Question: Problem 2 My pension plan will pay me $10,000 once a year for a 10-year period. The first payment will come in exactly after five

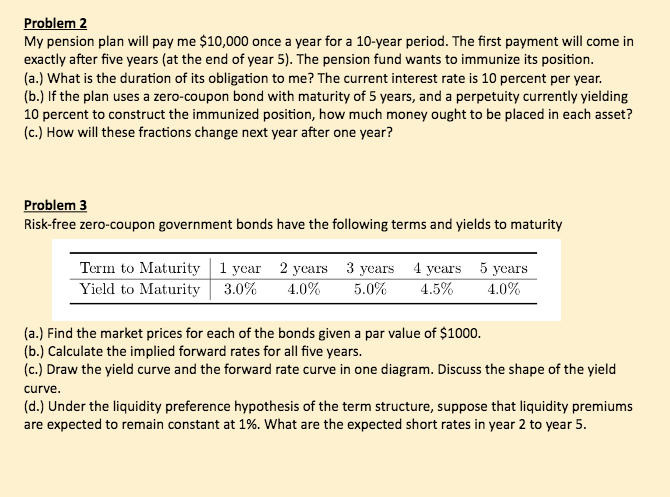

Problem 2 My pension plan will pay me $10,000 once a year for a 10-year period. The first payment will come in exactly after five years (at the end of year 5). The pension fund wants to immunize its position. (a.) What is the duration of its obligation to me? The current interest rate is 10 percent per year. (b.) If the plan uses a zero-coupon bond with maturity of 5 years, and a perpetuity currently yielding 10 percent to construct the immunized position, how much money ought to be placed in each asset? (c.) How will these fractions change next year after one year? Problem 3 Risk-free zero-coupon government bonds have the following terms and yields to maturity Term to Maturity 1 year 2 years 3 years 4 years 5 years Yield to Maturity 3.0% 4.0% 5.0% 4.5% 4.0% (a.) Find the market prices for each of the bonds given a par value of $1000. (b.) Calculate the implied forward rates for all five years. (c.) Draw the yield curve and the forward rate curve in one diagram. Discuss the shape of the yield curve. (d.) Under the liquidity preference hypothesis of the term structure, suppose that liquidity premiums are expected to remain constant at 1%. What are the expected short rates in year 2 to year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts