Question: Problem 2 My pension plan will pay me $10,000 once a year for a 10-year period. The first payment will come in exactly after five

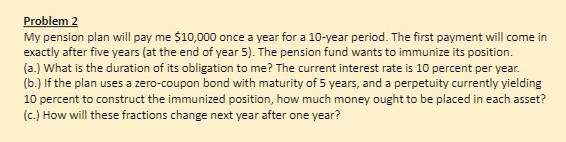

Problem 2 My pension plan will pay me $10,000 once a year for a 10-year period. The first payment will come in exactly after five years (at the end of year 5). The pension fund wants to immunize its position. (a.) What is the duration of its obligation to me? The current interest rate is 10 percent per year. (6.) If the plan uses a zero-coupon bond with maturity of 5 years, and a perpetuity currently yielding 10 percent to construct the immunized position, how much money ought to be placed in each asset? (c) How will these fractions change next year after one year? Problem 2 My pension plan will pay me $10,000 once a year for a 10-year period. The first payment will come in exactly after five years (at the end of year 5). The pension fund wants to immunize its position. (a.) What is the duration of its obligation to me? The current interest rate is 10 percent per year. (6.) If the plan uses a zero-coupon bond with maturity of 5 years, and a perpetuity currently yielding 10 percent to construct the immunized position, how much money ought to be placed in each asset? (c) How will these fractions change next year after one year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts