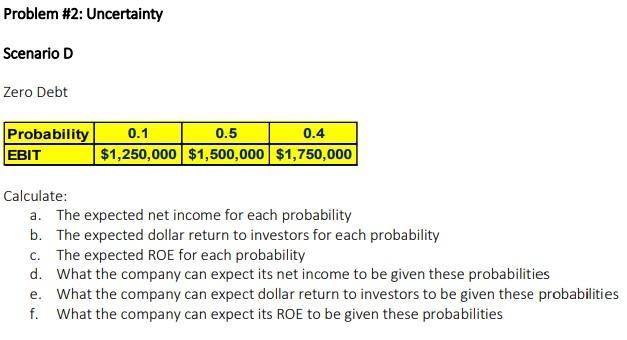

Question: Problem #2: Uncertainty Scenario D Zero Debt Probability 0.1 0.5 0.4 EBIT $1,250,000 $1,500,000 $1,750,000 Calculate: a. The expected net income for each probability b.

Problem #2: Uncertainty Scenario D Zero Debt Probability 0.1 0.5 0.4 EBIT $1,250,000 $1,500,000 $1,750,000 Calculate: a. The expected net income for each probability b. The expected dollar return to investors for each probability C. The expected ROE for each probability d. What the company can expect its net income to be given these probabilities e. What the company can expect dollar return to investors to be given these probabilities f. What the company can expect its ROE to be given these probabilities Problem #2: Uncertainty Scenario D Zero Debt Probability 0.1 0.5 0.4 EBIT $1,250,000 $1,500,000 $1,750,000 Calculate: a. The expected net income for each probability b. The expected dollar return to investors for each probability C. The expected ROE for each probability d. What the company can expect its net income to be given these probabilities e. What the company can expect dollar return to investors to be given these probabilities f. What the company can expect its ROE to be given these probabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts