Question: Problem 2-19 (Algo) Multiple Predetermined Overhead Rates; Applying Overhead (LO2-1, LO2-2, LO2-4] High Desert Potteryworks makes a variety of pottery products that it sells

![Problem 2-19 (Algo) Multiple Predetermined Overhead Rates; Applying Overhead (LO2-1, LO2-2, LO2-4]](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6658376488194_3806658376483d5f.jpg)

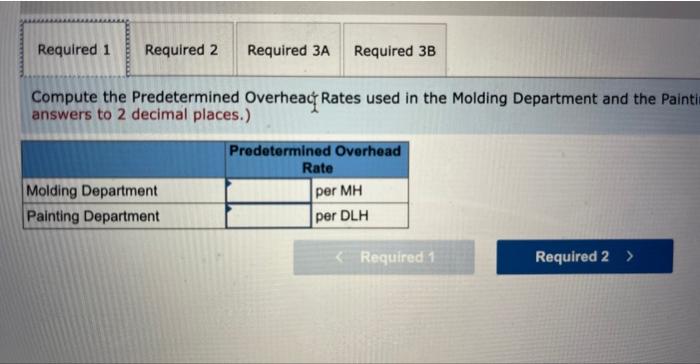

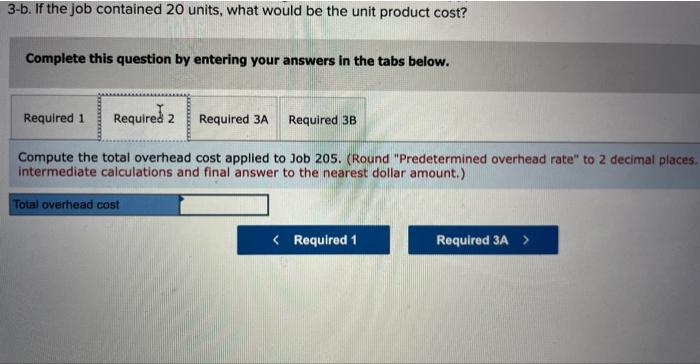

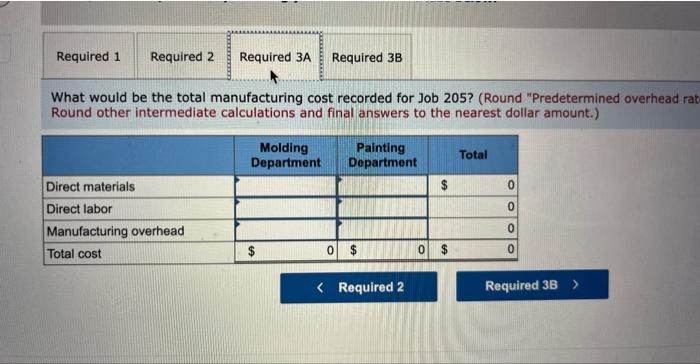

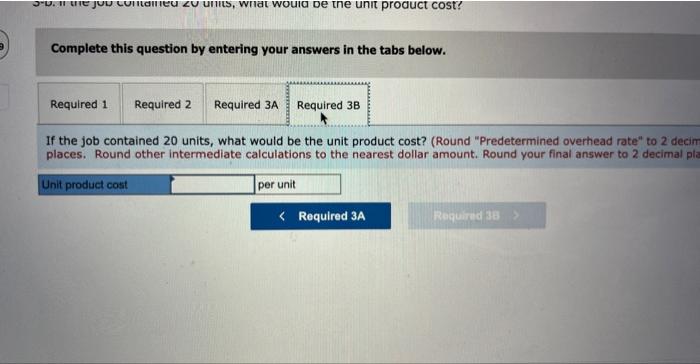

Problem 2-19 (Algo) Multiple Predetermined Overhead Rates; Applying Overhead (LO2-1, LO2-2, LO2-4] High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor- hours. At the beginning of the year, the company provided the following estimates: Direct labor-hours Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Department Molding 32,000 82,000 $188,600 $ 2.80 Painting 53,500 32,000 $ 502,900 0 $4.00 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Direct labor-hours Machine-hours Direct materials Direct labor cost Required: Department Molding Painting 400 133 70 $ 932 $ 1,240 $710 $ 980 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205. 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 20 units, what would be the unit product cost?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts