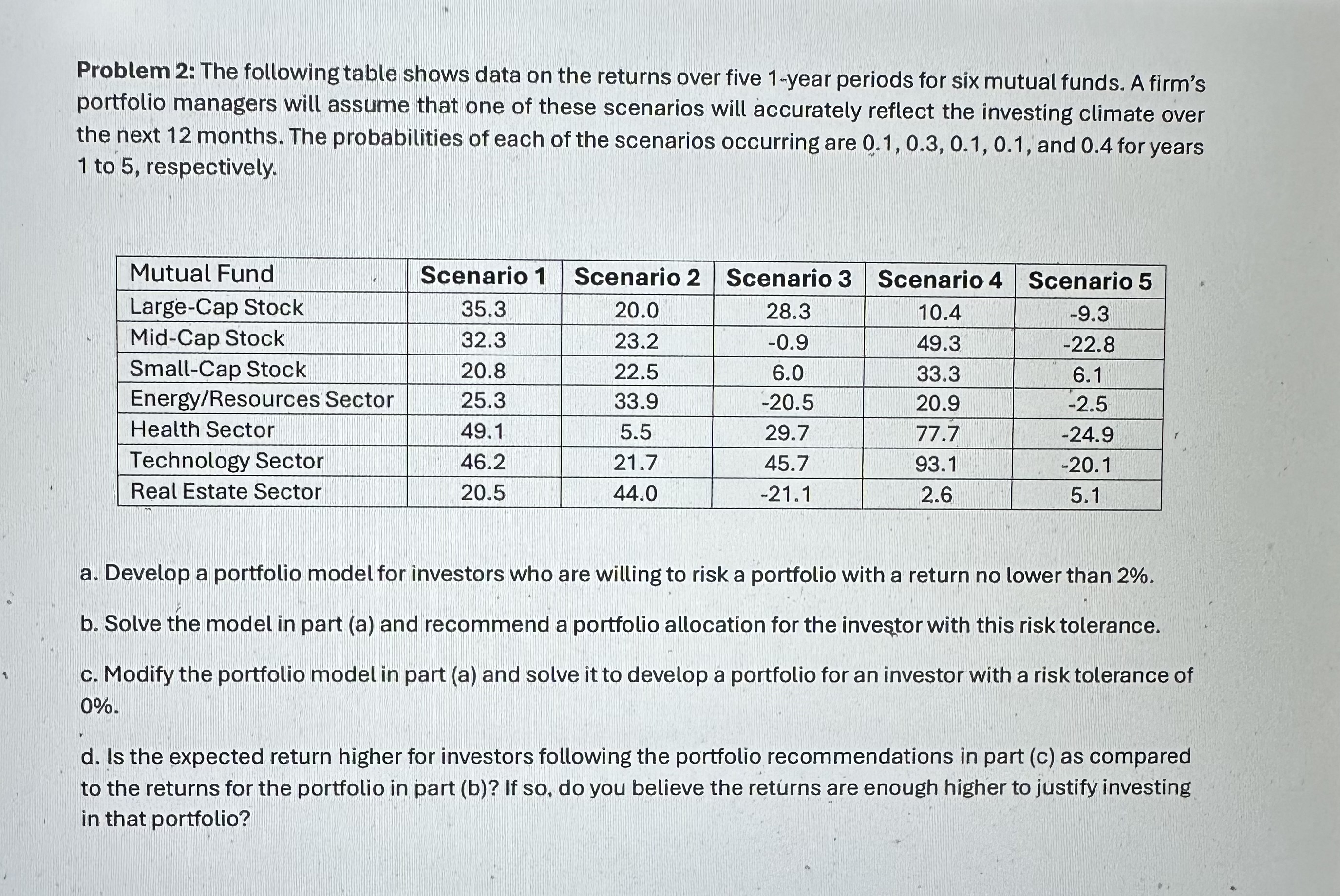

Question: Problem 2 : The following table shows data on the returns over five 1 - year periods for six mutual funds. A firm's portfolio managers

Problem : The following table shows data on the returns over five year periods for six mutual funds. A firm's portfolio managers will assume that one of these scenarios will accurately reflect the investing climate over the next months. The probabilities of each of the scenarios occurring are and for years to respectively. begintabularlccccchline Mutual Fund & Scenario & Scenario & Scenario & Scenario & Scenario hline LargeCap Stock & & & & & hline MidCap Stock & & & & & hline SmallCap Stock & & & & & hline EnergyResources Sector & & & & & hline Health Sector & & & & & hline Technology Sector & & & & & hline Real Estate Sector & & & & & hline endtabular a Develop a portfolio model for investors who are willing to risk a portfolio with a return no lower than b Solve the model in part a and recommend a portfolio allocation for the investor with this risk tolerance. c Modify the portfolio model in part a and solve it to develop a portfolio for an investor with a risk tolerance of d Is the expected return higher for investors following the portfolio recommendations in part c as compared to the returns for the portfolio in part b If so do you believe the returns are enough higher to justify investing in that portfolio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock