Question: Problem 2-2A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2 Aracel Engineering completed the following transactions in the

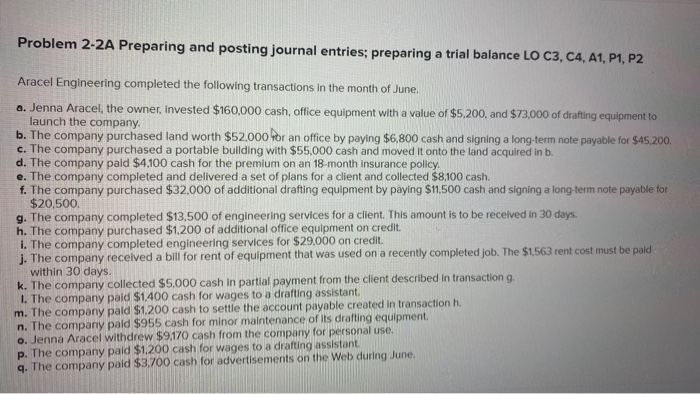

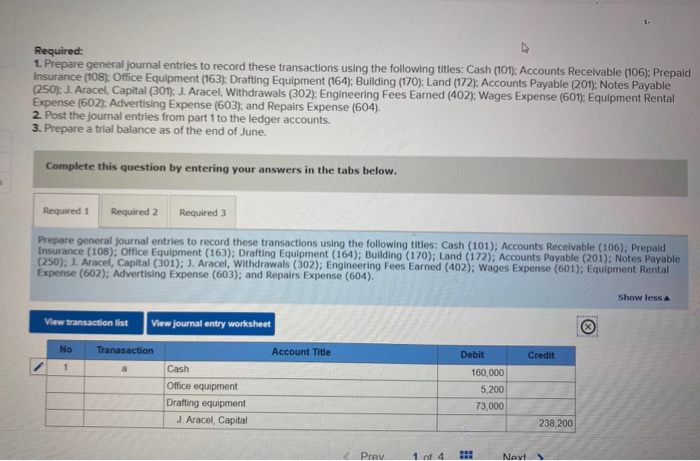

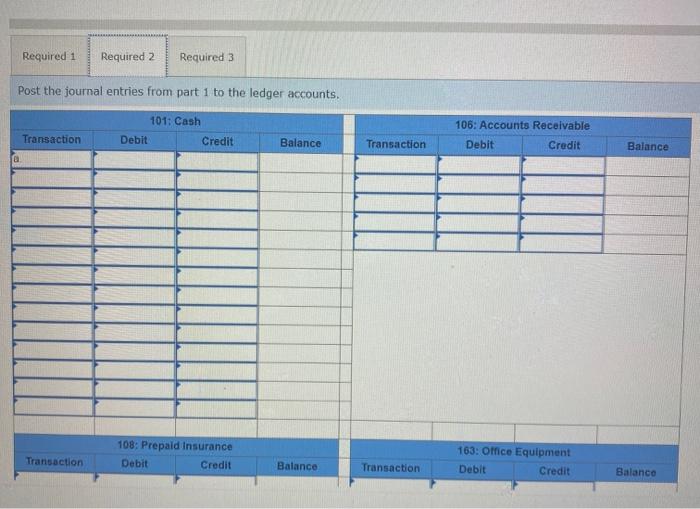

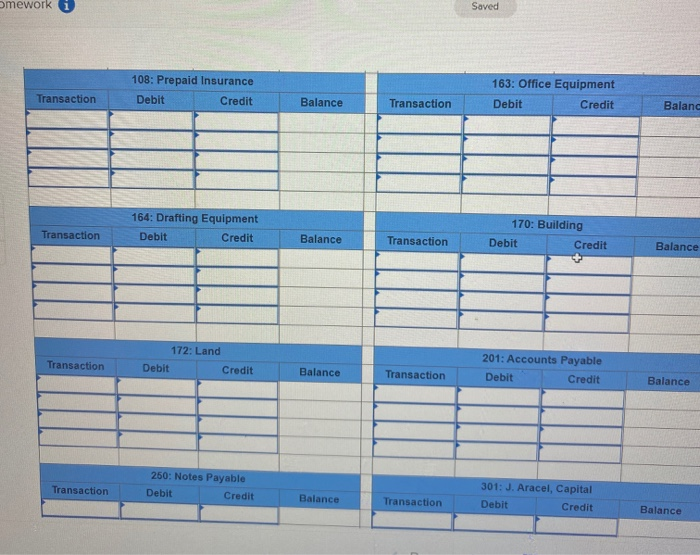

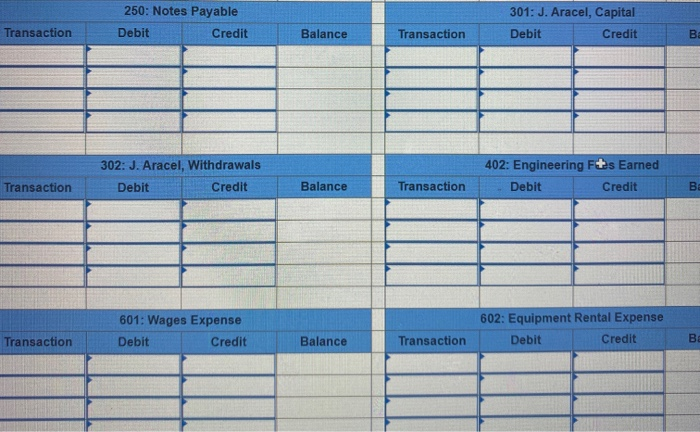

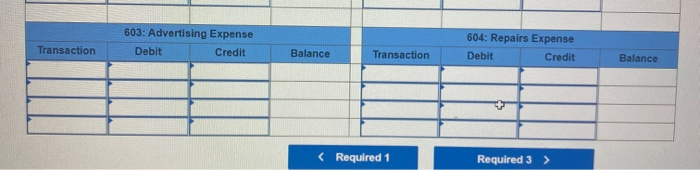

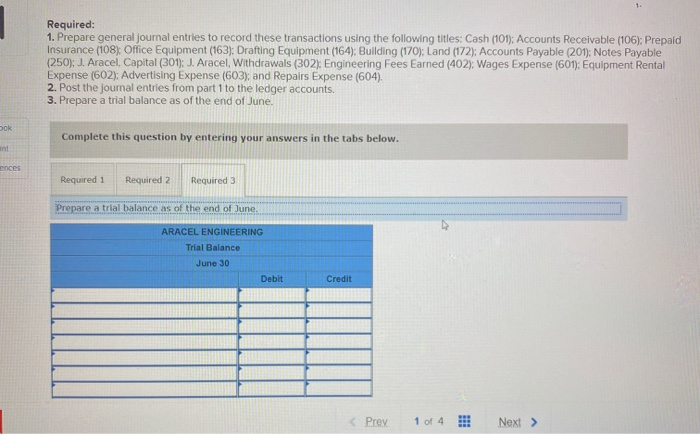

Problem 2-2A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2 Aracel Engineering completed the following transactions in the month of June. a. Jenna Aracel, the owner, invested $160,000 cash, office equipment with a value of $5.200, and $73,000 of drafting equipment to launch the company. b. The company purchased land worth $52,000 for an office by paying $6,800 cash and signing a long-term note payable for $45,200. c. The company purchased a portable building with $55,000 cash and moved it onto the land acquired in b. d. The company paid $4,100 cash for the premium on an 18-month insurance policy. e. The company completed and delivered a set of plans for a client and collected $8,100 cash. f. The company purchased $32.000 of additional drafting equipment by paying $11.500 cash and signing a long-term note payable for $20,500 g. The company completed $13,500 of engineering services for a client. This amount is to be received in 30 days. h. The company purchased $1.200 of additional office equipment on credit 1. The company completed engineering services for $29,000 on credit. j. The company received a bill for rent of equipment that was used on a recently completed job. The $1,563 rent cost must be paid within 30 days k. The company collected $5,000 cash in partial payment from the client described in transaction g. 1. The company paid $1,400 cash for wages to a drafting assistant m. The company paid $1.200 cash to settle the account payable created in transaction h. n. The company paid $955 cash for minor maintenance of its drafting equipment o. Jenna Aracel withdrew $9,170 cash from the company for personal use. p. The company paid $1,200 cash for wages to a drafting assistant 4. The company paid $3.700 cash for advertisements on the Web during June. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106): Prepaid Insurance (108): Office Equipment (163): Drafting Equipment (164); Building (170): Land (172): Accounts Payable (201): Notes Payable (250): J. Aracel Capital (301): J. Aracel, Withdrawals (302); Engineering Fees Earned (402); Wages Expense (601): Equipment Rental Expense (602): Advertising Expense (603); and Repairs Expense (604). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare general Journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Prepaid Insurance (108), Office Equipment (163); Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); ). Aracel, Capital (301); J. Aracel, Withdrawals (302); Engineering Fees Earned (402); Wages Expense (601); Equipment Rental Expense (602); Advertising Expense (603); and Repairs Expense (604). Show less View transaction list View journal entry worksheet No Tranasaction Account Title Credit 1 a Cash Office equipment Drafting equipment J.Aracel, Capital Debit 160,000 5,200 73.000 238,200 Prav 1 of Neyt Required 1 Required 2 Required 3 Post the journal entries from part 1 to the ledger accounts. 101: Cash Debit Credit Transaction 106: Accounts Receivable Debit Credit Balance Transaction Balance Transaction 108: Prepaid Insurance Debit Credit 163: Office Equipment Debit Credit Balance Transaction Balance mework i Saved 108: Prepaid Insurance Debit Credit Transaction 163: Office Equipment Debit Credit Balance Transaction Baland 164: Drafting Equipment Debit Credit Transaction 170: Building Debit Credit Balance Transaction Balance Transaction 172: Land Debit Credit Balance 201: Accounts Payable Debit Credit Transaction Balance Transaction 250: Notes Payable Debit Credit Balance 301: J. Aracel, Capital Debit Credit Transaction Balance 250: Notes Payable Debit Credit 301: J. Aracel, Capital Debit Credit Transaction Balance Transaction Ba 302: J. Aracel, Withdrawals Debit Credit 402: Engineering Fts Earned Debit Credit Transaction Balance Transaction BE 601: Wages Expense Debit Credit 602: Equipment Rental Expense Debit Credit Transaction Balance Transaction BE 603: Advertising Expense Debit Credit Transaction 604: Repairs Expense Debit Credit Balance Transaction Balance 1. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101): Accounts Receivable (106): Prepaid Insurance (108) Office Equipment (163): Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201): Notes Payable (250); J. Aracel, Capital (301) J. Aracel, Withdrawals (302): Engineering Fees Earned (402): Wages Expense (601); Equipment Rental Expense (602); Advertising Expense (603); and Repairs Expense (604). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of the end of June. Dok Complete this question by entering your answers in the tabs below. ences Required 1 Required 2 Required 3 Prepare a trial balance as of the end of June. ARACEL ENGINEERING Trial Balance June 30 Debit Credit Prey 1 of 4 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts