Question: Problem 2 : Using the footnote for Hertz Rental Car for 2017 below, identify which level of the fair value hierarchy was used to get

Problem 2 : Using the footnote for Hertz Rental Car for 2017 below, identify which level of the fair value hierarchy was used to get the fair value of the following items reported by Hertz at the end of 2017.

Investments in Equity Securities

Non Vehicle Debt

Money market funds

Intangible Assets

Vehicle Debt

Brazil Operations

Equity Method investment

Required:

1. Identify the level of fair value hierarchy used for each asset or liability.

2. Describe how that level inputs were applied to the particular item

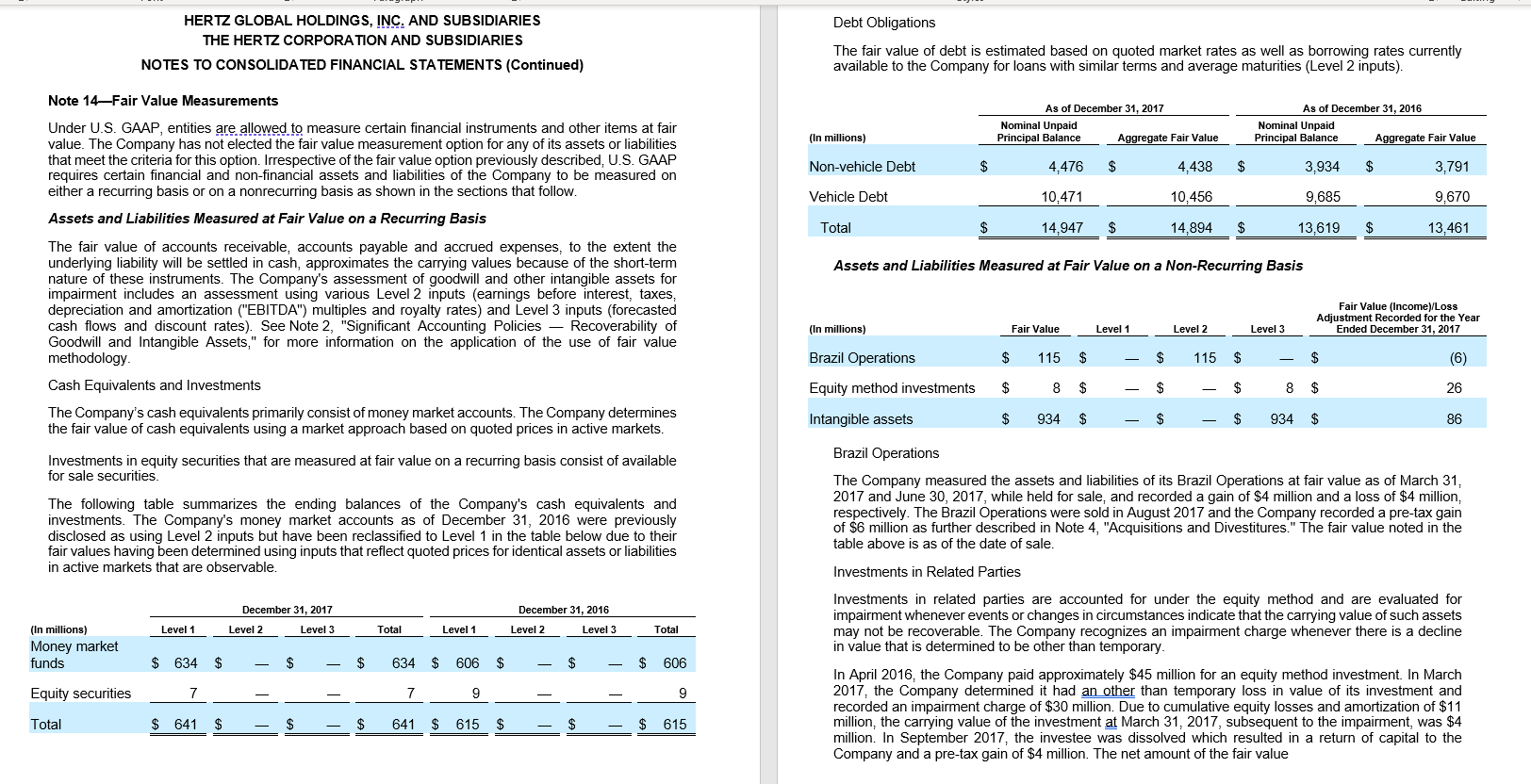

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES THE HERTZ CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Debt Obligations The fair value of debt is estimated based on quoted market rates as well as borrowing rates currently available to the Company for loans with similar terms and average maturities (Level 2 inputs). Note 14-Fair Value Measurements As of December 31, 2017 Nominal Unpaid Principal Balance Aggregate Fair Value As of December 31, 2016 Nominal Unpaid Principal Balance Aggregate Fair Value (In millions) Non-vehicle Debt $ 4,476 $ 4,438 3,934 $ 3,791 Vehicle Debt 10,471 10,456 9,685 9,670 Total $ 14,947 $ 14,894 13,619 13,461 Assets and Liabilities Measured at Fair Value on a Non-Recurring Basis Under U.S. GAAP, entities are allowed measure certain financial instruments and other items at fair value. The Company has not elected the fair value measurement option for any of its assets or liabilities that meet the criteria for this option. Irrespective of the fair value option previously described, U.S. GAAP requires certain financial and non-financial assets and liabilities of the Company to be measured on either a recurring basis or on a nonrecurring basis as shown in the sections that follow. Assets and Liabilities Measured at Fair Value on a Recurring Basis The fair value of accounts receivable, accounts payable and accrued expenses, to the extent the underlying liability will be settled in cash, approximates the carrying values because of the short-term nature of these instruments. The Company's assessment of goodwill and other intangible assets for impairment includes an assessment using various Level 2 inputs (earnings before interest, taxes, depreciation and amortization ("EBITDA") multiples and royalty rates) and Level 3 inputs (forecasted cash flows and discount rates). See Note 2, "Significant Accounting Policies Recoverability of Goodwill and Intangible Assets," for more information on the application of the use of fair value methodology Cash Equivalents and Investments The Company's cash equivalents primarily consist of money market accounts. The Company determines the fair value of cash equivalents using a market approach based on quoted prices in active markets. Fair Value (Income)/Loss Adjustment Recorded for the Year Ended December 31, 2017 (In millions) Fair Value Level 1 Level 2 Level 3 Brazil Operations $ 115 $ $ 115 $ $ (6) Equity method investments $ 8 $ $ $ 8 $ 26 Intangible assets $ 934 $ $ $ 934 $ 86 Investments in equity securities that are measured at fair value on a recurring basis consist of available for sale securities. The following table summarizes the ending balances of the Company's cash equivalents and investments. The Company's money market accounts as of December 31, 2016 were previously disclosed as using Level 2 inputs but have been reclassified to Level 1 in the table below due to their fair values having been determined using inputs that reflect quoted prices for identical assets or liabilities in active markets that are observable. Brazil Operations The Company measured the assets and liabilities of its Brazil Operations at fair value as of March 31, 2017 and June 30, 2017, while held for sale, and recorded a gain of $4 million and a loss of $4 million, respectively. The Brazil Operations were sold in August 2017 and the Company recorded a pre-tax gain of $6 million as further described in Note 4, "Acquisitions and Divestitures." The fair value noted in the table above is as of the date of sale. Investments in Related Parties December 31, 2017 Level 2 Level 3 December 31, 2016 Level 2 Level Level 1 Total Level 1 Total (In millions) Money market funds $ 634 $ $ $ 634 $ 606 $ $ $ 606 Investments in related parties are accounted for under the equity method and are evaluated for impairment whenever events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. The Company recognizes an impairment charge whenever there is a decline in value that is determined to be other than temporary In April 2016, the Company paid approximately $45 million for an equity method investment. In March 2017, the Company determined it had an other than temporary loss in value of its investment and recorded an impairment charge of $30 million. Due to cumulative equity losses and amortization of $11 million, the carrying value of the investment at March 31, 2017, subsequent to the impairment, was $4 million. In September 2017, the investee was dissolved which resulted in a return of capital to the Company and a pre-tax gain of $4 million. The net amount of the fair value Equity securities 7 7 9 9 Total $ 641 $ $ $ 641 615 $ $ $ 615 HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES THE HERTZ CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Debt Obligations The fair value of debt is estimated based on quoted market rates as well as borrowing rates currently available to the Company for loans with similar terms and average maturities (Level 2 inputs). Note 14-Fair Value Measurements As of December 31, 2017 Nominal Unpaid Principal Balance Aggregate Fair Value As of December 31, 2016 Nominal Unpaid Principal Balance Aggregate Fair Value (In millions) Non-vehicle Debt $ 4,476 $ 4,438 3,934 $ 3,791 Vehicle Debt 10,471 10,456 9,685 9,670 Total $ 14,947 $ 14,894 13,619 13,461 Assets and Liabilities Measured at Fair Value on a Non-Recurring Basis Under U.S. GAAP, entities are allowed measure certain financial instruments and other items at fair value. The Company has not elected the fair value measurement option for any of its assets or liabilities that meet the criteria for this option. Irrespective of the fair value option previously described, U.S. GAAP requires certain financial and non-financial assets and liabilities of the Company to be measured on either a recurring basis or on a nonrecurring basis as shown in the sections that follow. Assets and Liabilities Measured at Fair Value on a Recurring Basis The fair value of accounts receivable, accounts payable and accrued expenses, to the extent the underlying liability will be settled in cash, approximates the carrying values because of the short-term nature of these instruments. The Company's assessment of goodwill and other intangible assets for impairment includes an assessment using various Level 2 inputs (earnings before interest, taxes, depreciation and amortization ("EBITDA") multiples and royalty rates) and Level 3 inputs (forecasted cash flows and discount rates). See Note 2, "Significant Accounting Policies Recoverability of Goodwill and Intangible Assets," for more information on the application of the use of fair value methodology Cash Equivalents and Investments The Company's cash equivalents primarily consist of money market accounts. The Company determines the fair value of cash equivalents using a market approach based on quoted prices in active markets. Fair Value (Income)/Loss Adjustment Recorded for the Year Ended December 31, 2017 (In millions) Fair Value Level 1 Level 2 Level 3 Brazil Operations $ 115 $ $ 115 $ $ (6) Equity method investments $ 8 $ $ $ 8 $ 26 Intangible assets $ 934 $ $ $ 934 $ 86 Investments in equity securities that are measured at fair value on a recurring basis consist of available for sale securities. The following table summarizes the ending balances of the Company's cash equivalents and investments. The Company's money market accounts as of December 31, 2016 were previously disclosed as using Level 2 inputs but have been reclassified to Level 1 in the table below due to their fair values having been determined using inputs that reflect quoted prices for identical assets or liabilities in active markets that are observable. Brazil Operations The Company measured the assets and liabilities of its Brazil Operations at fair value as of March 31, 2017 and June 30, 2017, while held for sale, and recorded a gain of $4 million and a loss of $4 million, respectively. The Brazil Operations were sold in August 2017 and the Company recorded a pre-tax gain of $6 million as further described in Note 4, "Acquisitions and Divestitures." The fair value noted in the table above is as of the date of sale. Investments in Related Parties December 31, 2017 Level 2 Level 3 December 31, 2016 Level 2 Level Level 1 Total Level 1 Total (In millions) Money market funds $ 634 $ $ $ 634 $ 606 $ $ $ 606 Investments in related parties are accounted for under the equity method and are evaluated for impairment whenever events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. The Company recognizes an impairment charge whenever there is a decline in value that is determined to be other than temporary In April 2016, the Company paid approximately $45 million for an equity method investment. In March 2017, the Company determined it had an other than temporary loss in value of its investment and recorded an impairment charge of $30 million. Due to cumulative equity losses and amortization of $11 million, the carrying value of the investment at March 31, 2017, subsequent to the impairment, was $4 million. In September 2017, the investee was dissolved which resulted in a return of capital to the Company and a pre-tax gain of $4 million. The net amount of the fair value Equity securities 7 7 9 9 Total $ 641 $ $ $ 641 615 $ $ $ 615

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts