Question: Problem 2 (Real world vs risk-neutral world). The Black-Scholes formula is derived using C = e-rT EQ[C(T)] = e-rT EP[(S(T) K)+1, =e that is, as

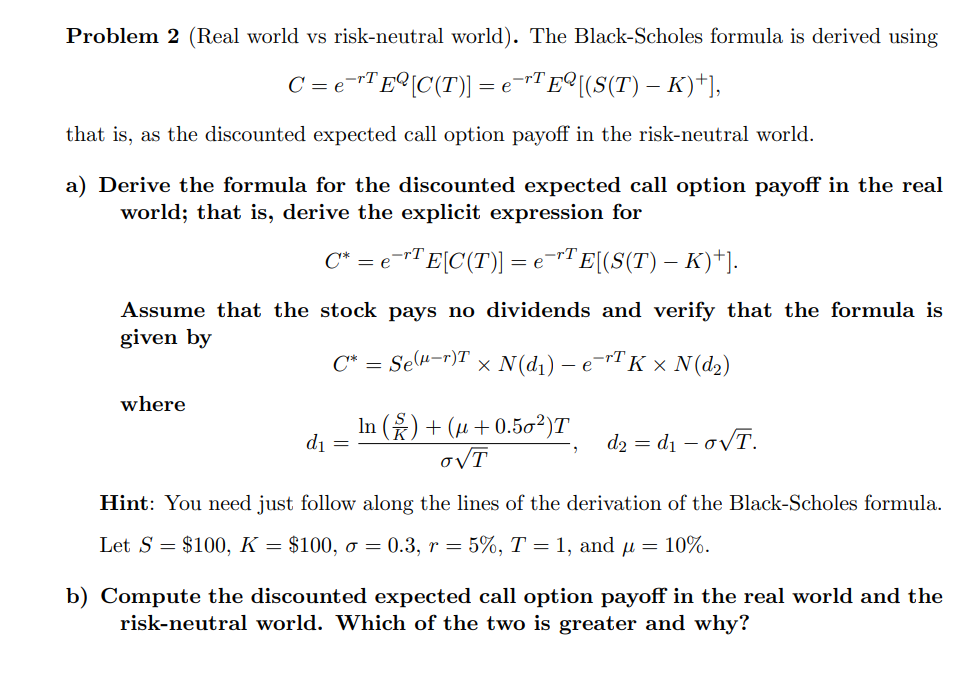

Problem 2 (Real world vs risk-neutral world). The Black-Scholes formula is derived using C = e-rT EQ[C(T)] = e-rT EP[(S(T) K)+1, =e that is, as the discounted expected call option payoff in the risk-neutral world. a) Derive the formula for the discounted expected call option payoff in the real world; that is, derive the explicit expression for (* = e-rT E(C(T)] = e-rT E[(S(T) K)+). e =e -r1 Assume that the stock pays no dividends and verify that the formula is given by C* = Selu-r)T ~ N(d) -e-TK ~ N(d2) where In () + (+0.502)T di = d2 = d - OVT. OVT Hint: You need just follow along the lines of the derivation of the Black-Scholes formula. Let S = $100, K = $100, 0 = 0.3, r = 5%, T = 1, and u = 10%. b) Compute the discounted expected call option payoff in the real world and the risk-neutral world. Which of the two is greater and why? Problem 2 (Real world vs risk-neutral world). The Black-Scholes formula is derived using C = e-rT EQ[C(T)] = e-rT EP[(S(T) K)+1, =e that is, as the discounted expected call option payoff in the risk-neutral world. a) Derive the formula for the discounted expected call option payoff in the real world; that is, derive the explicit expression for (* = e-rT E(C(T)] = e-rT E[(S(T) K)+). e =e -r1 Assume that the stock pays no dividends and verify that the formula is given by C* = Selu-r)T ~ N(d) -e-TK ~ N(d2) where In () + (+0.502)T di = d2 = d - OVT. OVT Hint: You need just follow along the lines of the derivation of the Black-Scholes formula. Let S = $100, K = $100, 0 = 0.3, r = 5%, T = 1, and u = 10%. b) Compute the discounted expected call option payoff in the real world and the risk-neutral world. Which of the two is greater and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts