Question: Problem 2 You are called in as a financial analyst to appraise the bonds of American Airlines Inc. The $1,000 par value bonds have a

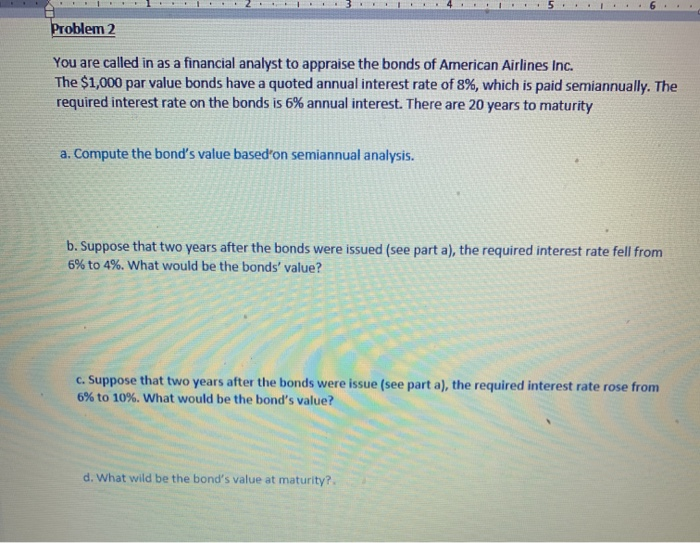

Problem 2 You are called in as a financial analyst to appraise the bonds of American Airlines Inc. The $1,000 par value bonds have a quoted annual interest rate of 8%, which is paid semiannually. The required interest rate on the bonds is 6% annual interest. There are 20 years to maturity a. Compute the bond's value based on semiannual analysis. b. Suppose that two years after the bonds were issued (see part a), the required interest rate fell from 6% to 4%. What would be the bonds' value? C. Suppose that two years after the bonds were issue (see part a), the required interest rate rose from 6% to 10%. What would be the bond's value? d. What wild be the bond's value at maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts