Question: Problem #2: Uncertainty Scenario D Zero Debt Probability EBIT 0.1 0.5 0.4 $1,250,000 $1,500,000 $1,750,000 Calculate: a. The expected net income for each probability b.

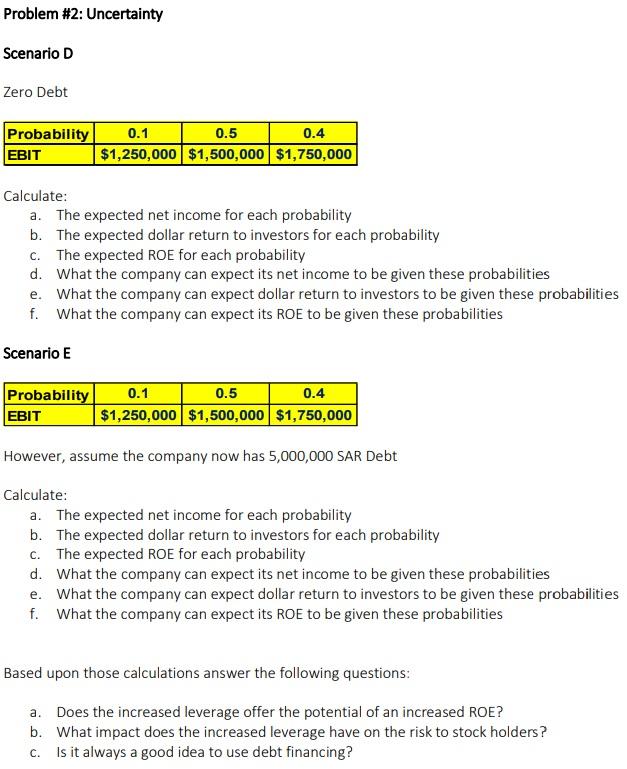

Problem #2: Uncertainty Scenario D Zero Debt Probability EBIT 0.1 0.5 0.4 $1,250,000 $1,500,000 $1,750,000 Calculate: a. The expected net income for each probability b. The expected dollar return to investors for each probability C. The expected ROE for each probability d. What the company can expect its net income to be given these probabilities e. What the company can expect dollar return to investors to be given these probabilities f. What the company can expect its ROE to be given these probabilities Scenario E Probability 0.1 0.5 0.4 EBIT $1,250,000 $1,500,000 $1,750,000 However, assume the company now has 5,000,000 SAR Debt Calculate: a. The expected net income for each probability b. The expected dollar return to investors for each probability C. The expected ROE for each probability d. What the company can expect its net income to be given these probabilities e. What the company can expect dollar return to investors to be given these probabilities f. What the company can expect its ROE to be given these probabilities Based upon those calculations answer the following questions: a. Does the increased leverage offer the potential of an increased ROE? b. What impact does the increased leverage have on the risk to stock holders? C. Is it always a good idea to use debt financing? Problem #2: Uncertainty Scenario D Zero Debt Probability EBIT 0.1 0.5 0.4 $1,250,000 $1,500,000 $1,750,000 Calculate: a. The expected net income for each probability b. The expected dollar return to investors for each probability C. The expected ROE for each probability d. What the company can expect its net income to be given these probabilities e. What the company can expect dollar return to investors to be given these probabilities f. What the company can expect its ROE to be given these probabilities Scenario E Probability 0.1 0.5 0.4 EBIT $1,250,000 $1,500,000 $1,750,000 However, assume the company now has 5,000,000 SAR Debt Calculate: a. The expected net income for each probability b. The expected dollar return to investors for each probability C. The expected ROE for each probability d. What the company can expect its net income to be given these probabilities e. What the company can expect dollar return to investors to be given these probabilities f. What the company can expect its ROE to be given these probabilities Based upon those calculations answer the following questions: a. Does the increased leverage offer the potential of an increased ROE? b. What impact does the increased leverage have on the risk to stock holders? C. Is it always a good idea to use debt financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts