Question: Problem 2 You are given the following information about a company: i) The assets of the company may go up to 210 million with probability

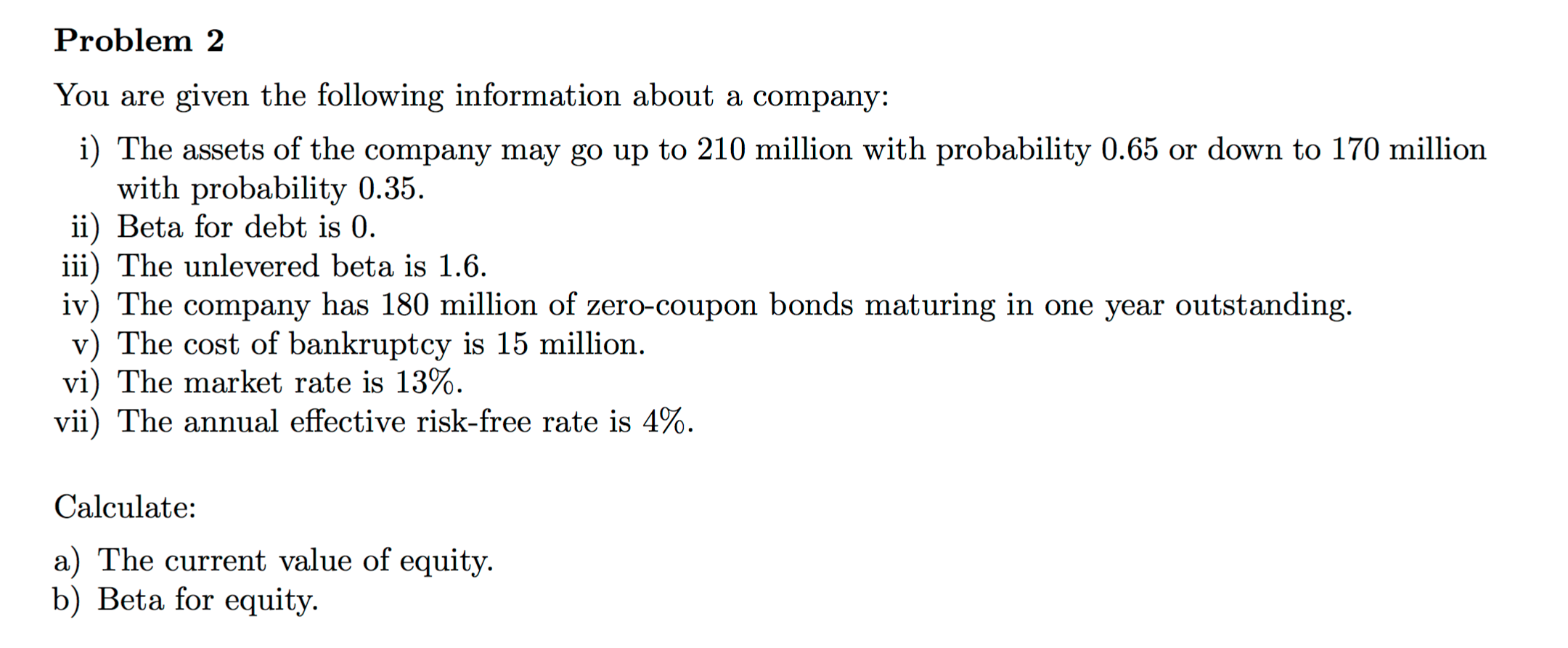

Problem 2 You are given the following information about a company: i) The assets of the company may go up to 210 million with probability 0.65 or down to 170 million with probability 0.35. ii) Beta for debt is 0. iii) The unlevered beta is 1.6. iv) The company has 180 million of zero-coupon bonds maturing in one year outstanding. v) The cost of bankruptcy is 15 million. vi) The market rate is 13%. vii) The annual effective risk-free rate is 4%. Calculate: a) The current value of equity. b) Beta for equity. Problem 2 You are given the following information about a company: i) The assets of the company may go up to 210 million with probability 0.65 or down to 170 million with probability 0.35. ii) Beta for debt is 0. iii) The unlevered beta is 1.6. iv) The company has 180 million of zero-coupon bonds maturing in one year outstanding. v) The cost of bankruptcy is 15 million. vi) The market rate is 13%. vii) The annual effective risk-free rate is 4%. Calculate: a) The current value of equity. b) Beta for equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts