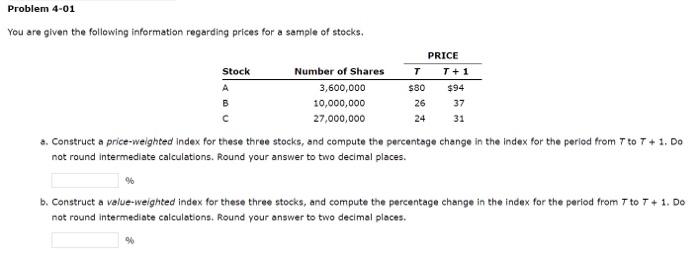

Question: Problem 4-01 You are given the following information regarding prices for a sample of stocks, PRICE Stock Number of Shares T T + 1 A

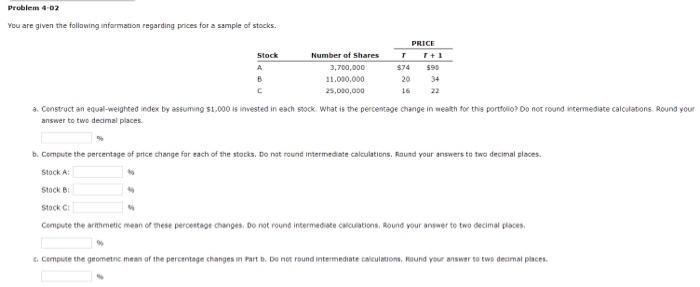

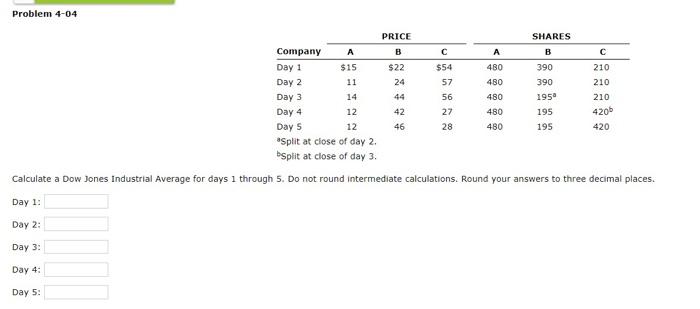

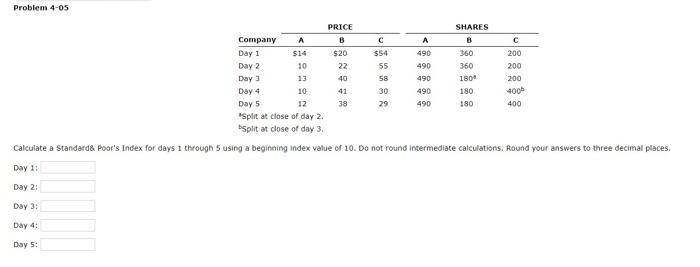

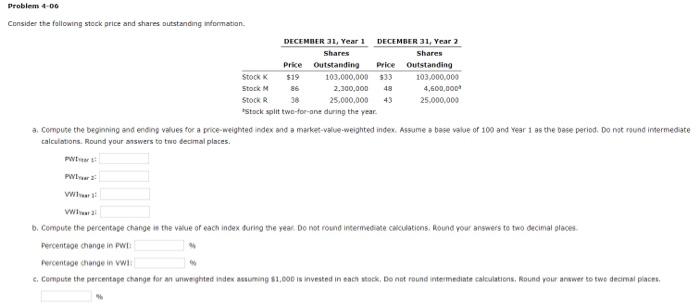

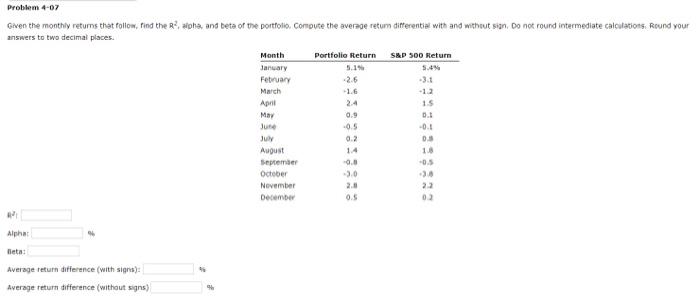

Problem 4-01 You are given the following information regarding prices for a sample of stocks, PRICE Stock Number of Shares T T + 1 A 3,600,000 $80 $94 B 10,000,000 26 37 27,000,000 24 31 a. Construct a price-weighted Index for these three stocks, and compute the percentage change in the Index for the period from to T + 1. Do not round intermediate calculations. Round your answer to two decimal places. b. Construct a value-weighted index for these three stocks, and compute the percentage change in the index for the period from 7 to T + 1. Do not round intermediate calculations. Round your answer to two decimal places. 96 Problem 4-02 You are given the following information regarding prices for a sample of stocks. PRICE Stock Number of shares T + 1 A 3,700,000 $74 590 11.000.000 20 34 25,000,000 1622 3. Construct an equal-weighted index by assuming $1.000 is invested in each stock. What is the percentage change in weath for this portfolio? Do not round intermediate calculations. Round your answer to two decimal places d. Compute the percentage of price range for each of the stocks. Do nat round Intermediate calculations. Raund your answers to two decimal places Stock Stock B Stock CD Compute the armmetic mean of mese percentage changes. Do not round Intermediate cuotion, Round your arewer to two decimal places 6. Compute the geometric mean of the percentage changes in part b. Do not round intermediate calculation round your miswer to two decimal places Problem 4-04 PRICE SHARES Company B B Day 1 $15 $22 $54 480 390 210 Day 2 11 24 57 480 390 210 44 56 480 1950 210 42 27 480 195 4206 Day 3 14 Day 4 12 Days 12 Split at close of day 2. Split at close of day 3. 46 28 480 195 420 Calculate a Dow Jones Industrial Average for days 1 through 5. Do not round intermediate calculations. Round your answers to three decimal places. Day 1: Day 2: Day 3: Day 4: Day 5: Problem 4-05 PRICE SHARES Company A B A B Day 1 $14 $20 $54 490 360 200 Day 2 10 22 55 490 360 200 Day 13 40 58 490 180+ 200 Day 4 10 41 30 490 180 400 Day 5 12 38 29 490 180 400 *Split at close of day 2 Split at close of day 3 Calculate a Standard&Poor's Index for days 1 through 5 using a beginning index value of 10. Do not round Intermediate calculations. Round your answers to three decimal places. Day 1: Day 2: Day 3: Day 4: Day 5: Problem 4-00 Consider the following stock price and shares outstanding information Shares 519 DECEMBER 31, Year 1 DECEMBER 31, Year 2 Shares Price Outstanding Price Outstanding 103.000.000 $33 103.000.000 2.300.000 4,500,000 38 25.000.000 43 25.000,000 Stock Stock Stock R 86 48 Stock split twe-for-ant during the year a. Compute the beginning and ending values for a price-weighted index and a market-value-weighted index. Assume a base value of 100 and Year is the base period. Do not round intermediate calculations. Round your answers to the decimal places. PW VW WW b. Compute the percentage change in the value of each index during the year. Do not round intermediate cautations. Round your answers to two decimal places Percentage change in PWL Percentage change in ww! c. Compute the percentage change for an unweighted index assuming $1,000 is invested in can stock, Donat round intermediate calculations, Round your answer to two decimal places Problem 4-07 Given the monthly returns that follow, find the Rapha, and beta or the portfolio Compute the average retum differential with and without an. Do not round intermediate calculations. Round your answers to two decimal places Month Portfolio Return S&P 500 Return January February 2.6 -3.1 March -16 April 15 0.9 0.1 May June -0.5 -0.1 July 0.2 0.3 14 1.8 -0.0 August September October November -3.0 30 23 December 0.5 02 Alpha lieta: Average return difference with signs): Average return difference (without signs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts