Question: Problem 24-1A Payback period, net present value, and net cash flow calculation P1 P3 Factor Company is planning to add a new product to

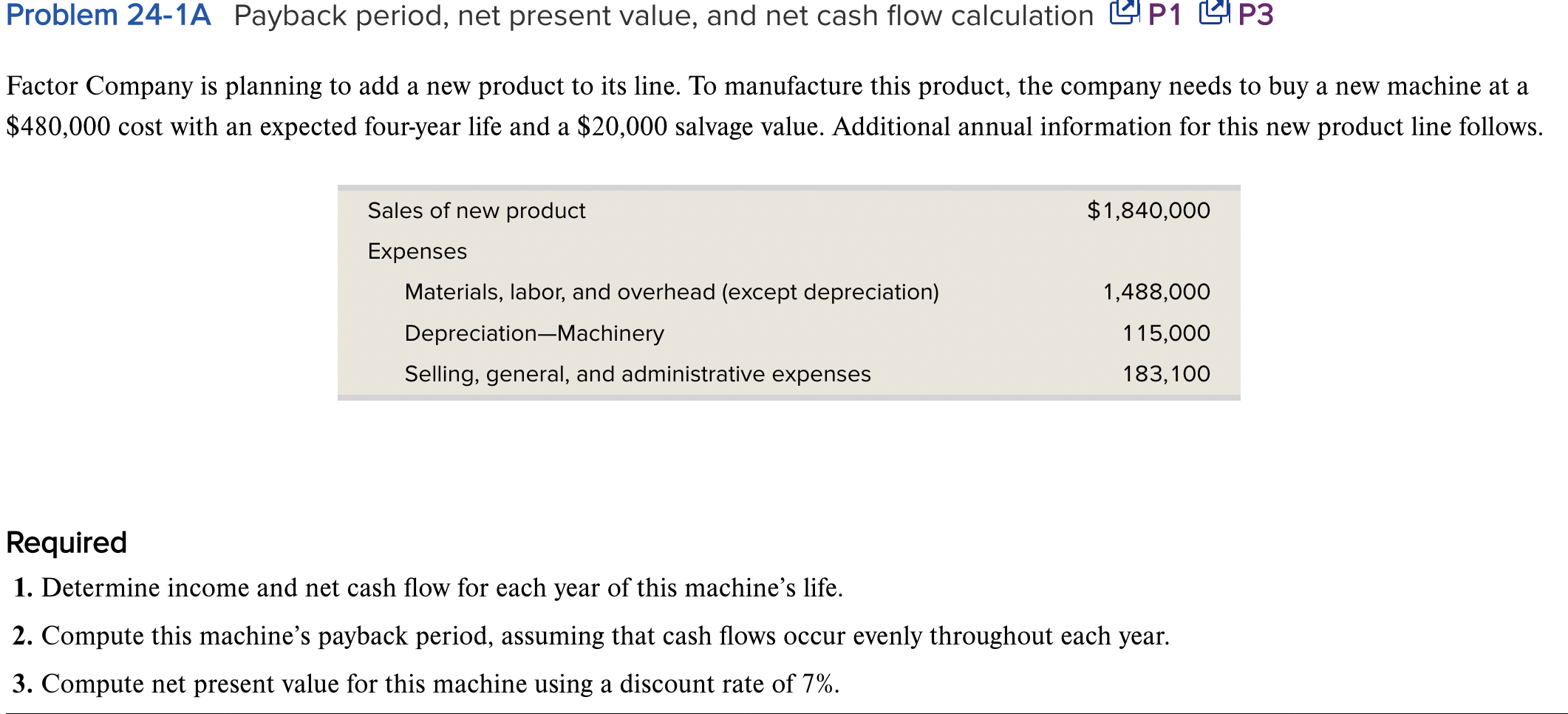

Problem 24-1A Payback period, net present value, and net cash flow calculation P1 P3 Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $480,000 cost with an expected four-year life and a $20,000 salvage value. Additional annual information for this new product line follows. Sales of new product $1,840,000 Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery 1,488,000 115,000 Selling, general, and administrative expenses 183,100 Required 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 7%.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts