Question: Problem #2 Seth Davis is 26 and resides in NYC with his dependent mother (Edith, 62 years old). Seth pays for greater than 50%

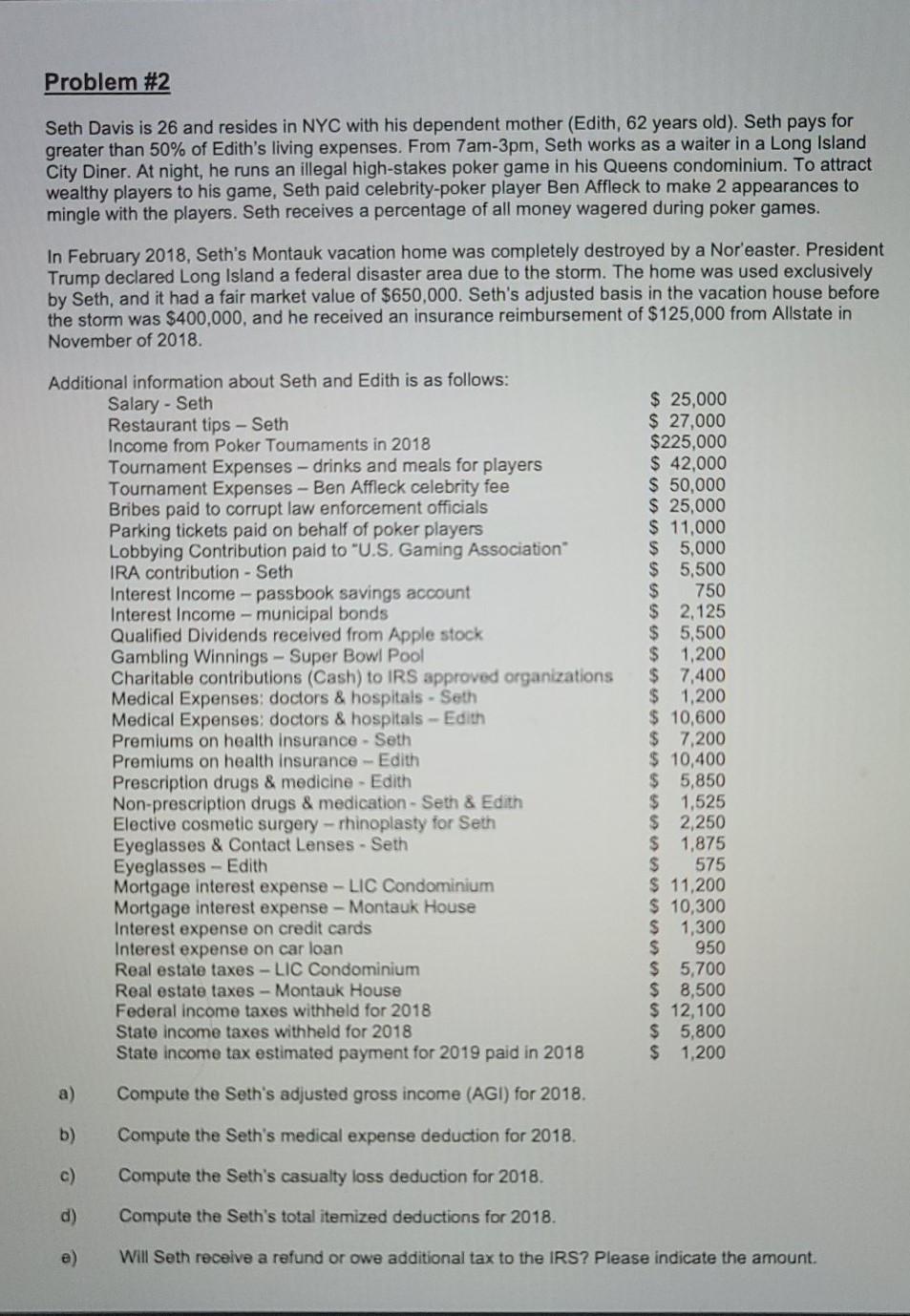

Problem #2 Seth Davis is 26 and resides in NYC with his dependent mother (Edith, 62 years old). Seth pays for greater than 50% of Edith's living expenses. From 7am-3pm, Seth works as a waiter in a Long Island City Diner. At night, he runs an illegal high-stakes poker game in his Queens condominium. To attract wealthy players to his game, Seth paid celebrity-poker player Ben Affleck to make 2 appearances to mingle with the players. Seth receives a percentage of all money wagered during poker games. In February 2018, Seth's Montauk vacation home was completely destroyed by a Nor'easter. President Trump declared Long Island a federal disaster area due to the storm. The home was used exclusively by Seth, and it had a fair market value of $650,000. Seth's adjusted basis in the vacation house before the storm was $400,000, and he received an insurance reimbursement of $125,000 from Allstate in November of 2018. Additional information about Seth and Edith is as follows: Salary - Seth Restaurant tips Seth Income from Poker Toumaments in 2018 Tournament Expenses - drinks and meals for players Tournament Expenses- Ben Affleck celebrity fee Bribes paid to corrupt law enforcement officials Parking tickets paid on behalf of poker players Lobbying Contribution paid to "U.S. Gaming Association" IRA contribution Seth Interest Income - passbook savings account Interest Income - municipal bonds Qualified Dividends received from Apple stock Gambling Winnings- Super Bowl Pool Charitable contributions (Cash) to IRS approved organizations Medical Expenses: doctors & hospitals - Seth Medical Expenses: doctors & hospitals- Edith Premiums on health insurance - Seth Premiums on health insurance-Edith Prescription drugs & medicine- Edith Non-prescription drugs & medication - Seth & Edith Elective cosmetic surgery-rhinoplasty for Seth Eyeglasses & Contact Lenses - Seth Eyeglasses- Edith Mortgage interest expense -LIC Condominium Mortgage interest expense- Montauk House Interest expense on credit cards Interest expense on car loan Real estate taxes- LIC Condominium Real estate taxes - Montauk House Federal income taxes withheld for 2018 State income taxes withheld for 2018 $ 25,000 $ 27,000 $225,000 $ 42,000 $ 50,000 $ 25,000 $ 11,000 $ 5,000 $ 5,500 $ 750 $ 2,125 $ 5,500 $ 1,200 $ 7,400 $1,200 $ 10,600 $ 7,200 $ 10,400 $ 5,850 $ 1,525 $ 2,250 $ 1,875 $ 575 $ 11,200 $ 10,300 $ 1,300 $ 950 $ 5,700 $ 8,500 $ 12,100 $ 5,800 $ 1,200 State income tax estimated payment for 2019 paid in 2018 a) Compute the Seth's adjusted gross income (AGI) for 2018. b) Compute the Seth's medical expense deduction for 2018. c) Compute the Seth's casualty loss deduction for 2018. d) Compute the Seth's total itemized deductions for 2018. e) Will Seth receive a refund or owe additional tax to the IRS? Please indicate the amount.

Step by Step Solution

There are 3 Steps involved in it

ANSWER a Seths adjusted gross income for 2018 is 225000 b Seths medical expense deduction for 2018 i... View full answer

Get step-by-step solutions from verified subject matter experts