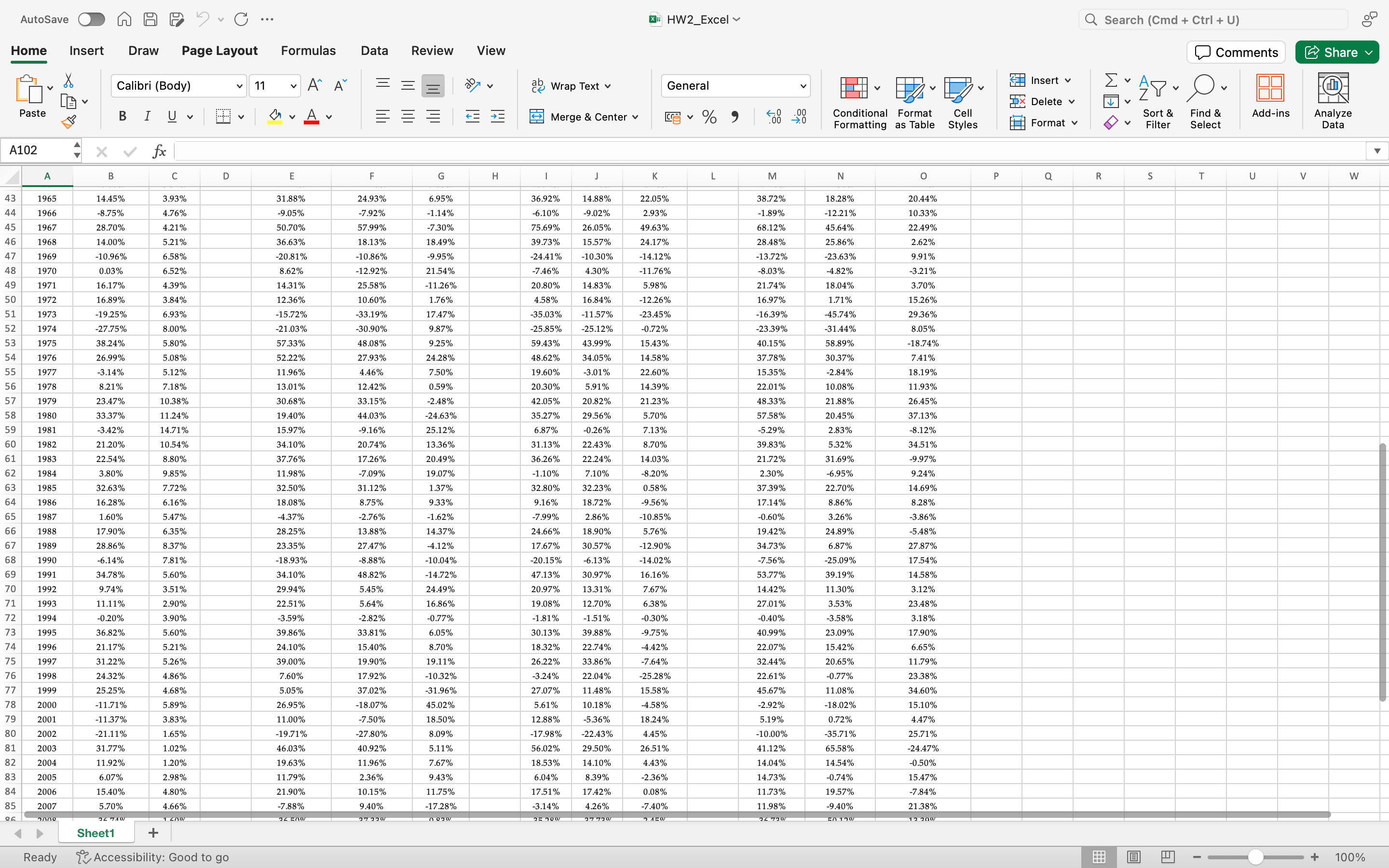

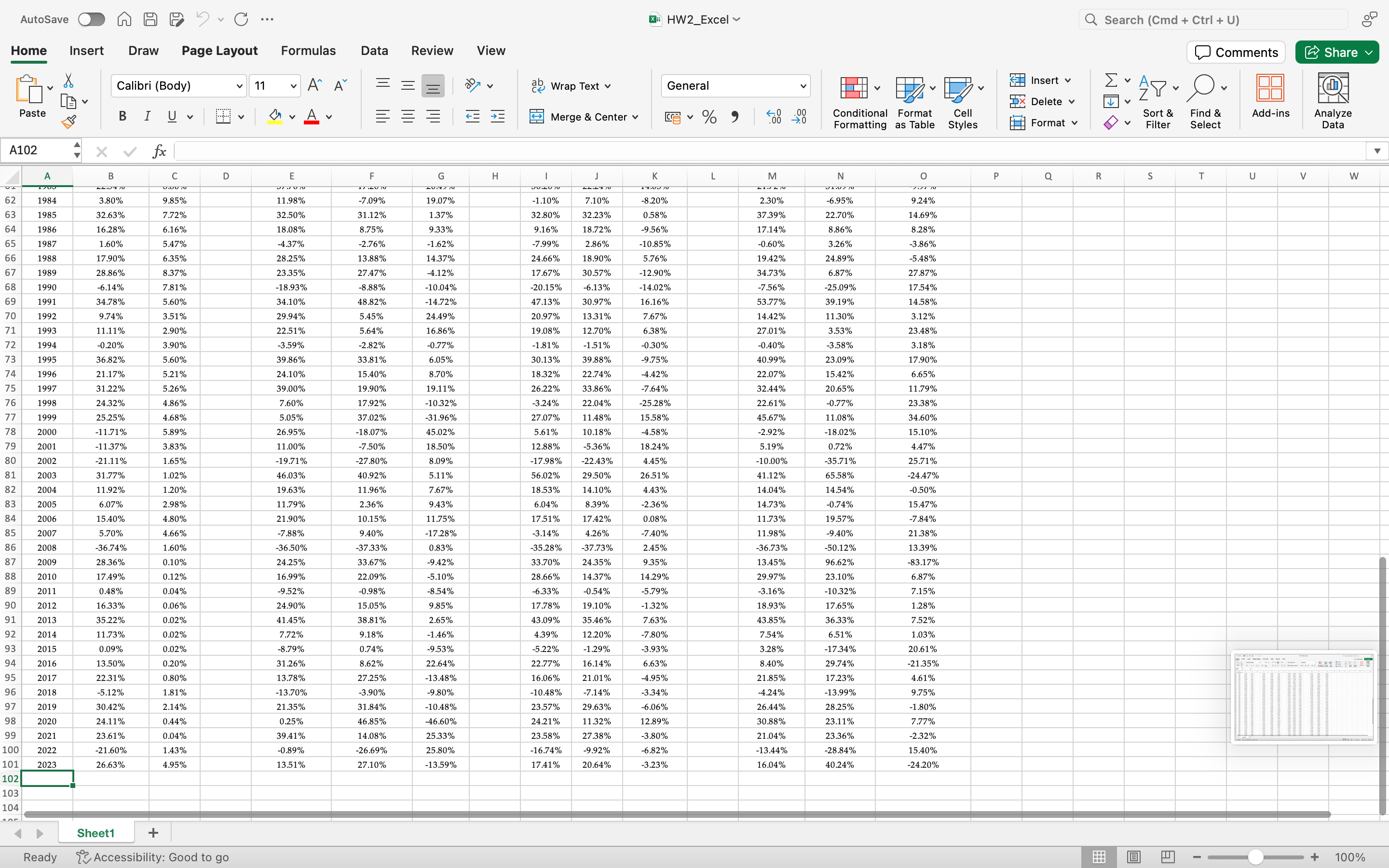

Question: Problem 2 Long Only Suppose you cannot short sell and can only invest in the long portfolio of each strategy. a) Calculate the Sharpe measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts