Question: Problem 22-10 You have been asked by a client to review the records of Crane Company, a small manufacturer of precision tools and machines. Your

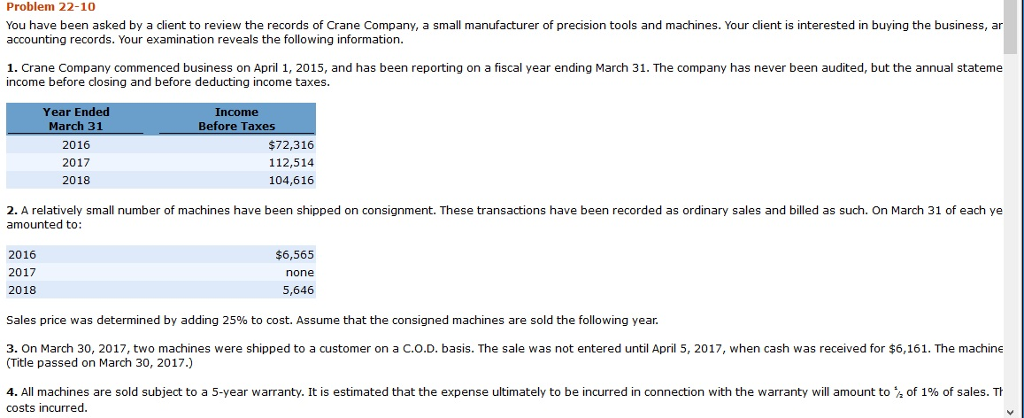

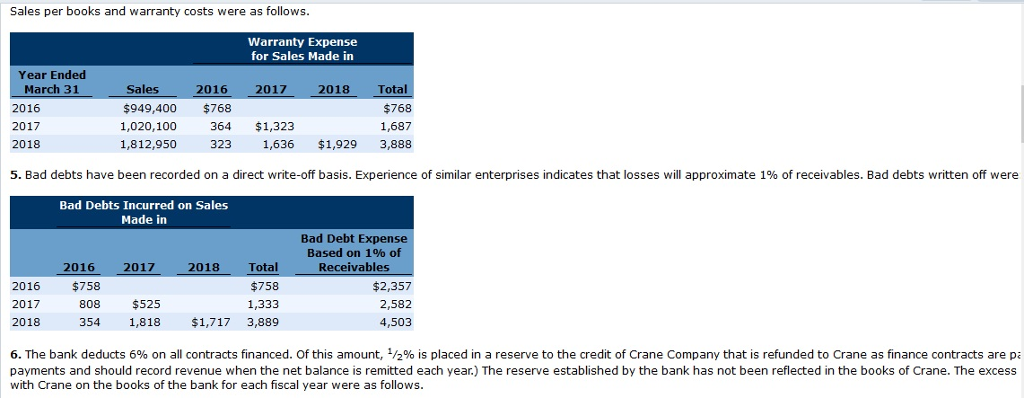

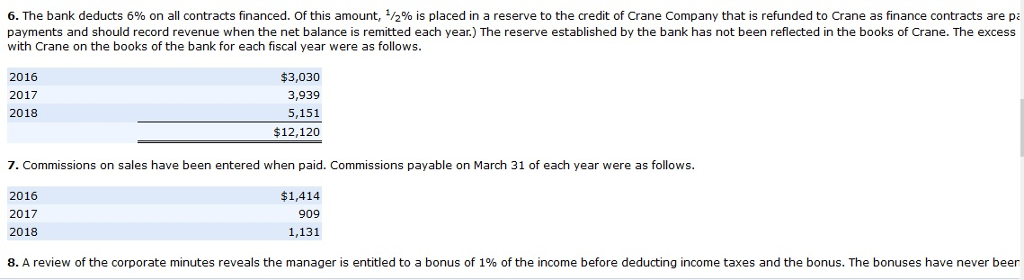

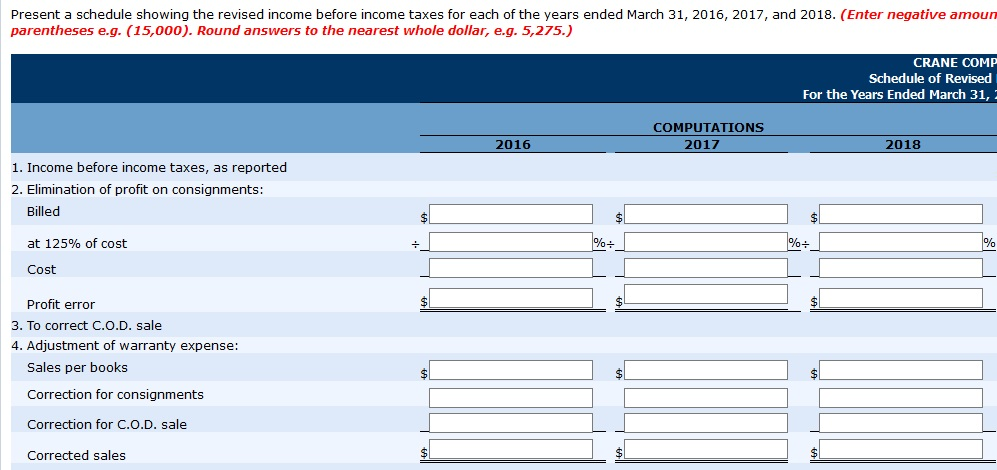

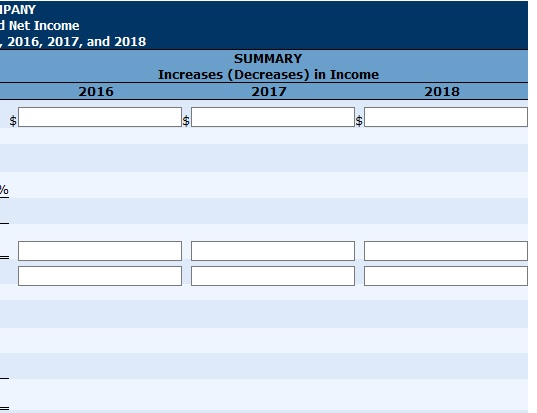

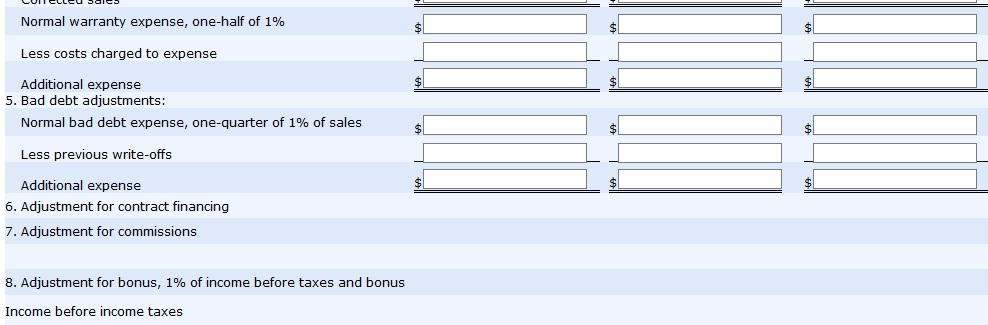

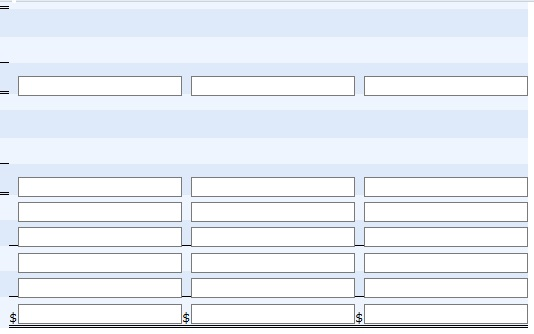

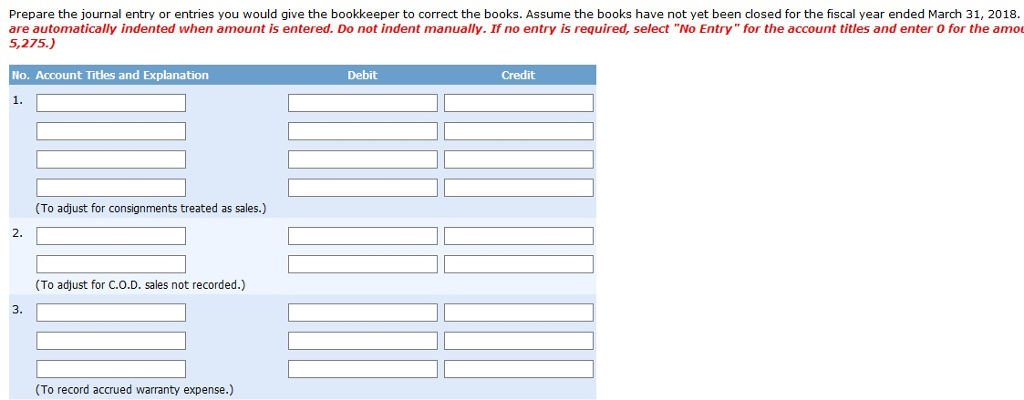

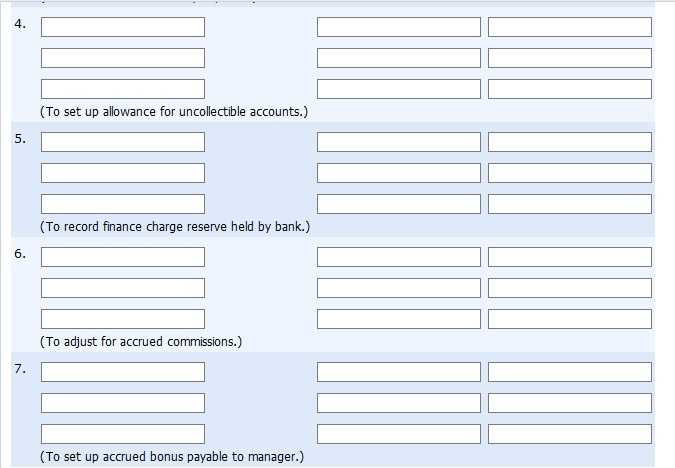

Problem 22-10 You have been asked by a client to review the records of Crane Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, a accounting records. Your examination reveals the following information. 1. Crane Company commenced business on April 1, 2015, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual stateme income before closing and before deducting income taxes. Year Ended Income Before Taxes $72,316 2016 2017 112,514 2018 104,616 2. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each ye amounted to: 2016 $6,565 2017 none 2018 5,646 Sales price was determined by adding 25% to cost. Assume that the consigned machines are sold the following year. 3. On March 30, 2017, two machines were shipped to a customer on a C.O.D. basis. The sale was not entered until April 5, 2017, when cash was received for $6,161. The machine (Title passed on March 30, 2017.) 4. All machines are sold subject to a 5-year warranty. It is estimated that the expense ultimately to be incurred in connection with the warranty will amount to of 1% of sales. Th costs incurred. Problem 22-10 You have been asked by a client to review the records of Crane Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, a accounting records. Your examination reveals the following information. 1. Crane Company commenced business on April 1, 2015, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual stateme income before closing and before deducting income taxes. Year Ended Income Before Taxes $72,316 2016 2017 112,514 2018 104,616 2. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each ye amounted to: 2016 $6,565 2017 none 2018 5,646 Sales price was determined by adding 25% to cost. Assume that the consigned machines are sold the following year. 3. On March 30, 2017, two machines were shipped to a customer on a C.O.D. basis. The sale was not entered until April 5, 2017, when cash was received for $6,161. The machine (Title passed on March 30, 2017.) 4. All machines are sold subject to a 5-year warranty. It is estimated that the expense ultimately to be incurred in connection with the warranty will amount to of 1% of sales. Th costs incurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts