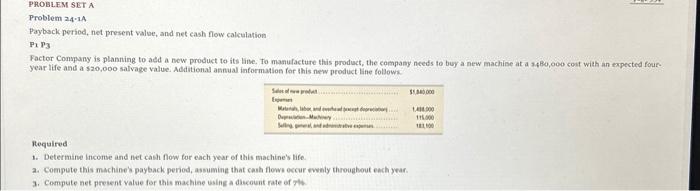

Question: Problem 24:1A Payback period, net present value, and net cash flow calculation P2P3 Factor Conspany is planning to add a new product to its line.

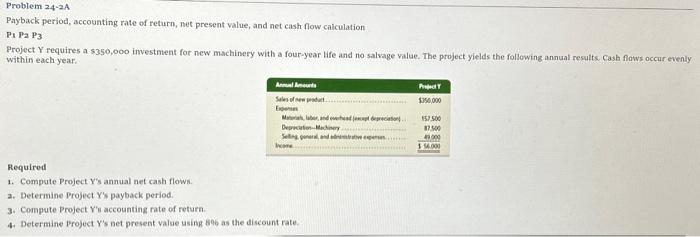

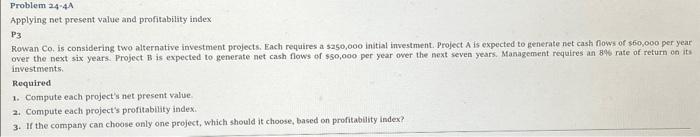

Problem 24:1A Payback period, net present value, and net cash flow calculation P2P3 Factor Conspany is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machise at a 3480,000 coit with an expected foue. year life and a szo,0oo salvage value. Additional annual information for this new product line foliows. Required 1. Determine income and net cash flow for each year of this machine's life. 2. Compute this machine's payback period, assumine that cash flows occur ewnily throughout each year. 3. Compute net present value for this machine using a dscount rate of 7 Applying net present value and profitability index P3 Rowan Co, is considering two alternative investment projects. Each requires a $250,000 initial imvestment. Project A is expected to generate net cash nows of s60,000 per year over the next six years. Project B is expected to generate net cash flows of 550,000 per year over the next seven years. Mfanagement requires an 8%6 rate of return on its investments. Required 1. Compute each project's net present value. 2. Compute each project's profitability index. 3. If the company can choose only one project, which should it choose, based on profitablity index? Payback period, accounting rate of return, net present value, and net cash flow calculation P4P2P3 Project Y requires a $350,000 investment for new machinery with a four-year life and no salvage value. The project yields the following annual results. Cash flaws occur evenly within each year. Required 1. Compute Project Y 's annual net cash flows. a. Determine Project Y's payback period. 3. Compute Project Ys accounting rate of return. 4. Determine Project Y 's net present value using 896 as the discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts