Question: Problem 20 You have until 11:36 PM to complete this assignment. Intro You bought 1 European call option with an exercise price of $50 that

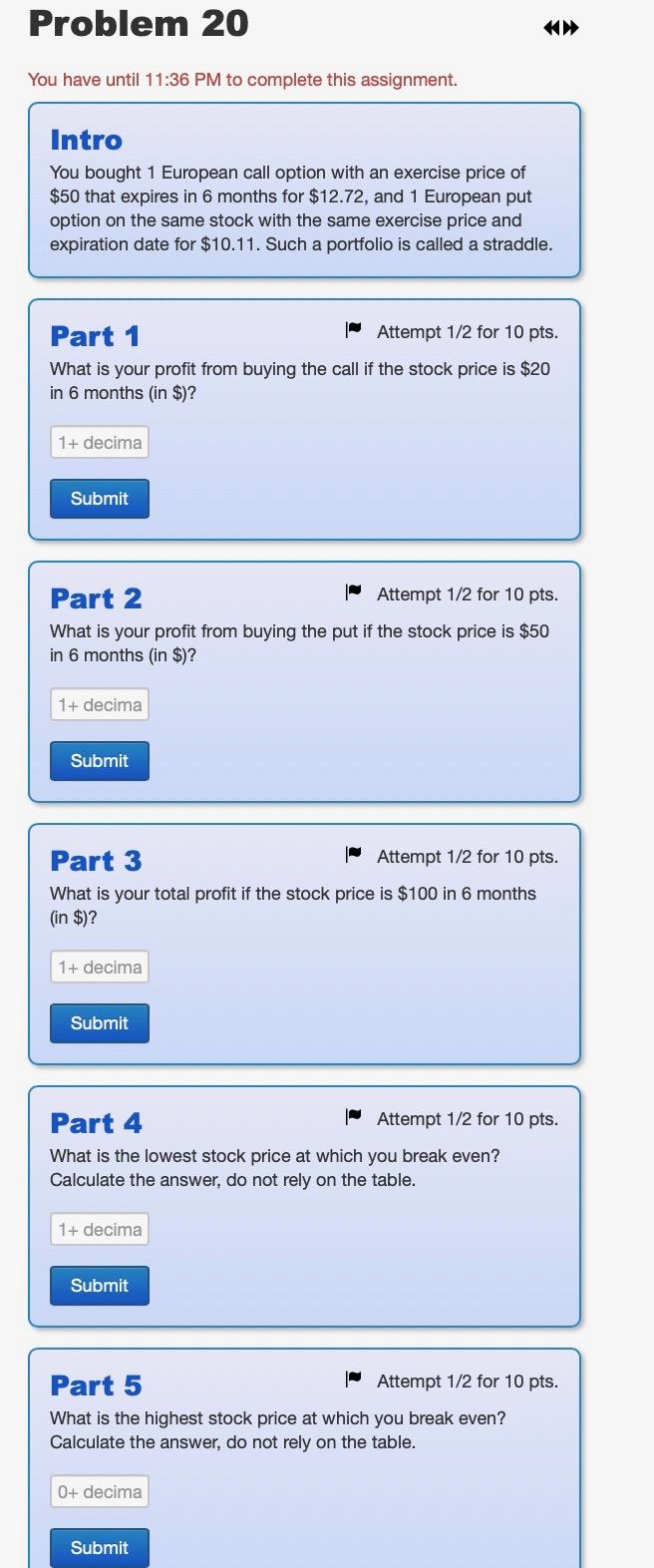

Problem 20 You have until 11:36 PM to complete this assignment. Intro You bought 1 European call option with an exercise price of $50 that expires in 6 months for $12.72, and 1 European put option on the same stock with the same exercise price and expiration date for $10.11. Such a portfolio is called a straddle. Part 1 Attempt 1/2 for 10 pts. What is your profit from buying the call if the stock price is $20 in 6 months (in $)? 1+ decima Submit Part 2 - Attempt 1/2 for 10 pts. What is your profit from buying the put if the stock price is $50 in 6 months (in $)? 1+ decima Submit Part 3 - Attempt 1/2 for 10 pts. What is your total profit if the stock price is $100 in 6 months (in $)? 1+ decima Submit Part 4 Attempt 1/2 for 10 pts. What is the lowest stock price at which you break even? Calculate the answer, do not rely on the table. 1+ decima Submit Part 5 Attempt 1/2 for 10 pts. What is the highest stock price at which you break even? Calculate the answer, do not rely on the table. 0+ decima Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts