Question: Problem 2: This question builds on the Exercise 19.1 related to tacos. Given the following information (which is identical to the scenario in the exercise),

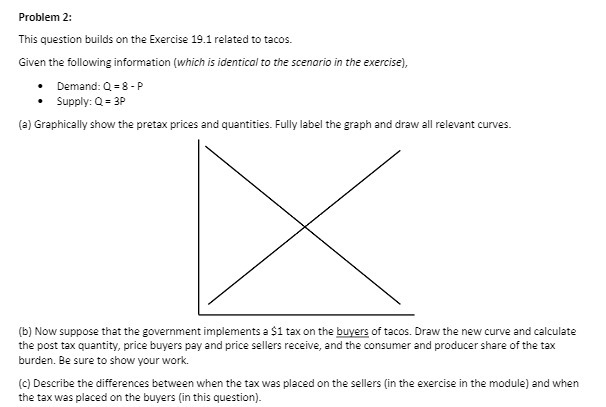

Problem 2: This question builds on the Exercise 19.1 related to tacos. Given the following information (which is identical to the scenario in the exercise), Demand: 0 = 8 - P Supply: Q = 3P (a) Graphically show the pretax prices and quantities. Fully label the graph and draw all relevant curves. (b) Now suppose that the government implements a $1 tax on the buyers of tacos. Draw the new curve and calculate the post tax quantity, price buyers pay and price sellers receive, and the consumer and producer share of the tax burden. Be sure to show your work. (c) Describe the differences between when the tax was placed on the sellers (in the exercise in the module) and when the tax was placed on the buyers (in this question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts