Question: Problem 2 (Pricing Kernel) In this problem, we will derive the pricing kernel in a direct fashion. From linear pricing, we know that for any

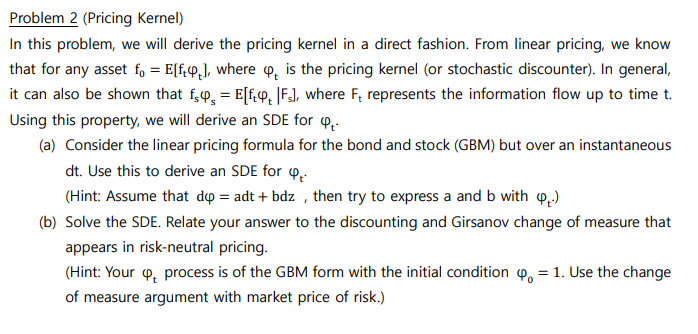

Problem 2 (Pricing Kernel) In this problem, we will derive the pricing kernel in a direct fashion. From linear pricing, we know that for any asset fo = E[f49_), where is the pricing kernel (or stochastic discounter). In general, it can also be shown that f$45 = E[f44|F3], where F, represents the information flow up to time t. Using this property, we will derive an SDE for Q (a) Consider the linear pricing formula for the bond and stock (GBM) but over an instantaneous dt. Use this to derive an SDE for or (Hint: Assume that d = adt + bdz , then try to express a and b with ox) (b) Solve the SDE. Relate your answer to the discounting and Girsanov change of measure that appears in risk-neutral pricing. (Hint: Your Qt process is of the GBM form with the initial condition 4 = 1. Use the change of measure argument with market price of risk.) Problem 2 (Pricing Kernel) In this problem, we will derive the pricing kernel in a direct fashion. From linear pricing, we know that for any asset fo = E[f49_), where is the pricing kernel (or stochastic discounter). In general, it can also be shown that f$45 = E[f44|F3], where F, represents the information flow up to time t. Using this property, we will derive an SDE for Q (a) Consider the linear pricing formula for the bond and stock (GBM) but over an instantaneous dt. Use this to derive an SDE for or (Hint: Assume that d = adt + bdz , then try to express a and b with ox) (b) Solve the SDE. Relate your answer to the discounting and Girsanov change of measure that appears in risk-neutral pricing. (Hint: Your Qt process is of the GBM form with the initial condition 4 = 1. Use the change of measure argument with market price of risk.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts